Walrus protocol stands as a decentralized storage system on Sui, utilizing WAL tokens for essential functions like fee payments and node incentives. For crypto traders, WAL offers utilities that blend holding strategies with ecosystem participation, such as staking for rewards derived from storage activity. This creates trading opportunities where WAL's value correlates with blob usage metrics, allowing positions built on protocol fundamentals rather than external hype.

WAL Supply and Allocation: Conservative Trading Perspectives

According to official sources, WAL features a total supply capped at 5 billion tokens, with allocations structured to support ecosystem sustainability—43% for community reserves, 30% for core contributors, and the rest for incentives and investors. Traders can view this supply as a foundation for position sizing, where community reserves fund subsidies that encourage blob storage, potentially increasing WAL demand over time. Concrete details include the token's divisibility into FROST units, with 1 WAL equaling 1 billion FROST, enabling precise micro-transactions for small-scale storage payments in Walrus.

In trading terms, this allocation model limits dilution risks, as no ongoing minting occurs beyond initial distributions. Traders holding WAL might monitor reserve deployments via Sui explorers, using them as signals for ecosystem expansions that could tighten supply. For instance, when subsidies activate for high-volume blob users, WAL circulation rises modestly, offering entry points during temporary supply increases. Constraints on allocations ensure no single category dominates, promoting balanced WAL distribution across the ecosystem and reducing centralization concerns for long-term holders.

Expanding on trading applications, conservative traders can calculate circulating WAL by subtracting locked stakes from total supply, factoring in governance deposits. This metric helps assess scarcity during epochs with elevated blob activity, where WAL payments for storage lock tokens temporarily. In the Walrus ecosystem, such dynamics reward patient positioning, as gradual reserve unlocks—tied to milestones—provide predictable supply events for scaling in or out.

Fee Payment Mechanics: WAL as a Trading Tool

WAL serves as the exclusive payment token for blob storage fees in Walrus, calculated dynamically per epoch to maintain approximate fiat equivalence. A blob payment involves querying rates through the protocol API, multiplying by data size and duration, then executing a Sui transaction to transfer WAL. Constraints require fees to exceed minimum node compensations, with buffers for volatility, ensuring payments always cover ecosystem costs.

Traders can leverage this mechanic by treating WAL as a functional asset for personal storage needs, like archiving trade data, while observing fee trends as demand indicators. For example, a spike in WAL fees signals growing blob uploads, prompting traders to accumulate tokens ahead of reward pool expansions. Bullet points on fee components:

Base rate per byte, adjusted epochally.

Duration multiplier for extensions beyond minima.

Redundancy surcharge for higher fault tolerance.

This utility integrates WAL into trading routines, where holding sufficient tokens for fees hedges against rate hikes, and ecosystem growth—driven by more Walrus users—amplifies payment volumes, supporting upward pressure on WAL.

Detailed walkthrough for a fee-optimized trade: Monitor epoch-end fee adjustments on Sui; estimate WAL needed for a 1MB blob over three months; buy WAL if rates dip post-adjustment; store data to participate in the ecosystem. Constraints like minimum durations prevent short-term speculation on fees, encouraging traders to align positions with sustained Walrus adoption.

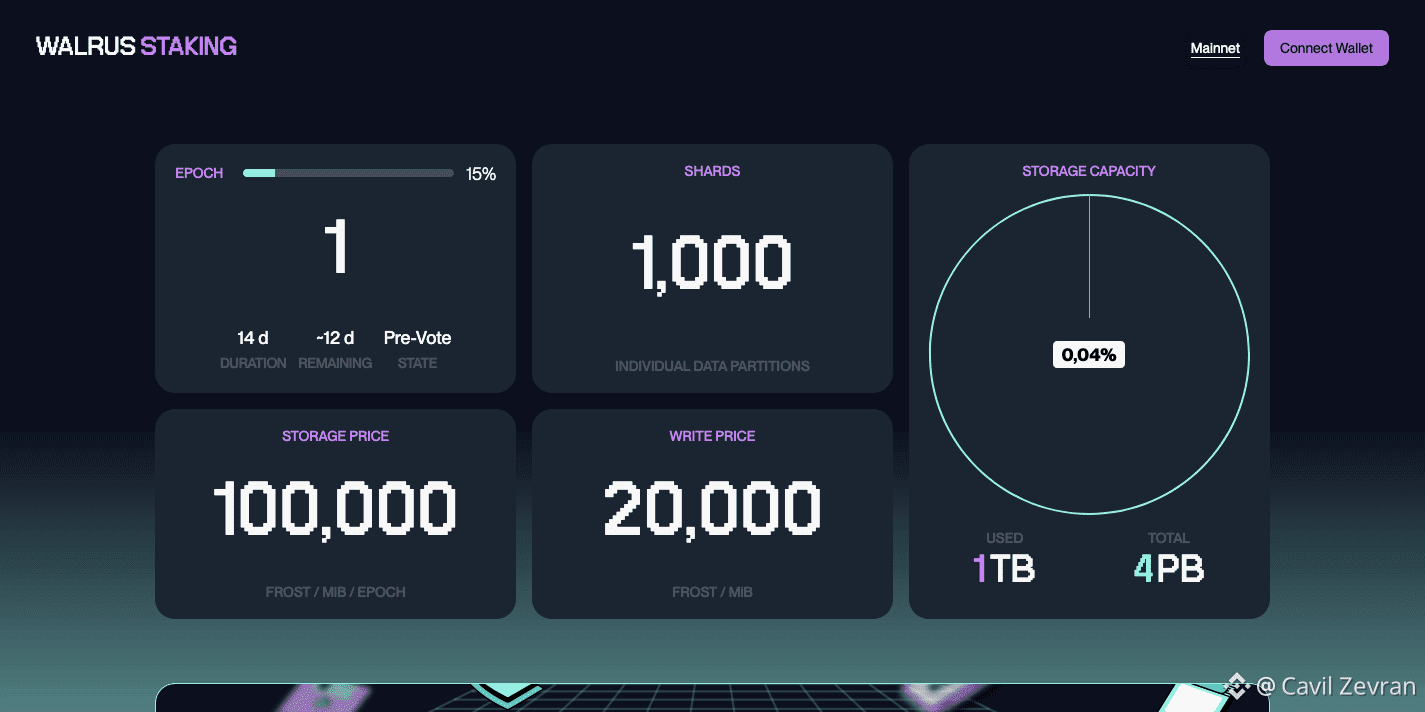

Staking Optimization: Yield Strategies in Walrus

Staking WAL delegates tokens to nodes, earning rewards from fee pools proportional to stake weights and node performance. Rewards claim at epoch ends, with slashing penalties—up to defined fractions of stake—for node failures like unavailable blobs. Traders optimize by selecting nodes with uptime above 95%, diversifying across 5-7 to mitigate risks.

In the Walrus ecosystem, staking yields fluctuate with blob activity; higher storage fees swell pools, making WAL attractive for compound strategies. A walkthrough for entry: Query node metrics via Walrus interfaces; delegate WAL in a Sui batch transaction; track accruals daily; reinvest claims to amplify positions. Constraints lock stakes during epochs, with cooldowns for withdrawals, suiting mid-term traders who balance liquidity needs.

Traders can model yields using on-chain data, estimating APR from past epochs where blob volumes doubled rewards. Bullet points on optimization:

Prioritize nodes with low slash histories.

Use partial delegations for testing.

Rotate based on ecosystem signals like subsidy activations.

This positions WAL staking as a core trading tactic, where ecosystem health directly translates to token returns, rewarding informed delegation over passive holding.

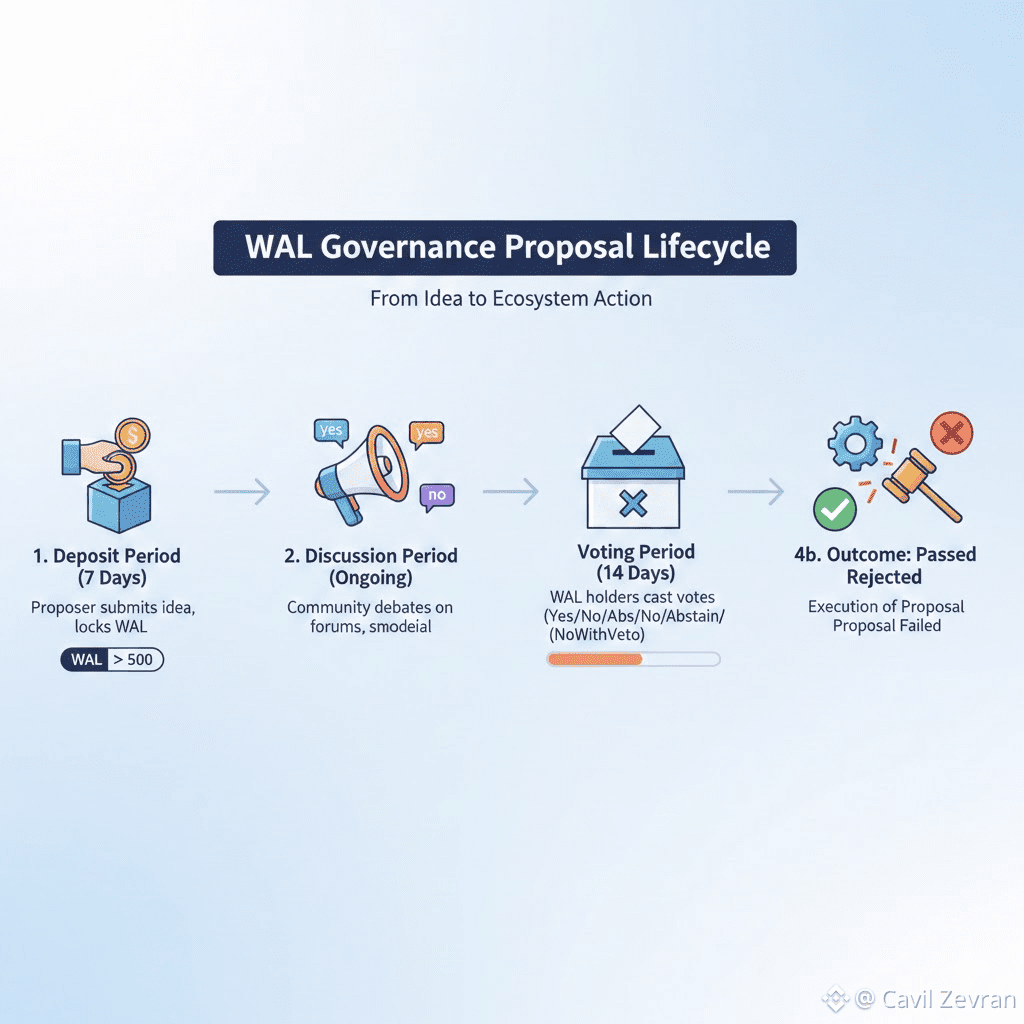

Governance Leverage: WAL Voting for Strategic Edges

WAL governance allows token holders to propose and vote on parameter tweaks, such as fee thresholds or staking minima, with weights scaled by locked amounts. Proposals require WAL deposits, refunded on approval, and votes occur in epoch windows via Sui contracts. Constraints include quorum requirements and minimum locks to deter spam.

For traders, this utility provides an edge by influencing WAL economics—voting for subsidy increases could boost adoption, tightening supply. Concrete steps: Lock WAL in vaults; draft or support proposals via interfaces; vote weighted by holdings; track outcomes for position adjustments. In the ecosystem, successful votes on node incentives might enhance yields, benefiting staked WAL.

Traders strategize by accumulating WAL pre-vote on contentious issues, like encoding adjustments affecting blob costs. Detailed constraint: Deposits forfeit on rejected proposals, adding risk-reward to participation. This ties WAL to active trading, where governance signals predict ecosystem shifts, guiding buy/sell decisions.

Circulation Analysis: Tracking WAL Flows for Trades

WAL circulation involves fees flowing to pools, then rewarding stakers, creating loops that traders analyze for velocity trends. On-chain trackers show inflows from blob payments and outflows via claims. Constraints recycle unclaimed rewards, compounding pools without new emissions.

Traders use circulation data to time entries, buying WAL during high-velocity epochs when fees peak from ecosystem growth. According to official sources, allocations include 10% for subsidies, deployed conservatively to stimulate Walrus usage. Bullet points on flow tracking:

Monitor payment volumes via Sui queries.

Assess reward distributions per epoch.

Factor subsidy draws reducing reserves.

In Walrus, these patterns reveal demand drivers, like AI blob surges increasing WAL locks, offering signals for position building.

Expanded analysis: Calculate net circulation by subtracting staked WAL from fees spent; low nets indicate scarcity. Walkthrough: Query daily flows; correlate with blob counts; trade on thresholds like 20% velocity rises. This empowers traders to view WAL as a flow-dependent asset within the ecosystem.

Blob Management Tactics: WAL Expenditure Planning

Managing blobs in Walrus requires WAL for uploads, extensions, and retrievals, with tactics like batching to cut gas. A blob extension walkthrough: Scan expirations; compute WAL via API; transact renewals in bundles. Constraints cap sizes, necessitating splits for large data, each costing WAL.

Traders plan expenditures by reserving WAL for critical blobs, using yields to offset. In the ecosystem, efficient management frees WAL for trading, as optimized storage minimizes locks. Detailed: Prioritize durations based on data value; use metadata for organization, paid in WAL fractions.

Bullet points on tactics:

Batch small blobs for fee savings.

Set auto-extensions via wallets.

Retrieve non-urgently to avoid premiums.

This integrates WAL utilities into trading, where blob tactics preserve liquidity.

Risk Mitigation in WAL Positions

Mitigating WAL risks involves hedging slashes through diversification and monitoring ecosystem metrics for downturns. Slashing deducts WAL for node faults, capped per event. Traders allocate 30% max to staking, holding rest liquid.

In Walrus, risks tie to blob declines reducing yields; counteract by tracking adoption. Walkthrough: Simulate scenarios with historical data; adjust positions quarterly. Constraints on cooldowns force planning, suiting conservative traders.

Detailed strategies: Use WAL options if available on Sui DEXs for hedges; diversify ecosystems but focus on Walrus utilities. This ensures balanced WAL exposure.

Walrus protocol centers WAL as a utility token with trading depth through payments, staking, and governance on Sui. Traders engaging these mechanics can build resilient positions aligned with ecosystem metrics.