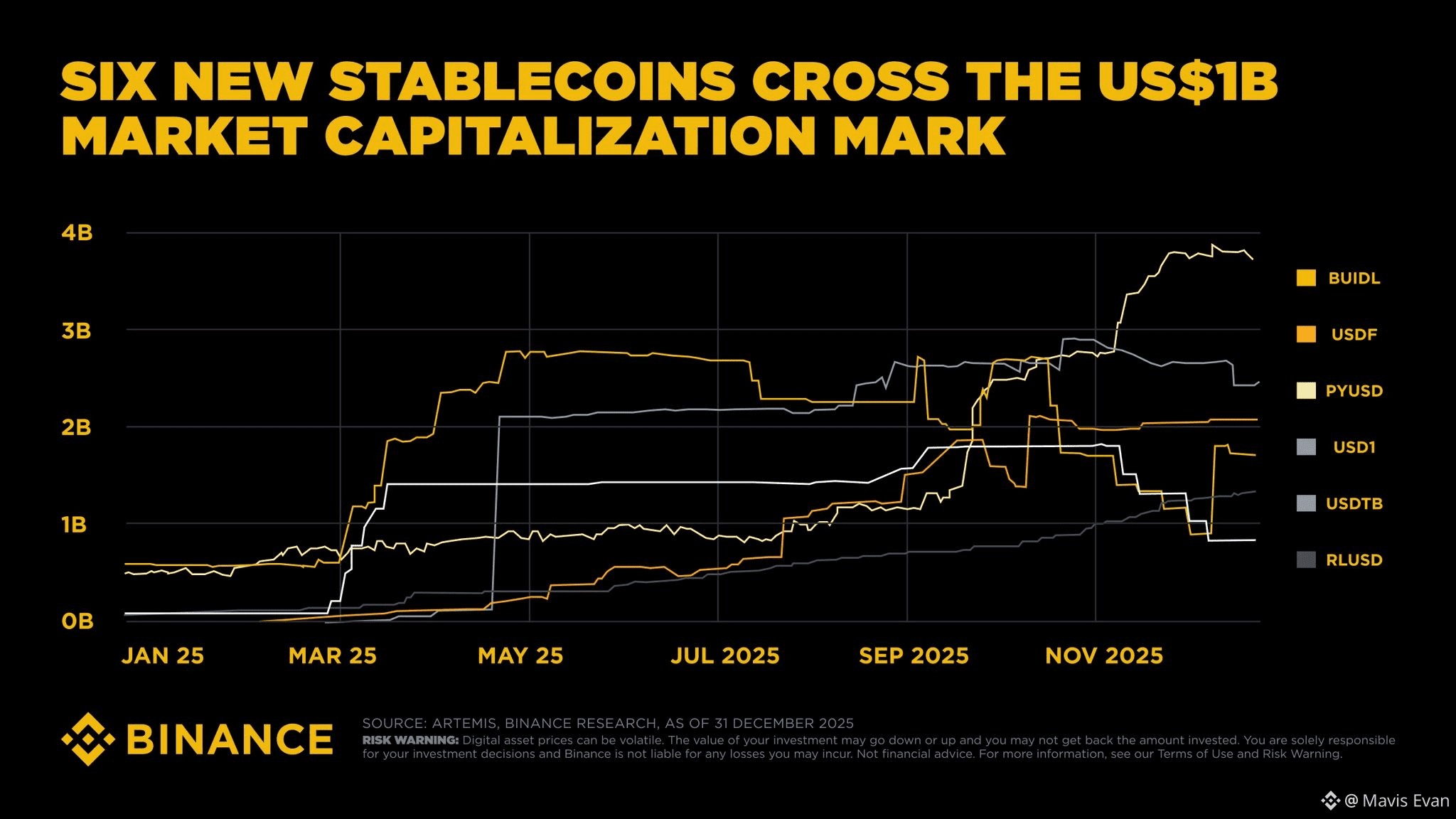

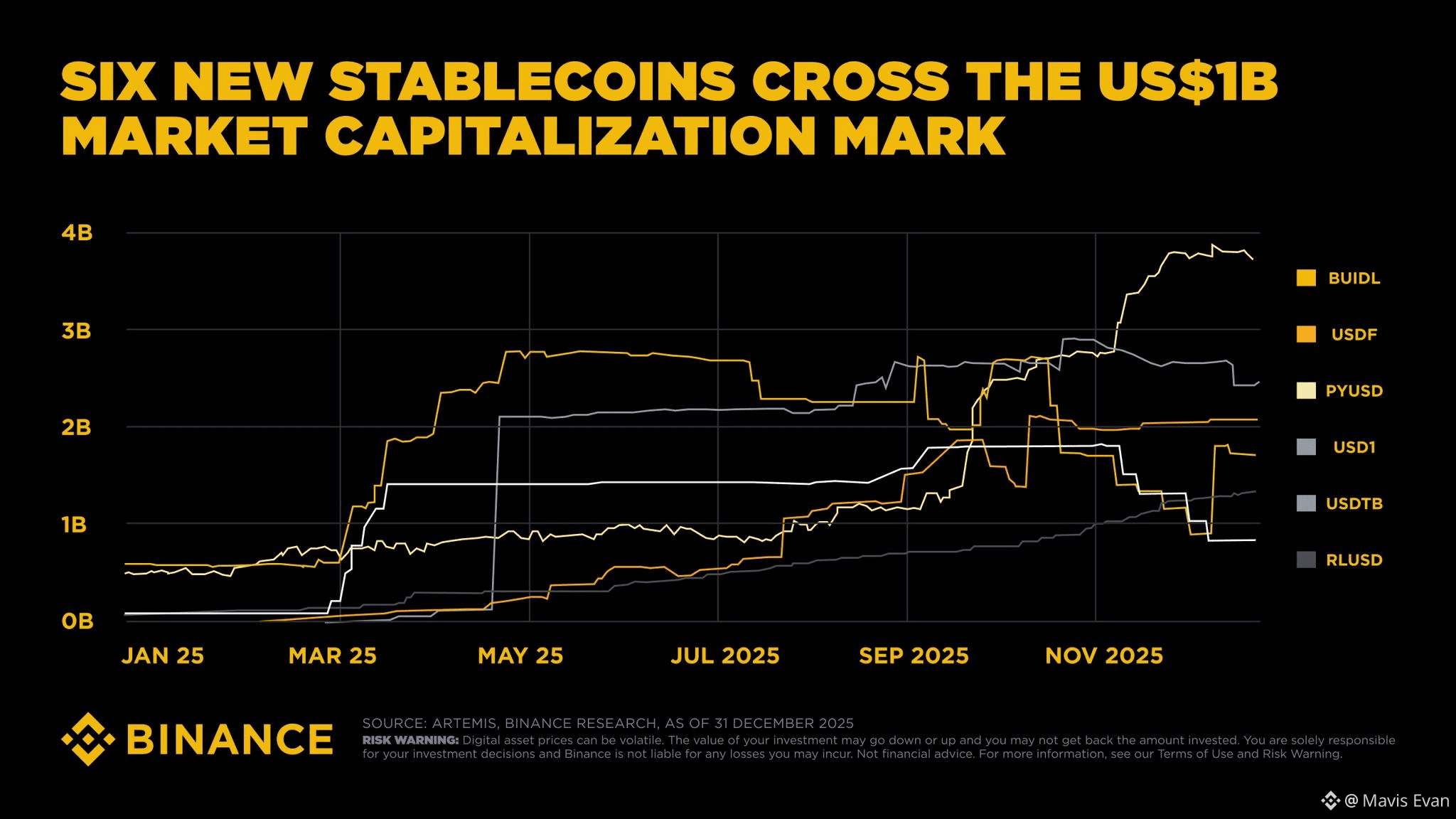

For most of crypto’s short history, the stablecoin market looked like a closed shop. USDT, USDC, and a handful of others dictated the flow of capital, determined where liquidity lived, and quietly decided which chains thrived. The chart in front of us tells a different story. In less than a year, six brand-new stablecoins crossed the one-billion-dollar market cap mark. Not one of them did it slowly. They surged in waves, pulled liquidity from legacy players, and forced the market to confront a simple truth. Stablecoins are no longer just dollar pegs. They are competitive financial products.

The six names lighting up the chart are BUIDL, USDF, PYUSD, USD1, USDTB, and RLUSD. Each line moves differently, but the direction is the same. Straight up.

A market that stopped waiting for permission

From January to March 2025, these coins barely existed. Market caps hovered near zero, drifting quietly under the radar while traders were busy chasing memecoins and L2 narratives. Then, almost overnight in late March, everything changed. One by one, these projects launched with institutional backing, deep exchange support, and carefully structured incentive programs. By May, multiple lines had already smashed through the $1B level.

This was not organic retail discovery. This was coordinated infrastructure deployment. Banks, custodians, payment companies, and funds didn’t test these products in public. They flipped the switch once the rails were ready.

BUIDL: The institutional juggernaut

The gold line dominates the chart. BUIDL is not just the first to cross $1B, it becomes the first to approach $4B by November. The growth curve is aggressive but not chaotic. It climbs, consolidates, then climbs again. That pattern is typical of a treasury-grade product, not a speculative token.

This kind of capital does not move because of hype. It moves when institutions decide that on-chain settlement is now cheaper, faster, and easier than legacy rails. BUIDL’s steady expansion tells us something uncomfortable. A large slice of traditional money is no longer experimenting with blockchain. It is operational on it.

PYUSD and USD1: The retail-institution bridge

PYUSD and USD1 move differently. Their lines are smoother, less explosive, but remarkably resilient. They don’t spike violently. They grind upward, absorb volatility, and hold their ground when others wobble.

These are consumer-facing stablecoins. Payments, wallets, e-commerce platforms, and retail-grade integrations are their battlefield. Their growth is quieter because it is happening at checkout counters, in remittance apps, and inside fintech platforms where users don’t even know which chain they are touching.

That is exactly the point.

USDF and USDTB: Liquidity migration in real time

The orange and steel-grey lines tell the most dramatic story. Both USDF and USDTB show explosive mid-year surges, sharp pullbacks, then renewed strength. This is what liquidity migration looks like when whales rebalance treasury stacks and DeFi protocols adjust collateral preferences.

These coins are not replacing old giants. They are siphoning flow from them. Every sudden jump is a protocol integration, a new trading pair, or a custody partnership going live. Every dip is capital rotating to chase yield or regulatory clarity.

This is market infrastructure being rewritten in public view.

RLUSD: The slow burn that matters most

RLUSD never dominates the chart. It doesn’t steal headlines. Yet its line is the most telling. A slow, consistent climb from near zero to well above $1B by year-end, without parabolic surges or dramatic crashes.

RLUSD never dominates the chart. It doesn’t steal headlines. Yet its line is the most telling. A slow, consistent climb from near zero to well above $1B by year-end, without parabolic surges or dramatic crashes.

This is the profile of regulatory alignment. RLUSD is growing because compliance teams trust it. That matters more than any marketing budget.

Why this moment is different

Six new stablecoins did not cross $1B because traders suddenly fell in love with new tickers. They crossed because the world is finally treating blockchain like financial infrastructure instead of a casino.

Three forces are colliding here:

Regulation is no longer a wall, it is a filter. Projects that can’t meet compliance standards are being sidelined quietly.

Institutions want programmable money. Not exposure to crypto. Not volatility. They want dollars that move at internet speed.

Liquidity is fragmenting on purpose. No single issuer is allowed to dominate anymore. Diversification is now a design feature.

The silent end of the old stablecoin era

Look at the chart again. What it really shows is not growth. It shows succession.

Stablecoins used to be plumbing. Invisible. Taken for granted. In 2025, they became products with business models, regulatory strategies, and competitive moats.

Six newcomers crossing the $1B line in the same year is not a coincidence. It is a warning.

The next crypto cycle will not be built on price charts. It will be built on settlement rails, compliance frameworks, and trust networks. And the stablecoins that quietly crossed this line in 2025 are already laying the foundation.

#CPIWatch #StrategyBTCPurchase #BTC100kNext? #MarketRebound