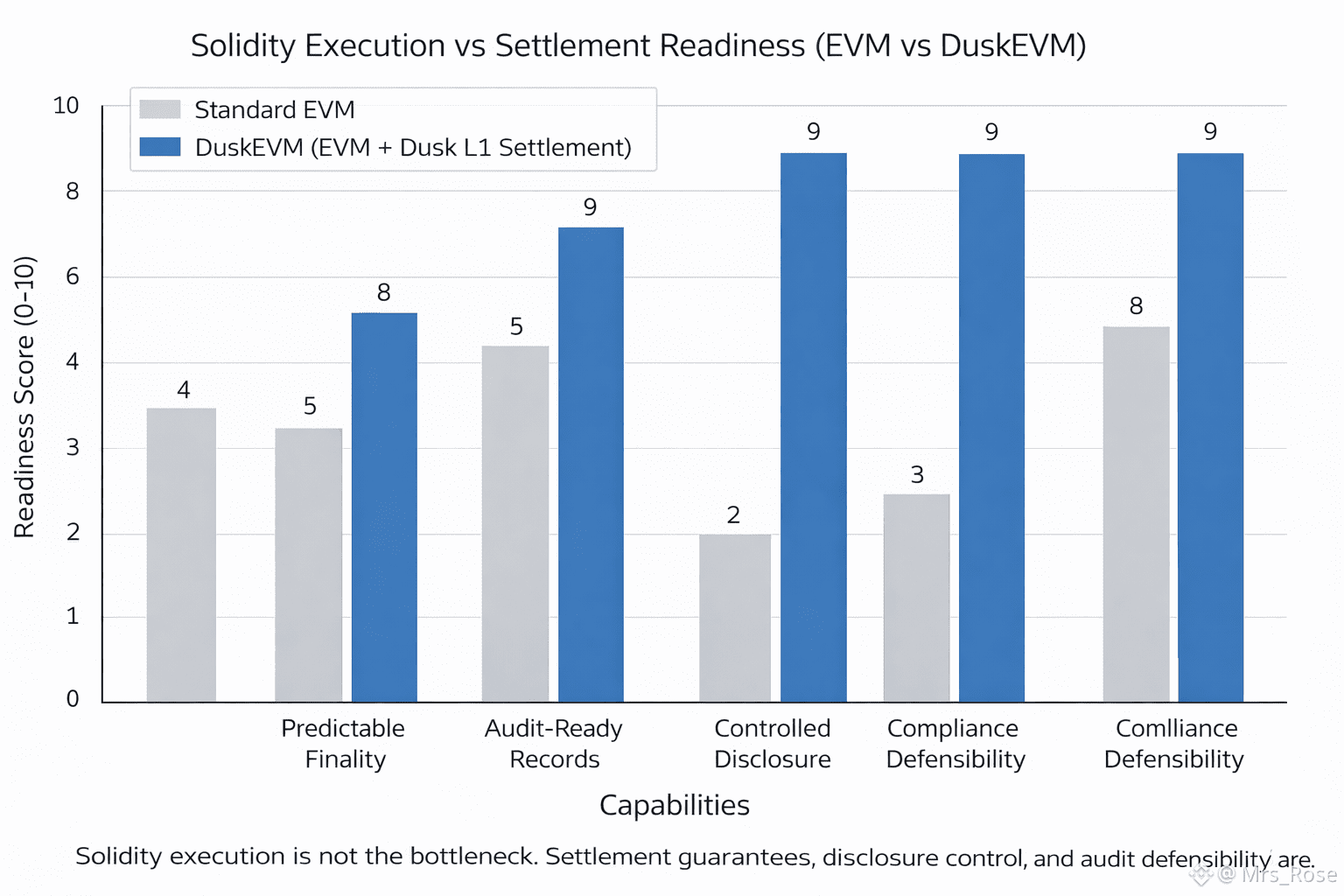

A lot of teams think the hard part is writing Solidity. It’s not. The hard part is what happens after the contract works: settlement assumptions, compliance checks, and “who can verify what” without turning the whole app into public-by-default finance.

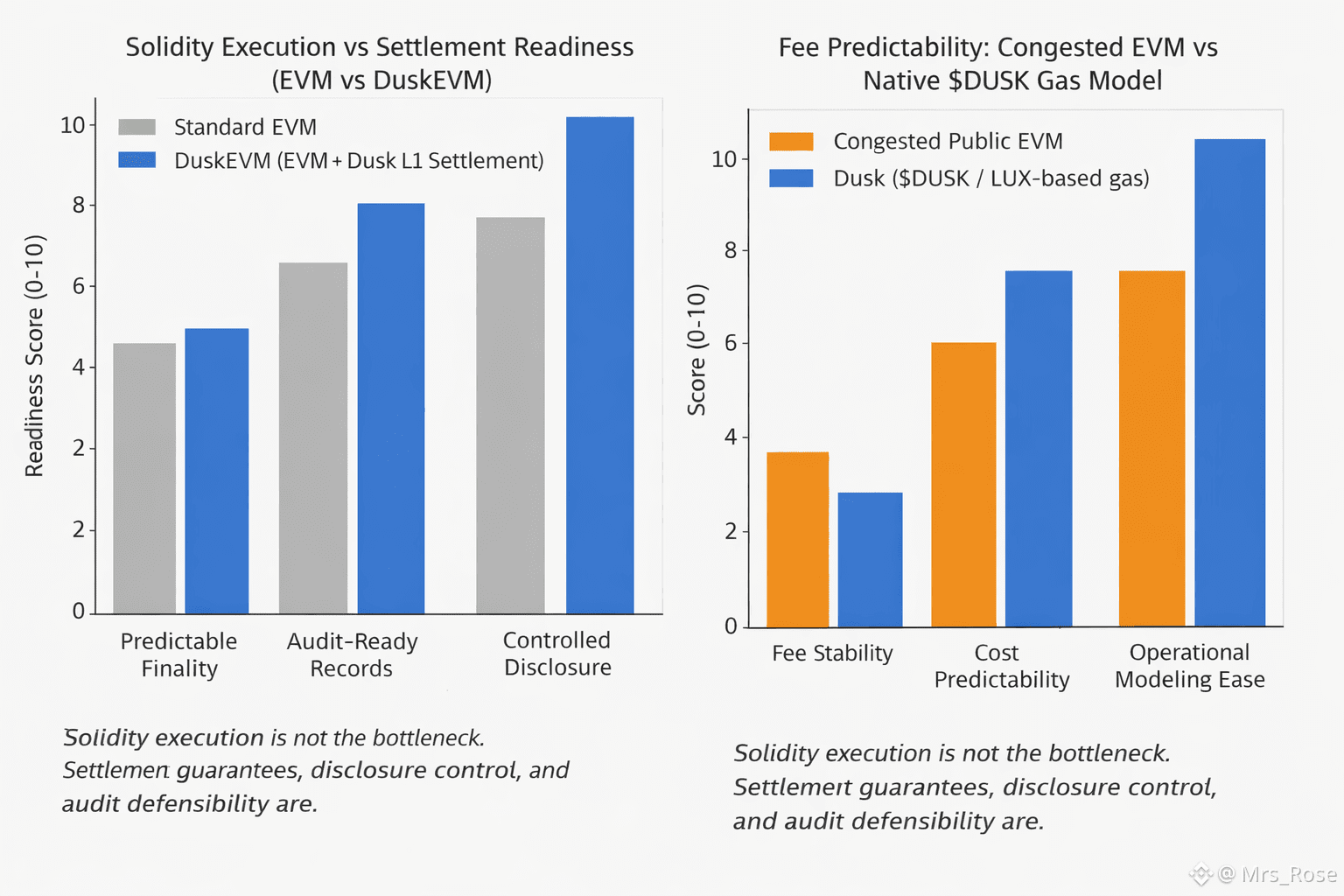

That’s the Solidity-to-settlement friction I keep seeing. Your contracts deploy fine on an EVM chain, but once you try to plug into regulated workflows, you hit stuff Solidity doesn’t solve by itself: predictable finality, audit-ready records, controlled disclosure, and operational rules that compliance teams can actually defend.

This is also why “EVM-compatible” alone doesn’t equal “institution-ready.” A standard EVM environment is amazing for open apps, but regulated finance cares about what’s underneath the execution layer how settlement is anchored, how verification works, how data exposure is controlled, and how consistent the rails are over time.

DuskEVM is interesting because it’s not asking builders to rewrite their world. It’s an EVM-compatible application layer that lets teams deploy standard Solidity contracts while settling to Dusk Layer 1 underneath. That split matters: execution stays familiar, but the base layer is designed for regulated, privacy-aware financial infrastructure.

Now the “compliant finance app” requirement isn’t just KYC and paperwork. It’s technical: you need auditability and you need to avoid leaking private market behavior as public metadata. That’s where Dusk’s approach is trying to land selective disclosure rather than total transparency or total opacity.

The practical proof-point is that this isn’t just a roadmap phrase. Dusk framed the DuskEVM mainnet rollout for January 2026 , which is when Solidity teams can actually test whether the “no rewrite” promise holds in real deployments.

Fees matter in this context too, because institutions model operational spend. Dusk’s gas model is tied to $DUSK (priced in LUX units), meaning real execution has a native fee currency that’s consistent across transactions and smart contracts—again, boring on purpose, because boring is what regulated operators trust.

So when I say DuskEVM removes friction, I mean it removes the gap between “Solidity works” and “settlement is acceptable.” Developers keep the EVM surface, institutions get a settlement environment designed for compliant workflows, and both sides can finally talk about pilots without the conversation dying at the first compliance question. @Dusk

#dusk