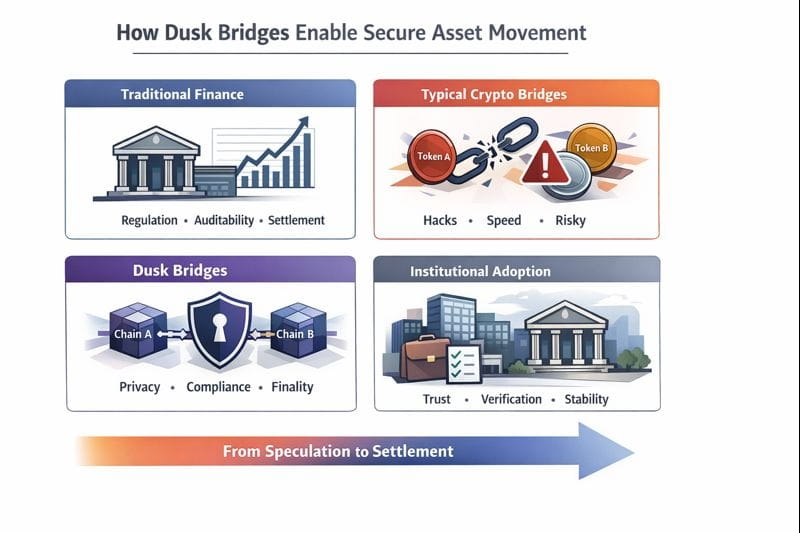

I started paying attention to blockchain bridges not because of a new protocol release but because of examining how traditional securities are transferred from one custodian to the next. It’s a tedious process full of checks and balances designed to be very risk-averse. It’s intentionally so because it’s not just about the value; it’s about the rights associated with those assets in the real world. A wrong transfer of those assets gives rise to liabilities in the real world. The concept of “bridging” in the world of blockchain is seen primarily from the point of convenience. However, in the regulated world of finance, “bridging” is more about the non-technical aspect than the technical one, which is what I find interesting in the case of the solution provided by Dusk.

In short, Dusk bridges connect the dots so that assets can be transferred from one domain to another while, at the same time, respecting the rules that regulate the asset and its privacy parameters. Contrary to generic cross-chain bridges that are concerned with either being fast or maintaining liquidity levels, the bridges implemented by Dusk are intended for financial assets represented in the form of tokens like shares, bonds, or funds that are regulated. This is in addition to ensuring that when a financial asset is transferred from one chain to another, its rules for regulatory compliance, its ownership, as well as its promises for privacy are transferred along with it.

Dusk bridges use cryptographic proofs for verification instead of off-chain intermediaries. The key feature of Dusk's design is that it combines these with a privacy-preserving mechanism for verification. In particular, instead of requiring verification of sensitive information for transactions, the Dusk bridge provides a mechanism for verification of regulatory requirements such as the credentials of investors or the rules of jurisdictions for which the assets should not betray sensitive information. As a result, it does not require physical intermediaries for each transaction.

In traditional finance, different actors see different aspects of a transaction. Supervisors see compliance data, custodians see settlement information, and investors see balances. In dusk bridges, this concept applies as well. Dusk bridges work similarly. The network is able to ensure a transfer is valid, but it doesn't need to know who the investor is or what was the reason for the transfer. When regulators are authorized, they can audit the transactions with appropriate visibility. Investors maintain their privacy. Issuers remain confident that assets are held and transferred only by compliant participants. This selective transparency is central in making blockchain infrastructure usable for regulated assets.

A bridge is only as sound as the incentives that underpin it. Whether a validator or operator can gain by cutting corners, the system will eventually break. Dusk's approach focuses on the alignment of incentives through protocol-level enforcement rather than reliance on unique actors. Validators are incentivized for correctly validating compliant transfers and penalized for their misbehavior. Issuers benefit because their assets remain in a state of approved compliance. Investors benefit because assets remain transferable without sacrificing their privacy. Regulators benefit because oversight is integrated at the system level-not bolted on afterward. This is better alignment, reducing reliance on manual intervention and lowering long-term operational costs.

Many bridges optimize for volume and speed. In regulated finance, sustainability is more important than raw throughput. Assets like bonds or equity tokens are held for years, not minutes. The point is that it is essential that a system remains predictable and auditable. Dusk bridges have been developed with a long-term perspective. There is a reduced overhead with automation. The rule-based transfers assist in avoiding errors. Over a period of time, a system is developed that scales not based on a per second processing increase but based on larger market.

Dusk bridges facilitate the management of asset lifecycles. Issued assets can now seamlessly transition from primary issuance platforms, secondary markets, and settlement layers without requiring reissuance and reconciliation. Issuer compliance rules are maintained, eliminating risks associated with the law. There is less friction for the issuer to contribute to the liquidity of the secondary market while retaining control over the eligibility of investors.

It provides portability without compromising protection. Through it, assets are allowed to move between spaces while preserving both privacy and regulatory protection. Such an environment promotes healthier secondary markets, where liquidity is not achieved at the expense of either non-compliance or private information being compromised.

Dusk bridges provide regulators with something often missing in blockchain systems: enforceable visibility without total surveillance. Secure, compliant bridges are quiet infrastructure: they rarely capture attention, but they decide if blockchain systems will be able to support real economies, not simply trading venues. Long-term, the value of such systems lies in trust earned through design. When asset movement becomes predictable, private, and compliant by default, blockchain stops being an experiment and starts becoming infrastructure.