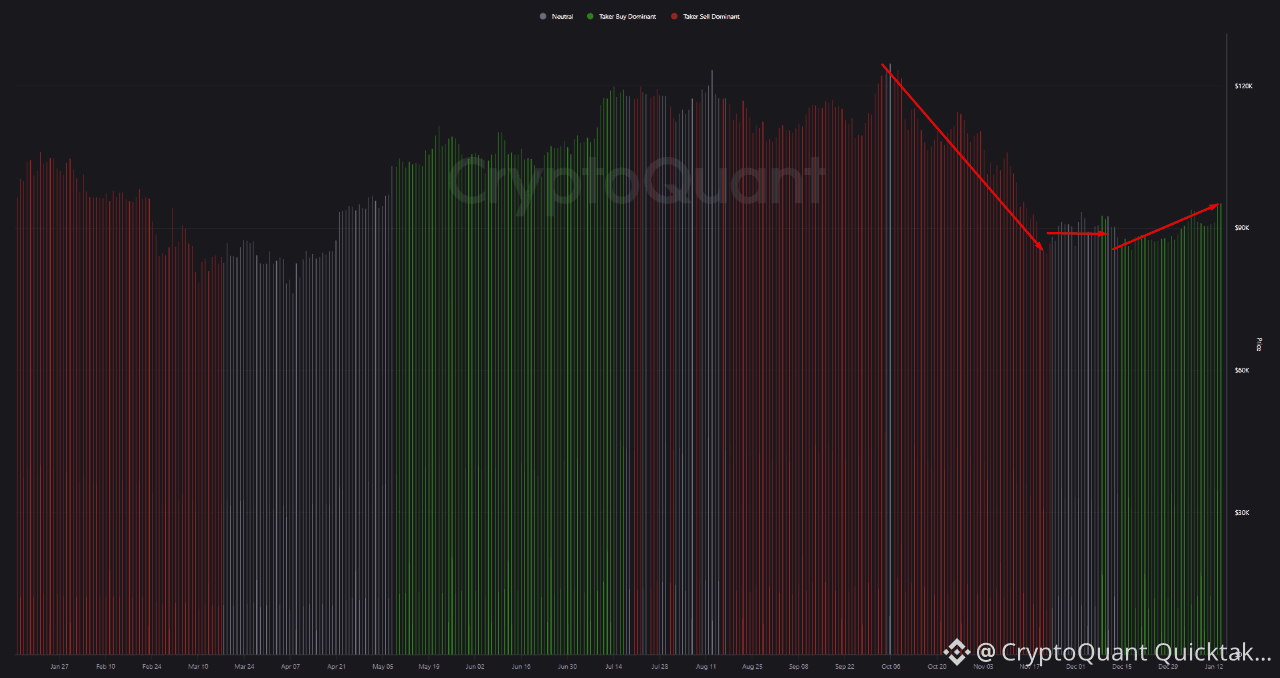

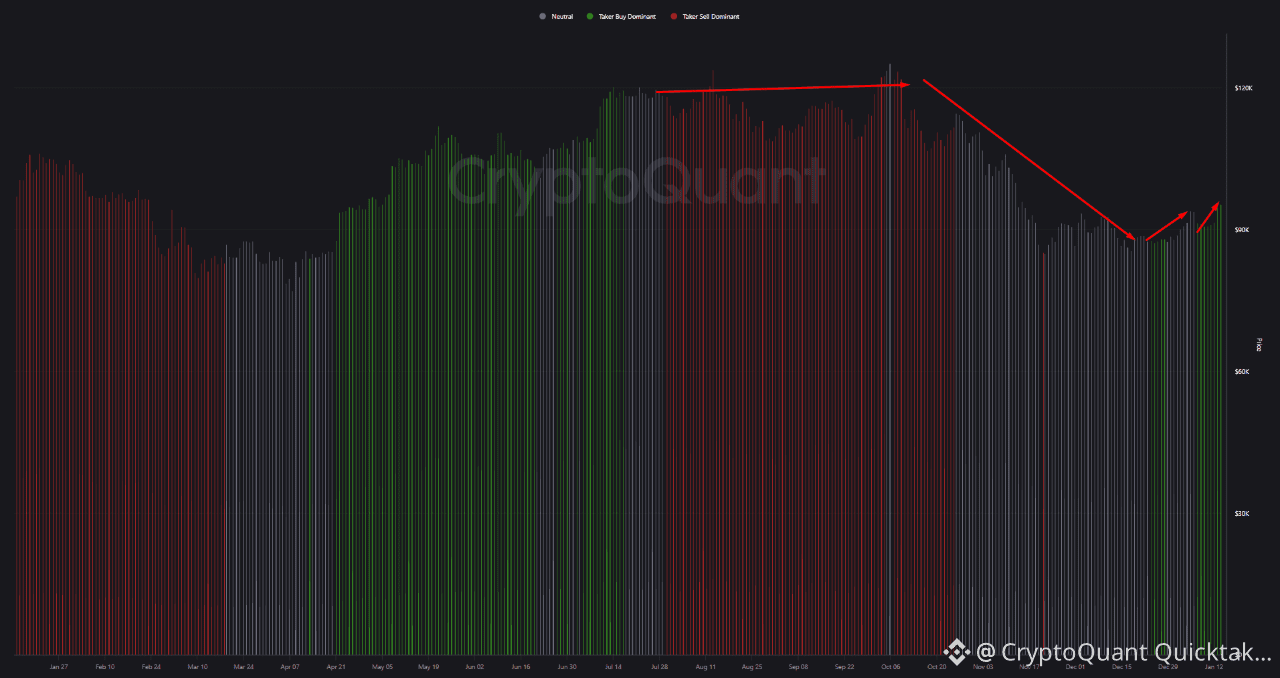

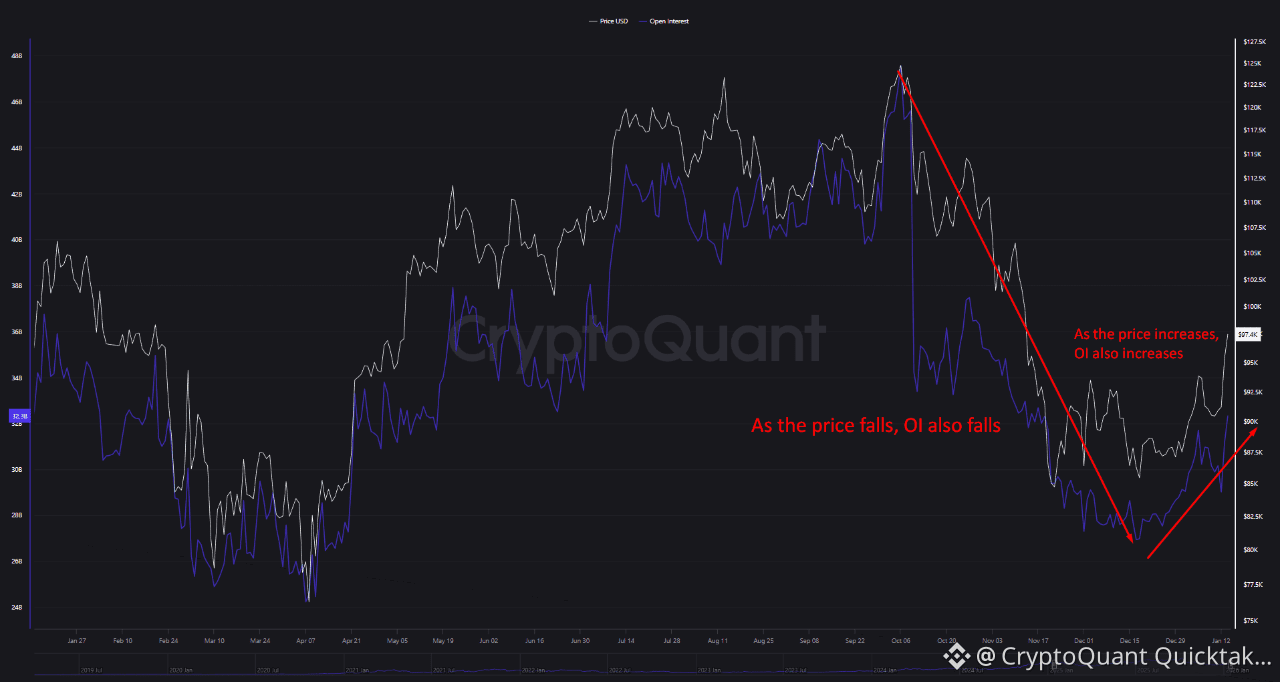

Analyzing Spot Taker CVD (90D), Futures Taker CVD (90D), and Open Interest across all exchanges provides a clear picture of Bitcoin’s current market structure.

Spot Taker CVD has recently shifted from a prolonged sell-dominant phase into neutral and early buy-dominant territory. This transition suggests that real spot demand is gradually returning, indicating accumulation rather than panic-driven selling.

On the derivatives side, Futures Taker CVD shows that aggressive sell pressure has significantly weakened. While strong long aggression has not yet emerged, the reduction in taker-driven selling points to short-side exhaustion and stabilization rather than active distribution.

Meanwhile, Open Interest experienced a sharp reset following its peak, reflecting forced position closures and leverage cleanup. The recent recovery in Open Interest is measured and controlled, occurring alongside price stability rather than excessive leverage buildup.

🔍 Combined Interpretation

When viewed together, these three metrics indicate that:

Spot buyers are stepping back in

Derivatives markets are no longer aggressively short

Leverage has been flushed and is rebuilding cautiously

This combination is typically observed during post-distribution consolidation phases, where the market transitions from correction to structural recovery.

🎯 Market Bias

From an on-chain perspective, the current setup favors stability with a mild upside bias, rather than conditions associated with cycle tops or overheated leverage.

Bias: Neutral → Slightly Bullish

Written by KriptoCenneti