South Korea has taken a step that is easy to underestimate at first glance, yet difficult to overstate in its long-term impact. In a recent legislative session, the National Assembly approved amendments that formally recognize tokenized securities under Korean law. This is not a limited trial or a regulatory sandbox. It is a comprehensive legal framework with a defined implementation timeline.

For the global crypto and financial markets, the message is clear. Tokenization has moved beyond experimentation. It is being absorbed into the core of financial infrastructure.

What Was Actually Approved

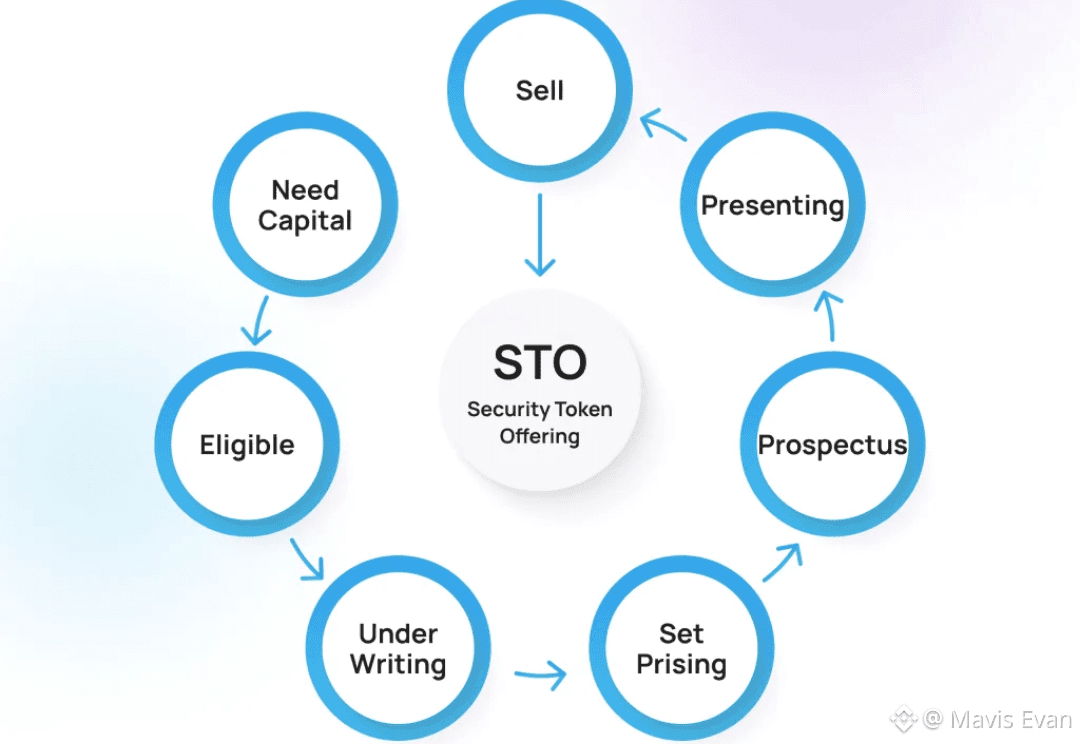

Lawmakers passed revisions to both the Capital Markets Act and the Electronic Securities Act, establishing a legal basis for issuing and trading securities directly on blockchain networks. Under the amended framework, security token offerings are not restricted to a narrow category of assets. Equity, debt instruments, and broader investment contracts are all explicitly covered.

Oversight will sit with the Financial Services Commission (FSC), which has been preparing for this transition for several years. Initial regulatory guidelines were published as early as 2023, signaling that the legislation is the culmination of a longer policy process rather than a sudden pivot.

The law is expected to be promulgated without major obstacles and will officially come into force in January 2027, following a one-year preparation and implementation period. That timeline gives institutions, issuers, and infrastructure providers a clear runway to build.

Why This Matters More Than the Headline Suggests

Tokenized securities are often framed as traditional assets “put on-chain,” but that description misses the deeper shift. What South Korea is enabling is not cosmetic digitization. It is operational transformation.

Regulators have explicitly emphasized distributed ledger–based securities account management and the expanded use of smart contracts. In practice, this means automation of issuance, settlement, and compliance. Reconciliation costs fall. Manual processes shrink. Rules move from policy documents into executable code.

The implications are especially significant for assets that never fit neatly into traditional capital markets. Real estate projects, fine art, collectibles, and bespoke investment contracts have historically faced distribution and liquidity constraints. Under a regulated tokenization framework, these assets can be structured, fractionalized, and traded without sacrificing legal clarity.

This is the bridge between traditional finance and blockchain that the industry has spent years describing but rarely implementing at scale.

Institutions Are Not Waiting

This legislative shift is not happening in a vacuum. Large financial institutions in South Korea have been preparing for precisely this outcome.

Firms such as Mirae Asset Securities and Hana Financial Group have already begun developing internal platforms, partnerships, and operational infrastructure aimed at tokenized products. Their positioning suggests that the law is expected to unlock real commercial activity, not merely theoretical experimentation.

Global projections reinforce that view. Standard Chartered estimates that tokenized real-world assets, excluding stablecoins, could grow from today’s tens of billions into a market approaching two trillion dollars by 2028.

Domestically, Boston Consulting Group projects that South Korea’s tokenized securities market alone could reach 367 trillion won, roughly 249 billion dollars, by the end of the decade.

That scale places tokenized securities firmly in the category of parallel capital markets, not niche innovation.

The Broader Regulatory Context

The tokenized securities framework is only one piece of a larger regulatory strategy. South Korea is also advancing its second major crypto law, the Digital Asset Basic Act, which is expected to be finalized by early 2027.

That legislation is set to address won-pegged stablecoins, spot crypto ETFs, and broader digital asset governance. When viewed together, these initiatives point to a deliberate effort to construct a coherent, institution-friendly crypto regime.

While other jurisdictions continue to debate definitions and jurisdictional boundaries, South Korea is building rails.

Why the Market Should Be Paying Attention Now

This development is unlikely to spark immediate price movements, and that may be why it has not dominated headlines. Its importance lies elsewhere.

Tokenized securities sit at the intersection of DeFi, traditional finance, and real-world assets. Jurisdictions that provide early legal clarity attract issuers, liquidity, custodians, and infrastructure providers. Over time, those advantages compound.

For global platforms and investor communities, this kind of regulatory signal matters more than short-term volatility. It shapes where capital forms, where products launch, and where financial experimentation becomes sustainable.

South Korea has now made its position clear. Blockchain-based finance is not a side experiment. It is being integrated into the country’s financial future.

For the crypto industry, this may turn out to be one of the most consequential quiet approvals of the year.

#StrategyBTCPurchase #USDemocraticPartyBlueVault #MarketRebound