My initial exposure to decentralized storage was not in a twitter conversation or a discussion in a Discord chat room, but when a colleague asked me why his family pictures were not where he expected them to be at a cloud storage provider. This was a purely human problem, one of trusting another person in one's online existence, that recalled how current infrastructure supports such trust in a centralized model that I wish to discuss below. Within crypto, there are projects investigating a novel vision of that infrastructure, one based not on a company's reliability, availability, and economic motivations, but instead one that builds these into a kind of system among decentralized people. Various such projects have come along in the last couple of years, each one different in some detail about its underlying architecture, economic system, including token design, and tradeoffs. Among these is what appears to be a somewhat newer player in this market, or at least newer compared to some of its more entrenched peers, such as Filecoin, Arweave, or Storj, with whom it, Walrus, sits.

In order to make a comparison between the different projects, it may help to define what exactly decentralized storage entails. Decentralized storage, in simple terms, can be viewed as a cloud storage solution akin to Dropbox, Google Drive, and the likes of the big companies, but with multiple storage companies, including individuals, holding parts of the encrypted file and this file network functioning even when most of the participants in the network go offline! That’s taking the analogy of storing important papers in a safe deposit box with each of your “friends” holding a piece of the important papers so that you can recreate the paper when you want it back, instead of relying on the single entity that has the safe deposit box!

A large number of decentralized storage platforms use tokens for economic incentives. The general idea is that storage nodes earn tokens for providing storage and uptime, clients pay with tokens for storing and retrieving data, and validators or participants of the network assist with security and verification of transactions, sometimes receiving a share. Their value is pegged to the demand for storage, cost of operation, and confidence in the reliability of the protocol. The design choices of issuance schedules, staking requirements, inflation rates, and economic sinks around such tokens will have a direct influence on the protocol incentives and tokenomics. For a trader or investor, knowledge of the aforementioned token details is just as important as that regarding the architecture of the network.

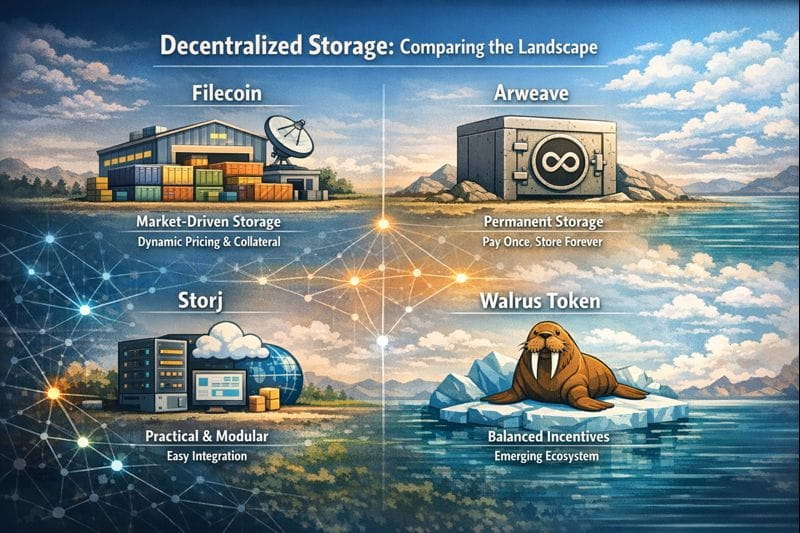

Filecoin is one of the first large-scale attempts to create a decentralized storage marketplace. A few early adopters have already begun providing storage and retrieval services for the network, and clients pay for those services using FIL tokens. FIL pays for storage and is staked as collateral to create economic penalties for misbehavior. Filecoin shines in its market dynamics: supply and demand determine storage capacity and pricing. This may provide reasonably well-aligned incentivization but also leaves the network vulnerable to storage economic volatility. If storage demand is low compared to supply, providers earn less, which could cut into participation and undermine reliability.

Arweave takes a very different approach, striving for permanent data storage using an innovative endowment model. Clients pay once to store data forever, buying storage with AR tokens, but part of the money is put into a fund to be used to pay future storage providers. This design is appealing to use cases for which permanence matters, such as archiving historical records or important public data. However, for the endowment model to be economically sustainable in the long run, it relies on assumptions regarding hardware costs and token valuation that introduce unique risks. From a trading investor point of view, this makes AR's value capture very sensitive to real-world storage economics and speculation in the confidence of the longevity of the endowment.

Storj focuses on ease and compatibility with existing tools. Storage nodes are operated by individuals, while clients pay in STORJ tokens. Its architecture focuses on the integration with S3-compatible APIs and modular services such as backup and CDN distribution. Storj’s approach is pragmatic adoption by developers and enterprises. It doesn't compete on permanent storage or wide marketplace offerings but does so based on ease of use and cost competitiveness. To an investor, it means that Storj's success is fully coupled with real usage and the developer integrations, not speculative narratives.

Filecoin is an open freight exchange where carriers bid to carry your cargo, including price changes based on supply and demand but a competitive marketplace holds costs down. TBuying an Arweave is equivalent to buying a concrete vault where your things will last eternally, if and only if the vault’s maintenance budget remains good for the long haul. Storj could be likened to a bunch of satellite storage centers that are designed to be convenient and fast to access. What’s possibly new with Walrus is that it’s essentially a logistics cooperative with a fresh governance and monetary incentives model that’s still looking to carve its specific niche in this larger ecosystem of cloud storage services. You evaluate them not only on their aims but also on their traction: Are people actually retaining them as customers and being willing to pay them fees? Are they actually available to deliver? Is their token trading at a multiple that reflects its utility or is speculation at play here?

There are common risks to all decentralized storage initiatives. A challenge of operational dependence is that data availability might be adversely affected in case many storage firms exit altogether. There could be tokenomics mismatch, such as reducing value or an inability to maintain motivations sufficiently. The adoption factors mean that without genuine demand for storage, tokens are only useful in name only. Stakeholders are also concerned that without clear guidelines on data sovereignty, security regulations may affect participation in the new network. More particularly, for new tokens like Walrus, liquidity risk is a particularly serious concern. A project may have beautiful architecture, but without genuine users and sources, its infrastructure is purely theoretical.

When it comes to serious investors, it should be remembered that a store of data has to be thought of in terms of application infrastructure rather than short-term narratives. Like the value of a broadband internet connection isn’t something that can be evaluated through short-term market fluctuations, actual value of a store of data will be in its usage and application through the digital landscape. Projects that can strike a good harmony between tangible rewards, applications, and actual demand will be on a stronger foundation for a long-term existence. It will have to be seen if Walrus Token will be able to achieve this or not.

When comparing Walrus Token to other decentralized storage initiatives, it is more about relative trade-offs than pitting one against another to see which is superior or wins. In more traditional infrastructure investments, the aim is to focus on endurance, efficiency, and actual usage rather than the novelty that comes with new listings.