I remembered the relevance of decentralized storage from an ordinary Tuesday when I was scouring through some old documents from a defunct cloud storage company that had shut down long ago. They didn’t lose their data, they just shut down, and with that, their data just faded away. This was an inconspicuous problem that made me pause to think: our current digital ecosystem is centralized. Be it cloud storage, communication applications, or trading, it remains accessible only if a particular company or entity is functional. For a trader or an investor, this is an infrastructural risk that isn’t priced although it impacts silently.

This issue is exactly what Walrus Token seeks to solve, although it’s not in a way that involves hot air or speculation. Walrus Token is a protocol used to distribute reliable, distributed, and verifier-friendly storage for large media, such as videos, artificial intelligence datasets, Non-Fungible Tokens, or other BLOB data, for that matter. From an investment perspective, to comprehend Walrus Token, one has to comprehend their underlying tech stack.

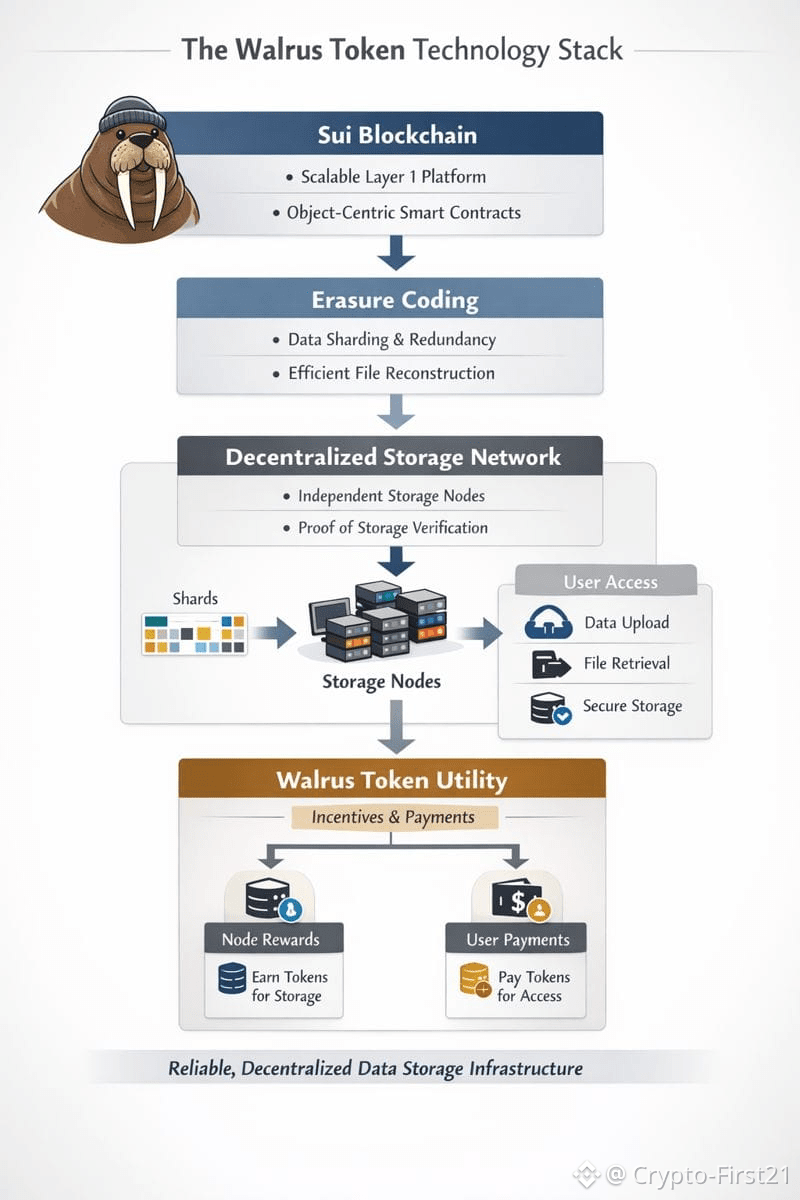

Walrus has a core Sui blockchain that serves as a Layer 1 smart contract platform with scalability and asset integrity in mind. Behind every Walrus lies Sui, a blockchain with a focus on scalability and assurance of assets on a Layer 1, scalable smart contract platform. Sui is neither a trend nor a preference; it is a choice of infrastructure. In difference to previous blockchains, whose first principles include a focus on universality or decentralization in preference to speed in execution, Sui’s strategy is based on what is referred to as move semantics. Traversal of transactions and assets is conducted from an object-oriented standpoint, meaning a scan of the entire ledger is not required. In essence, it is like having multiple highways for different types of data: a big file can be transferred without holding up traffic on the road system.

In addition to Sui’s storage solution, Walrus uses erasure coding. The latter is a theoretical tooling concept that improves storage efficiency. In regular file storage systems, files are often replicated on multiple server instances. While this is very easy to implement with storage, it is rather inefficient. In erasure coding, files are split into parts and encoded with redundancy. Any of these pieces can put together the original file. This design dramatically reduces storage costs, while maintaining reliability. A useful analogy here is a jigsaw puzzle: you need only a fraction of its pieces to see the complete picture. To investors, erasure coding is a sign of conservative and efficient design-one that sustains reliability without unnecessary bloat in storage requirements or token economics.

Beyond file reliability, the Walrus token itself is integrated both as a utility and an incentive mechanism. Nodes are paid in tokens for storing data and providing bandwidth, while users pay for storage services in tokens. This double role creates a balancing feedback loop in which network health directly relates to token demand: more data requires more nodes, more nodes earn more tokens, and the system self-balances. Unlike purely speculative tokens that exist mostly to trade, the Walrus token draws value from its operational utility. They tend to respond to adoption trends rather than hype cycles, which makes risk assessment more methodical.

This market is a lot more concentrated than traders often give it credit for-a few operational failures or regulatory changes can send ripples across industries. Walrus and similar decentralized storage protocols add a layer of resilience. They aren't trying to replace traditional providers overnight; rather, they offer redundancy, censorship resistance, and cost-efficient storage for specialized applications-think AI datasets, NFT marketplaces, and archival systems. There's the "infrastructure value" that one can't quite quantify immediately but is crucial in the long term.

However, decentralization also introduces a whole different kind of risk that an attentive investor should not ignore. Network security relies on the honesty and availability of many independent nodes; while erasure coding removes any single point of failure, the reliability of the network is also directly connected with node participation and incentives. Misaligned economics, rapid decline in token value, or highly concentrated storage will make it less robust. From a trader's perspective, these are infrastructure risks, somewhat similar to liquidity or credit risks in traditional finance-the subtle, long-term types often only recognized after they have materialized.

The next level of complexity lies in the aspects of transparency and auditability. A decentralized storage solution like Walrus gives users the ability to check if files are being deposited as claimed. Nodes can prove their storage proofs, which can be verified by using cryptographic primitives on the blockchain network. It can be described in simpler terms by stating that it is like getting a receipt for all the transactions made while using an independent auditor, in place of using the company server. It works as a benefit to the infrastructure investor because it nullifies the risk of counterparty risk associated with it.

In terms of long-term relevance, what is evident from their tech setup is a paradigm shift in how digital infrastructure is expected to be developed in the future. The problem in the real world—relating to dependence on one company—is evident in cloud failures, data deletion, and forced shutdowns by governments. What is being provided here is not something to be implemented overnight but a platform in which storage is possible anywhere in the world, in any individual’s care, with their ownership to be validated. Understanding the role of this ecosystem is important for a trader or investor. Here, token dynamics relate not just to speculation but to palpable utility, the size of network participants, and the reliability of storage operations. These are a set of parameters that support a framework in risk assessments, adoption potentials, and resilience, many of which have been more or less ignored in the usual headline-driven market analyses.

In practice, such a view makes one actually appraise Walrus Token against other crypto assets. Instead of following the hype, one checks: How many nodes are actively participating? Are the incentive mechanisms working as they should? Is erasure coding effectively balancing redundancy and efficiency? Are developers building applications that depend on the network? These are concrete questions linking the technology stack with possible network effects and, in the end, token utility.

Now, reflecting on my very first effort to retrieve the lost files, it's pretty obvious that decentralized storage isn't about flashy, shiny innovation; it's about continuity, reliability, and structural resilience. For investors and traders, Walrus Token provides a perspective on infrastructure crypto, an arena where the use cases and functionality of the infrastructure supersede the story it tells. The understanding of the technology stack of Sui blockchain, erasure coding, incentive-aligned tokens, and proof mechanisms is essential for comprehension of the functionality and endurance of Walrus as a working infrastructure for data on the decentralized network.

In summary, in assessing Walrus Token for purposes of investing, there has to be a shift in focus from market moods to underlying structure. The structure has been designed for the purpose of solving real-world issues in data storage in a very systematic way that brings together incentives, efficiency, and reliability. The functionality of the network is in no way dependent on hype patterns but only on adoption levels. Although there are risks associated with Token, these risks are measurable in a very understandable context, making Walrus a study subject for the coming together of infrastructure-oriented crypto markets and serious levels of investment analysis.