When people talk about blockchain, transparency is often treated as a default good. Everything visible. Everything traceable. Everything open.

At first glance, that sounds ideal. But the more I think about real financial systems, the more this assumption starts to feel incomplete.

Traditional finance doesn’t operate in full public view. Transactions, positions, identities, and strategies are protected for a reason. Exposure can create risk, not trust. This is where many blockchain designs quietly clash with reality.

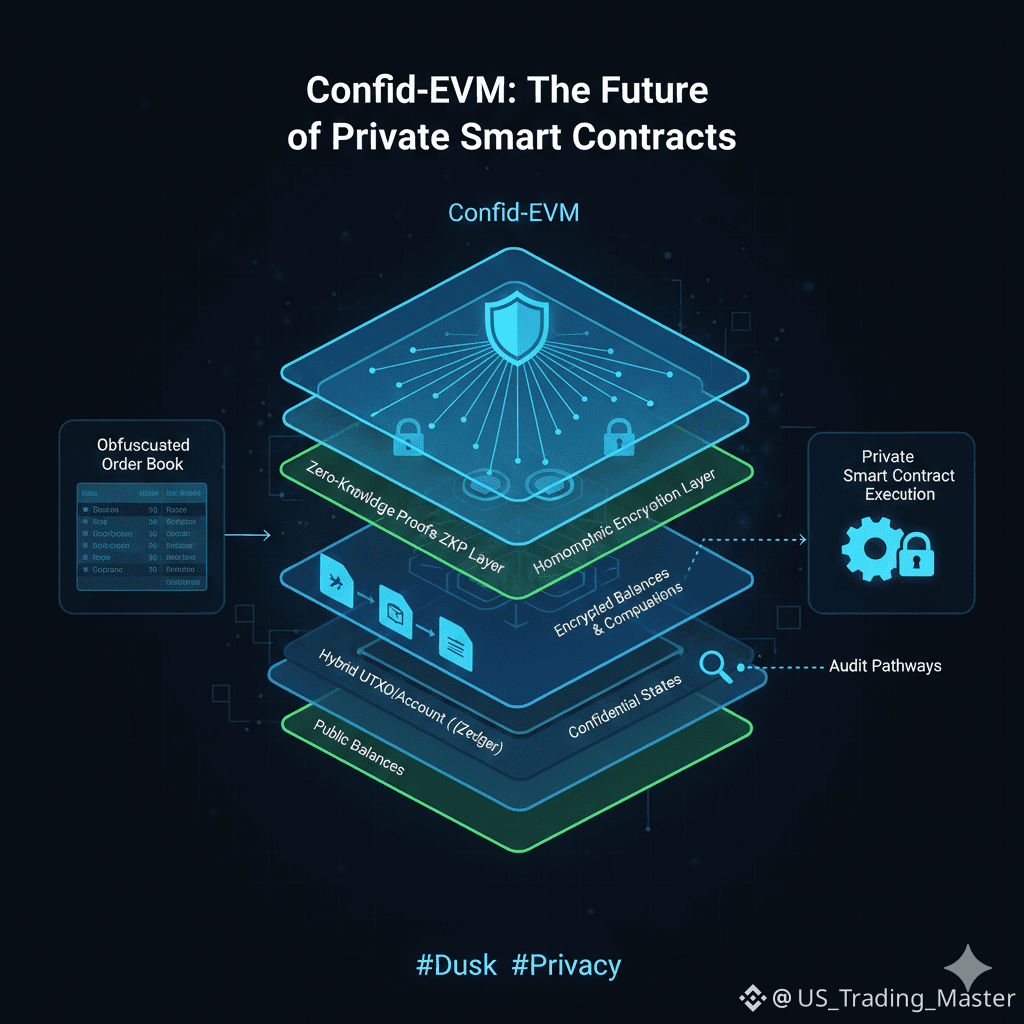

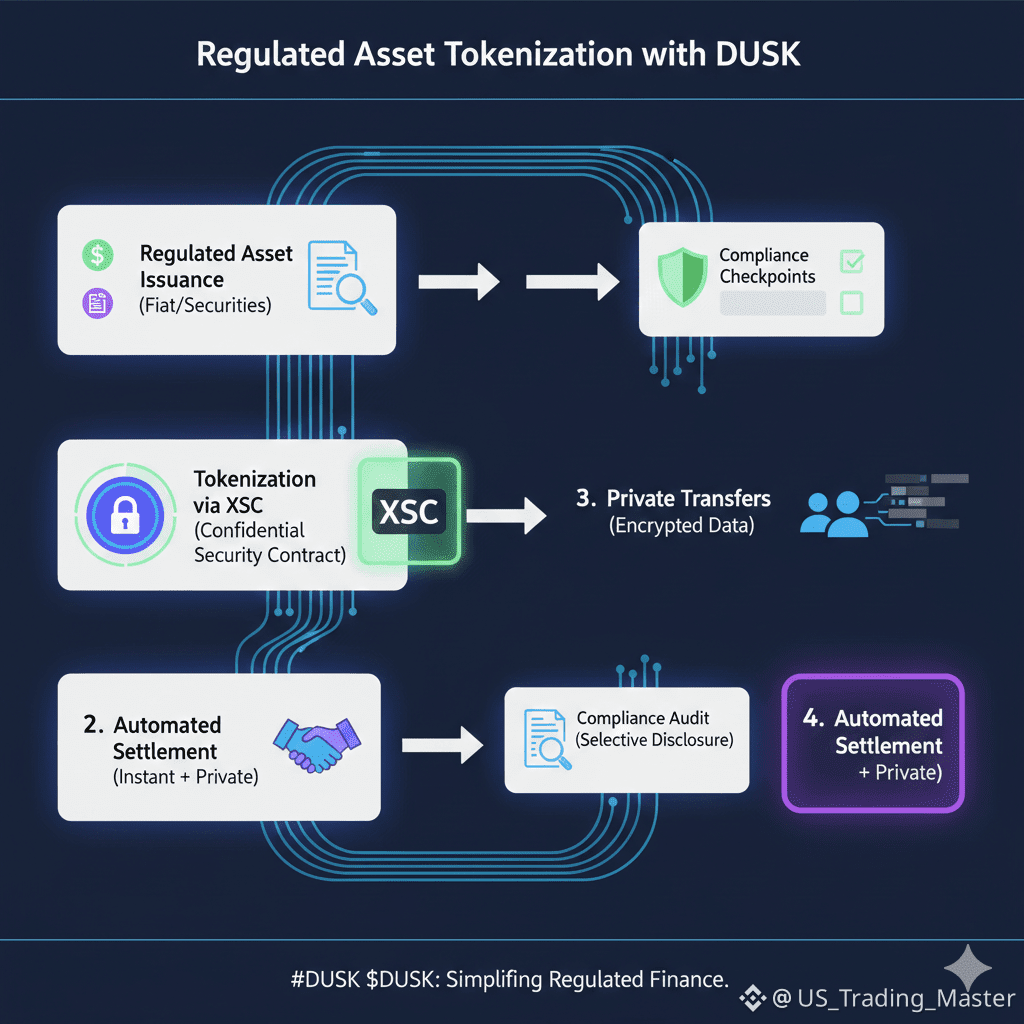

What stood out to me while studying this infrastructure is that privacy isn’t treated as an optional layer added later. It’s embedded into how transactions and contracts are structured from the beginning. That changes the conversation entirely.

Instead of asking, “How do we hide data?” the better question becomes, “Who actually needs to see this information?”

In my view, this approach aligns much more closely with how financial markets already work. Verification still exists. Settlement still happens. But unnecessary exposure is avoided.

This philosophy is central to what @Dusk is building with $DUSK , and it’s why I think this project deserves attention beyond surface-level metrics. #dusk