This is not a rumor. This is not a test. This is real adoption.

Belgium’s banking giant KBC, managing over $375 billion in assets, has officially confirmed that it will allow all customers to buy Bitcoin starting next month. One of Europe’s most conservative and regulated banks is opening the door to crypto for everyday users.

That alone tells you how fast the landscape is changing.

Why This Is Huge for Bitcoin

When a traditional bank of this size moves, it is never for hype. It is done after risk checks, compliance reviews, and regulatory clarity. KBC’s decision signals that Bitcoin is no longer seen as a fringe asset inside European finance.

For millions of customers, buying Bitcoin will soon be as normal as buying stocks or mutual funds. No complicated exchanges. No external wallets required for entry. Just direct access through a trusted banking platform.

This is how mass adoption actually happens.

What This Means for Europe

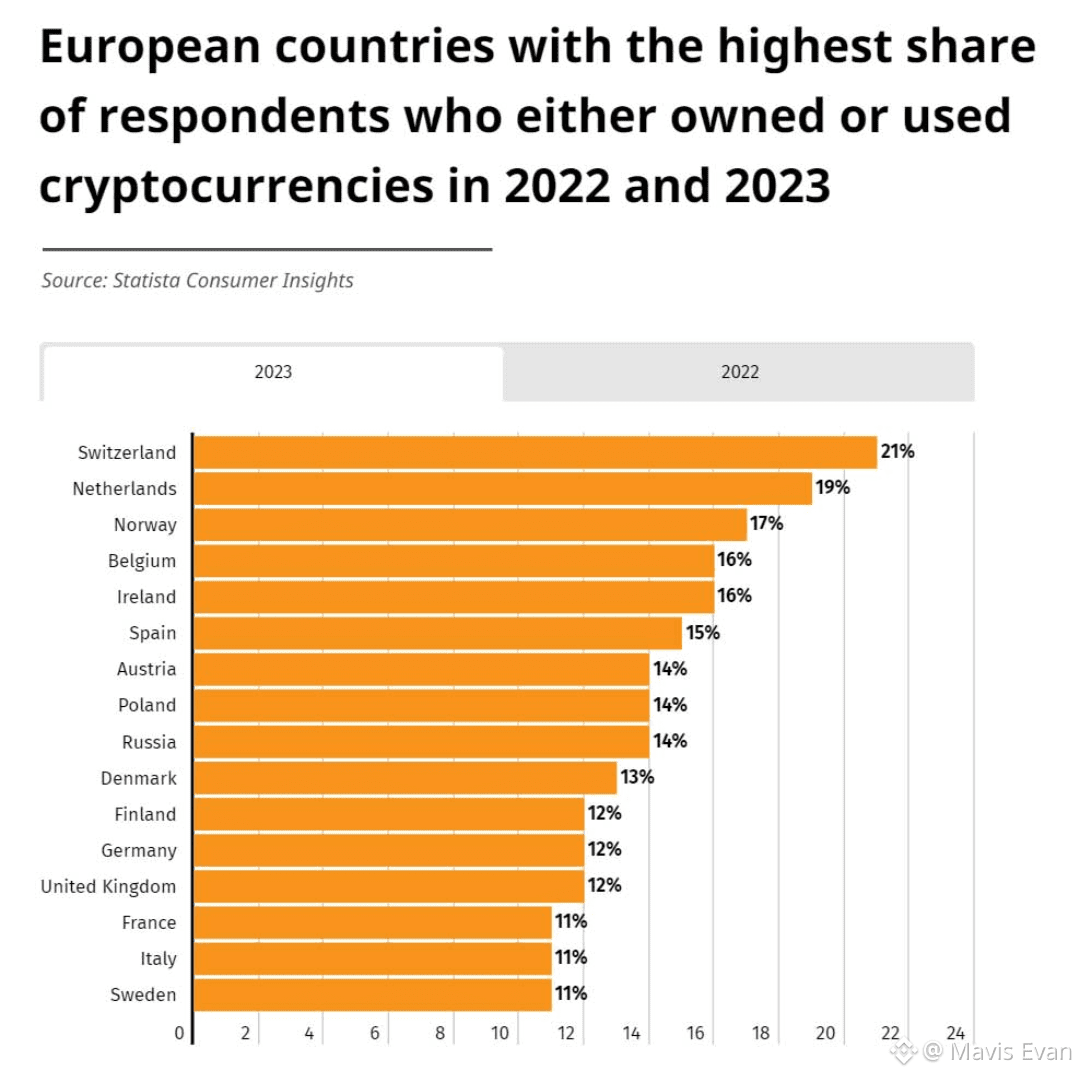

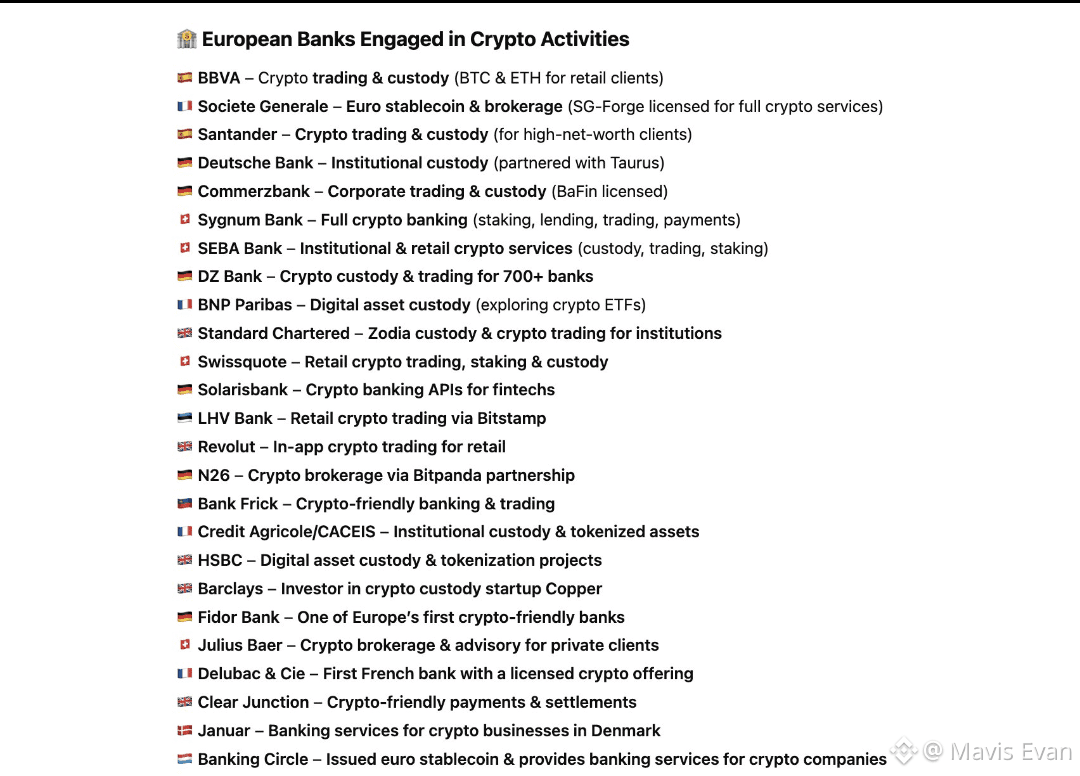

European banks have been slow but careful with crypto. Now that one of Belgium’s largest institutions has taken the lead, pressure builds on others to follow. Once customers expect crypto access from their bank, it becomes a competitive requirement, not a bonus feature.

This move strengthens Europe’s position as a serious player in regulated Bitcoin adoption. It also proves that crypto and traditional finance are no longer enemies. They are merging.

Trending Signal for the Market

Big banks do not chase trends. They respond to demand.

KBC allowing Bitcoin purchases shows one clear truth: customer interest is too large to ignore. Retail adoption is rising. Institutional comfort is growing. Regulation is catching up.

This is the quiet kind of bullish news that shapes the next cycle.

Bitcoin is not knocking on the banking door anymore.

The door is opening.

And Europe just made its move.