The crypto market is once again testing a critical psychological level. Total market capitalization has slipped below $3 trillion, marking the third such test this month and raising fresh questions about whether the sector is entering a deeper corrective phase rather than a routine pullback.

What stands out this time is where the pressure is coming from. Losses are concentrated in large-cap assets with strong institutional and ETF exposure. This suggests a calculated reduction of risk by professional investors, not broad panic from retail participants.

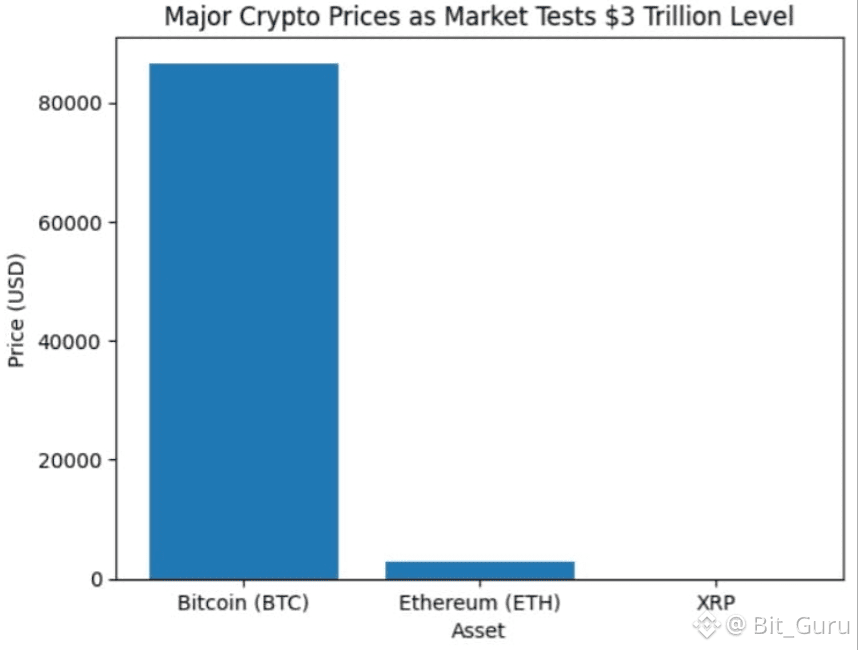

Bitcoin has retreated toward the mid-$86K area, stalling recent recovery attempts and dragging sentiment across the market. Ethereum has slipped back toward the $2,900 zone after failing to sustain higher levels, while XRP struggled to hold above key psychological resistance. These assets led the upside earlier in the year — and they are now leading the downside as year-end positioning sets in.

Interestingly, crypto weakness is diverging from strength in Asian equity markets, which are finding support from expectations of fiscal stimulus in China. This contrast highlights crypto’s sensitivity to global liquidity and dollar strength, rather than regional growth optimism.

Adding pressure, the U.S. dollar has rebounded after recent lows, a move that typically weighs on dollar-denominated assets like Bitcoin. At the same time, market sentiment has deteriorated sharply, with the Crypto Fear & Greed Index dropping into extreme fear territory — a level that often coincides with heightened volatility.

From a technical perspective, analysts are closely watching the $81,000 zone for Bitcoin as near-term support. A clean hold could stabilize conditions, while a breakdown may open the door to deeper consolidation into historically significant ranges.

Despite near-term weakness, on-chain data remains mixed. Short-term momentum appears stretched, but long-term accumulation by institutions and corporates continues quietly in the background — a reminder that conviction and positioning don’t always move in sync.

Bottom line:

The market is at a decision point. Thin liquidity, cautious institutions, and fragile sentiment suggest volatility may persist, but long-term structural interest remains intact. How the market behaves around the $3 trillion level will likely define the tone for the weeks ahead.

#BTC #ETH #XRP #CryptoMarket #BinanceSquare