The Day @Dusk Started Feeling Like Rails Instead of Noise

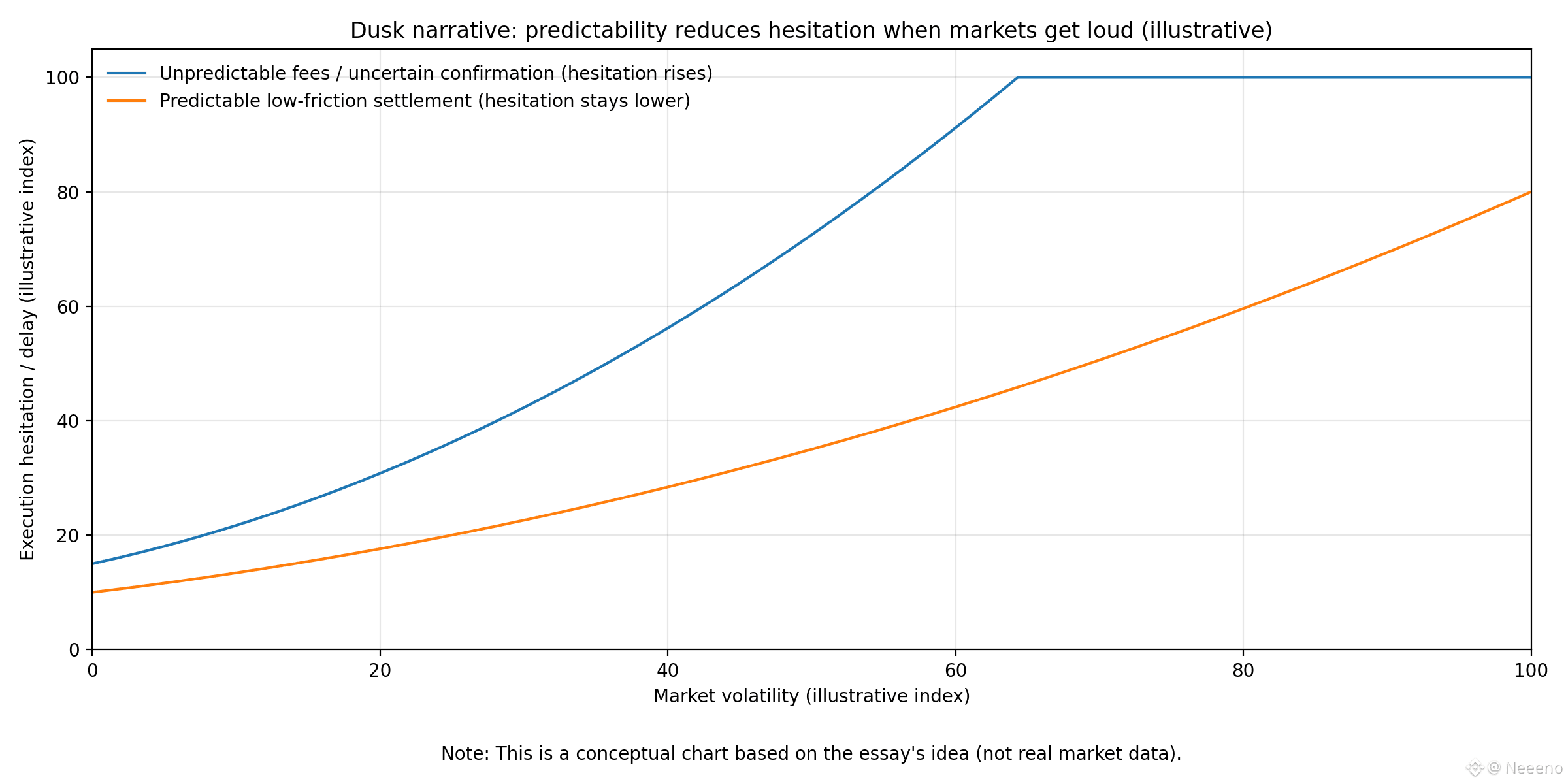

The first thing Dusk changes is not your strategy. It changes your posture. With DUSK, you don’t feel like you’re asking permission from the network every time you move. You stop bracing for the moment a simple transfer becomes a negotiation with uncertainty. That emotional shift sounds small until you notice how much of trading is really just managing your own hesitation.

In mid-January 2026, the numbers around DUSK look like the kind of snapshot traders recognize as “awake again”: price pushing in the high-single-cent range and volume large enough to remind you that attention can return fast when conditions align. The circulating supply sits just under 487M, with the full cap far above that, which gives the token’s day-to-day movement a familiar blend of liquidity and sensitivity. None of this is a prophecy. It’s just the current terrain you’re walking on.

But the terrain matters because fees are not just math. Fees are a kind of social pressure. When costs spike unpredictably, people trade like they’re holding their breath. They avoid small corrections. They delay exits. They “wait one more minute” and then blame themselves for what was actually an infrastructure problem wearing a psychological mask. Dusk’s promise, in practice, is that the network should not be the thing that shames you for acting responsibly.

This is where DUSK stops being a ticker and starts being a behavior pattern. If moving value is cheap and consistent, the professional habits become affordable again. You can reduce exposure in steps instead of one dramatic motion. You can split collateral without feeling punished. You can rotate without needing the market to be calm. Low friction doesn’t create discipline, but it stops taxing discipline until it breaks.

What makes Dusk feel different to people who live close to execution is that it keeps pointing toward settlement as a lived experience, not a theoretical property. The documentation keeps returning to the same idea: a base layer meant to provide finality and act as the anchor for everything built above it. That’s not poetry. That’s an operational promise: when the system says something happened, it should stay happened, even when the room gets loud.

That promise only becomes real when the software keeps moving forward in public, under scrutiny, without drama. Early January brought another node release, dated January 7, 2026, the kind of small, iterative step that rarely trends but quietly changes what operators can rely on. A chain becomes trustworthy the way a bridge becomes trustworthy: not by speeches, but by maintenances

And maintenance is where the “low fee” story earns its right to exist. Cheap execution that collapses under load is not cheap; it’s deferred cost. The real value is predictability—knowing that the same action tomorrow will not suddenly cost you ten times more because the network is in a mood. Predictability is what lets people build routines. Routines are what turn a speculative asset into a system people lean on.

Dusk also lives in a domain where the mess is not optional: regulated markets, where human disagreement has paperwork attached to it. Off-chain reality does not arrive as a clean data feed. It arrives as conflicting sources, late corrections, jurisdictional boundaries, and obligations that don’t care how elegant your code is. So Dusk keeps choosing relationships that force it to face that mess directly, instead of pretending the mess will politely stay outside.

That is why recent institutional-leaning integrations matter more than they look like they do. In November 2025, Dusk and its exchange partner announced adoption of external standards for verified market data and cross-system communication—another quiet move toward making on-chain settlement reflect real-world truth without turning the whole ledger into a public confession booth. It’s the difference between “we can build markets” and “we can defend markets when someone challenges the data.”

Earlier, Dusk’s partnership announcements around a regulated digital euro were another signal of the same instinct: bring settlement assets that fit the compliance shape of the world Dusk claims to serve. When a network says it’s built for regulated finance, the question isn’t whether it can move tokens cheaply. The question is whether it can move the right kind of value, with the right kind of guarantees, without improvising under pressure.

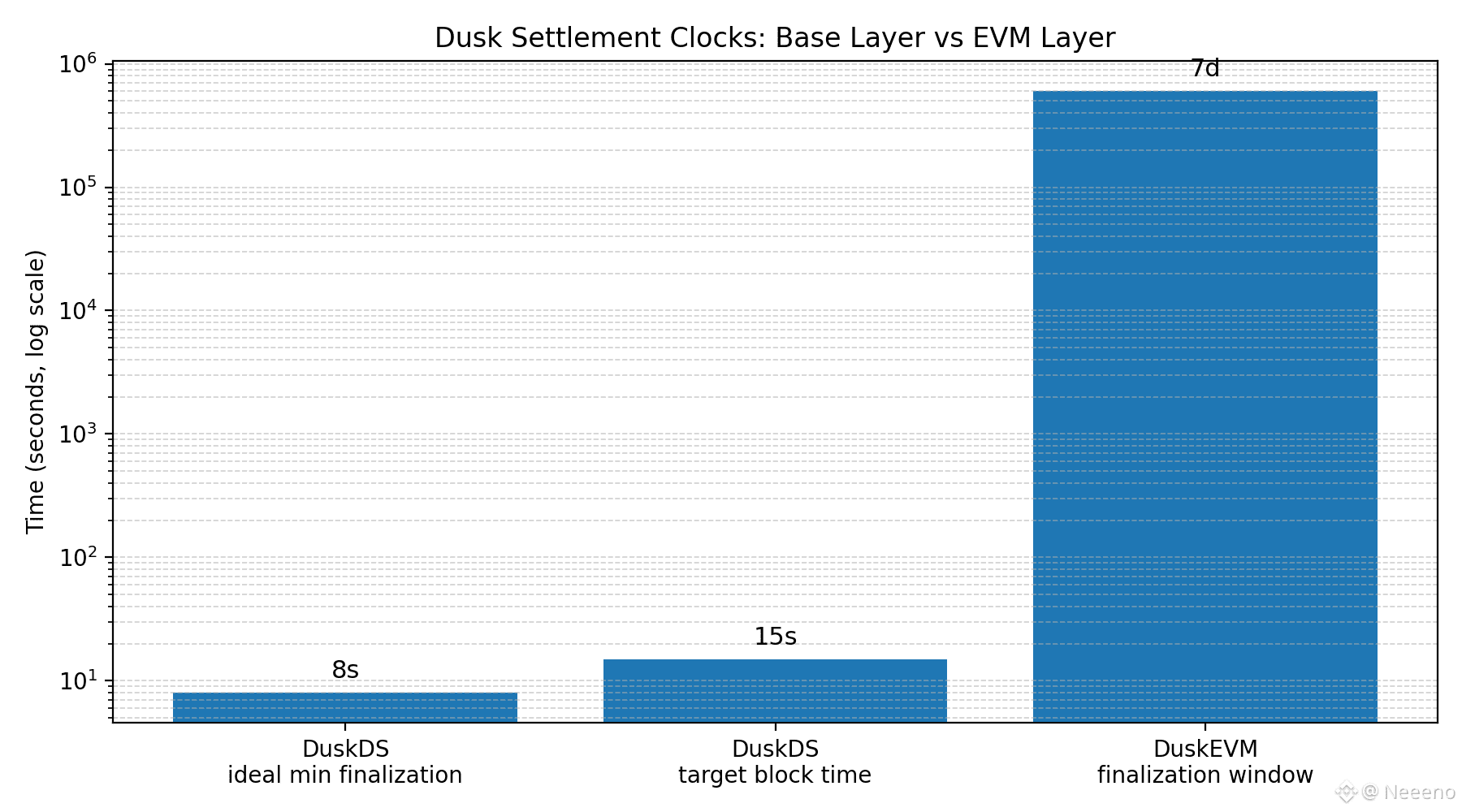

Still, Dusk doesn’t pretend everything under its umbrella shares identical timing guarantees. Its documentation is unusually direct about one uncomfortable detail: the EVM-compatible execution environment currently carries a seven-day finalization period inherited from the underlying stack, described as temporary with future upgrades aiming to compress that delay. Traders who ignore that nuance will eventually pay for it—not in fees, but in mispriced confidence.

This distinction is not academic. Under stress, people don’t lose money because they can’t trade. They lose money because they misunderstand the clock they are trading on. They think “final” means final everywhere, and then discover that “final” has layers. Dusk’s real advantage, if it continues to mature, will be that it teaches users to think in operational layers without forcing them to become engineers.

You can see the ecosystem gravity in small surface events too. Listings and new venues don’t prove fundamentals, but they change who can participate without friction. A January 2026 exchange listing announcement is minor in isolation, yet it contributes to a broader pattern: DUSK being easier to access, easier to move, easier to treat like working capital rather than a fragile collectible.

The deeper story, though, is incentives—the quiet economics of honest behavior. A chain that aims at finance can’t rely on good vibes. It has to make reliability the rational choice even when nobody is watching. That means operators must find it worth staying online, users must find it safe to keep using it, and the system must make cheating expensive enough that fear doesn’t become the dominant emotion in the room.

This is why “low fees” only matters when it is paired with seriousness. Cheap movement is a gift; cheap settlement is a responsibility. Dusk is trying to become the kind of infrastructure where responsibility is invisible—where the user experiences confidence not because they read a claim, but because the system keeps behaving the same way on calm days and on ugly days.

If Dusk succeeds, it won’t be because DUSK was trendy. It will be because the network learned to treat every transaction like it might be evidence, every delay like it might become a dispute, and every small cost like it might change a human decision. Quiet responsibility is not glamorous, but it is the only form of reliability that survives attention. Invisible infrastructure is what holds when markets don’t. And in the end, that’s the only kind of advantage worth building.