There is a presumption in the crypto space that innovation is speed and opacity. There is a presumption that more recent tokens are created with speculation, with tricks, or with max decentralization as goals. But such a presumption doesn’t get what projects like Xpl Token are trying to accomplish. No matter what, when it comes to blockchain, the most significant innovation isn’t going to come in terms of spectacular returns. Innovation, in blockchain, is going to come in terms of creating something that is usable, something that works. And that’s what Xpl Token has to be judged by.

Xpl Token was created not to capitalize on volatility but to fix the inefficiencies present in the contemporary financial infrastructure. The founding tenet: use blockchain technology for finance in a way that helps serious players, not hinder them, and integrate sound behavior, openness, and compliance into the system.

Right from the beginning, the team operated under three constraints. Firstly, regulatory compliance, any financial token that wishes to be useful in institutions must be compliant with existing regulations, ranging from know your customer norms to the antimony laundering norms. The second is privacy with accountability: sensitive transaction details cannot be public by default, yet regulators need auditable trails. Third, scalability without compromise: systems must handle real-world transaction volumes reliably without sacrificing security or modularity.

These are not constraints on creativity but rather the things that define creativity. Every architectural choice in Xpl Token was a response to these real-world demands:

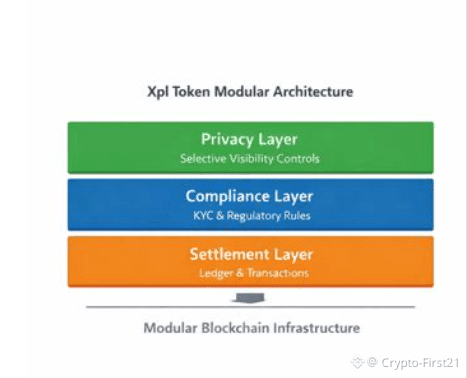

At its very core, XPL Token is built on a modular blockchain architecture. "Modular" will often be a buzzword nowadays in crypto discussions, but here it has practical meaning: the system separates the concerns into layers that can evolve independently while keeping integrity.

The settlement layer is the backbone where ownership and token transfers are recorded. It is designed for consistency and immutability, thus it should be considered the ledger that has the real truth. The compliance layer is one where regulation becomes a first-class protocol feature. Permissions, KYC verification, and transaction flagging are baked into the ledger itself, not appended later on. The privacy layer ensures selective, rather than absolute, anonymity, making transaction details available only to relevant parties. This would enable institutions to be confidential yet audit able.

Xpl Token keeps these layers separate, thereby avoiding monoliths that tend to be rigid and slow. Changes in one layer will not affect the whole network. This means predictable infrastructure for the institution.

A modular design is more than a preference—it is a necessity. Banking and financial environments are complex. There are shifting conditions related to regulations and the volume of transactions. Modular blockchain technology enables a bank or a fund to use the Xpl Token without having to wait for the entire network to upgrade.

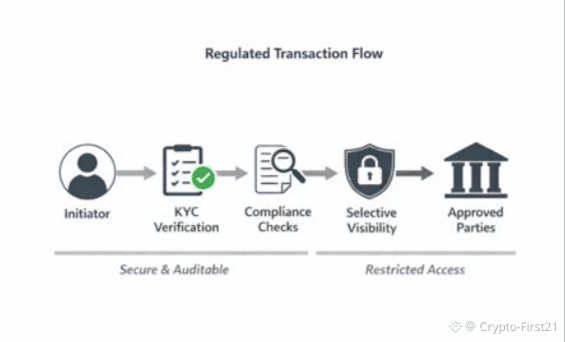

With regard to Xpl Token, privacy is viewed as selective transparency. Selective transparency is a practical process that ensures auditors view only what they need to view. Similarly, it ensures that regulators have a mechanism to view compliance levels. Similarly, it ensures that only necessary information is shared with third parties.

There is compliance integration at the protocol level. For other projects that require KYC or AML compliance off-chain, the enforcement of rules is integral to the design of the Xpl Token. Transactions on the platform can occur in accordance with maritime law or indicate infringement in a manner that is traceable.

Xpl Token is not a theory-concept. Its testnets have already proven the functionality of secure transaction processing, selectively visible transactions, and automated compliance functionality. Collaborations with digital currency custodians and regulated Financial Service Providers prove its application-focus. A few of its partners began using Xpl Token for the tokenization of fiat currency, establishing compliance with regulations while maintaining audit trails. Early live implementations for cross-border settlement systems have exemplified how the modular nature enables rapid development without affecting the existing settlement framework. A few trading firms are evaluating Xpl Token for private assets on its ledger due to privacy features and automated compliance.

Such integrations are emblematic of a larger point: it necessarily feels adoption by all cannot be avoided because it addresses existing needs that many tokens cannot.

Looking at a practical example, a financial organization might like to issue a tokenized corporate bond. In traditional blockchains, either there is information openness or there is the need for a compliance overlay done manually by human involvement. In Xpl Token, the whole bond issuance process can occur on-chain. The ownership of the bond will be maintained on the settlement level only. Only approved third parties have access to transaction information; auditors preserve full access. In this manner, Xpl Token validates abstract architectural choices about modularity, privacy, and regulation to create real-world results that closely resemble traditional finance, through blockchain optimization.

The strength of Xpl Token is its alignment with reality rather than hype. The majority of blockchain projects center on speculation, innovation, and network effect. The strength of Xpl Token is based on discipline and predictability. They have designed a structure for digital finance that will coexist with regulation and privacy.

This strategy has a broader application: that the future of blockchain is more than decentralization or speedy transactions. It is to build infrastructure that will give institutions and end-users confidence. In the way that the system of Xpl Token has intertwined principles of privacy with the system, it shows how good infrastructure can make blockchain a viable platform for serious financial business activities.

Ultimately, the value of Xpl Token must be assessed not by its fluctuations in the market, but by the strength and usefulness of this infrastructure and its strength. And for those who are able to see beyond the headlines and the informational paraphernalia that distracts and distorts public discourse, it is a harbinger of what can and perhaps should be the role and destiny of financial technology.