When @Walrus 🦭/acc Went Live, Data Started Behaving Like It Matters

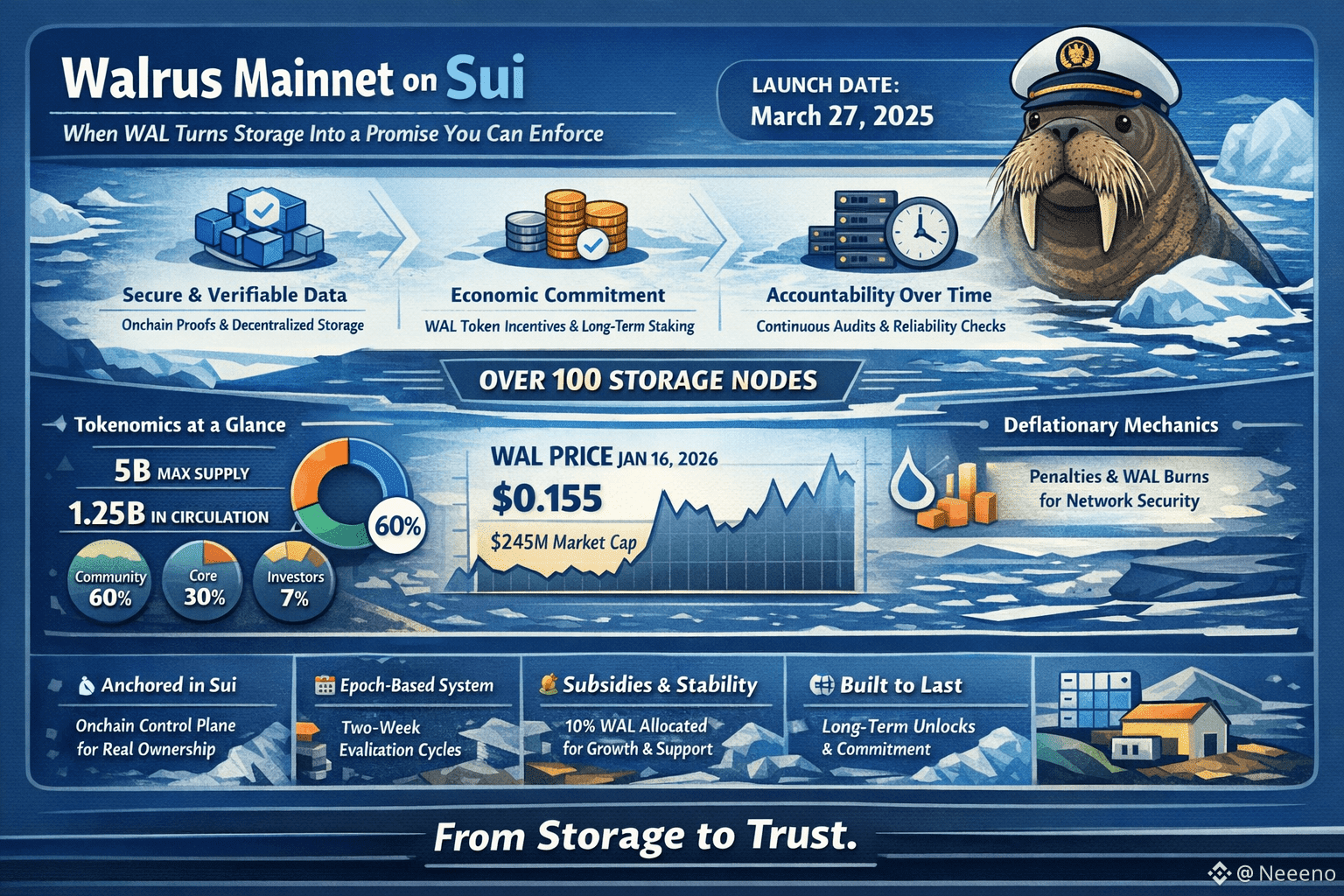

Mainnet isn’t a celebration in the Walrus world. It’s a commitment you can measure in boring, unforgiving ways: whether data is still there when nobody is watching, whether it’s still retrievable when operators get tired, whether ownership still means something when incentives start to wobble. On March 27, 2025, Walrus stepped into that kind of time, not as an idea, but as a live network run by a decentralized set of storage operators—“over 100 storage nodes,” according to the project’s own mainnet announcement.

What makes this launch feel different from the usual “we shipped” moment is that Walrus treats storage as a moral contract, not a technical accessory. People don’t lose money only when transfers fail; they lose dignity when records vanish, when proof disappears, when a piece of their work becomes unreachable and everyone pretends that’s normal. Walrus is built around the assumption that this kind of loss is not theoretical. It’s what happens when systems rely on good moods, generous operators, and the fragile patience of users who keep refreshing a page.

Walrus also refuses the comforting lie that data lives “off-chain” in a way that’s politically neutral. The system is explicit about where truth is anchored. Walrus uses Sui as the place where the ownership and metadata story becomes canonical—where a stored blob is represented by an onchain object, and where control of that object maps to control of the stored data. That decision turns messy arguments into something you can actually settle: not by asking people to trust a dashboard, but by letting the control plane act as the shared memory that everyone is forced to respect.

If you’ve lived inside storage problems long enough, you know the most painful failures aren’t dramatic. They’re subtle. A file is “there,” but retrieval stalls. An application loads, but images are missing. A record exists, but the version you need is suddenly “not available in your region,” or “temporarily rate-limited,” or “migrated.” Walrus is built for that gray zone where everything is technically up, yet users feel unsafe. It tries to make unavailability expensive, not just embarrassing, by designing the network around continuous accountability for keeping data present over time.

The economics of Walrus are where the project shows its seriousness, because economics is where people stop performing and start revealing who they are. WAL is not framed as a badge or a decoration; it is framed as the payment and coordination token that makes storage behave like a service with consequences. Walrus describes a payment mechanism designed to keep storage costs stable in fiat terms, with users paying upfront for a time-bounded storage duration, and that payment being distributed across time to the operators and stakers who do the work. It’s a small detail that carries a big psychological weight: it narrows the gap between what users think they paid for and what the network must keep delivering.

This is also why subsidies matter here in a more honest way than people admit. Walrus allocates 10% of WAL to subsidies intended to support early adoption while still keeping storage-node businesses viable. That sounds like a growth lever, but it’s also a safety lever: it’s Walrus acknowledging that early markets are noisy and thin, and that a network can’t demand perfect reliability from operators while starving them with immature fee flow. Subsidies are the bridge between “we want this to be reliable” and “we understand reliability has a cost.”

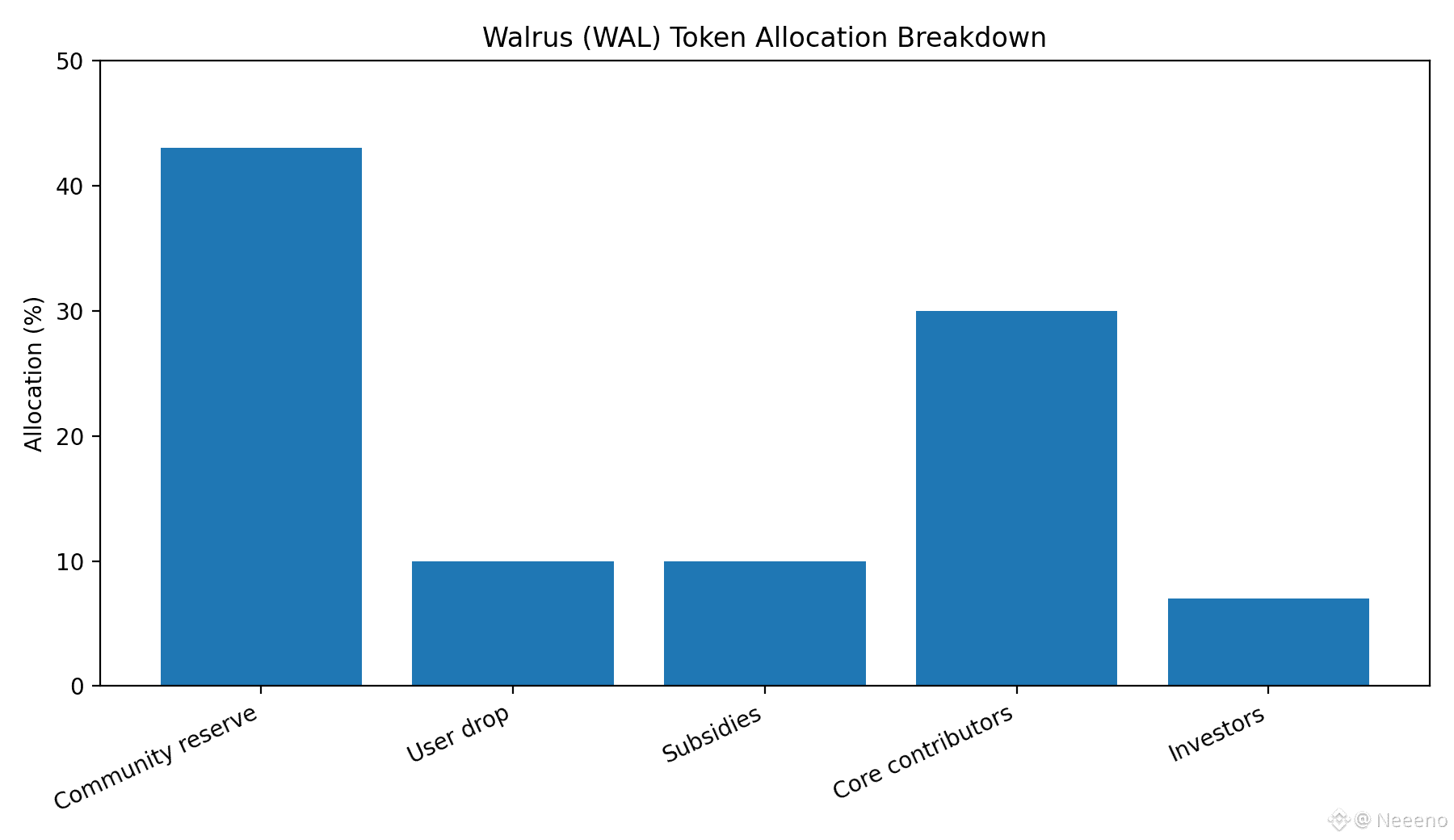

Token distribution is one of the places Walrus tries to reduce resentment before it forms.Walrus says WAL has a maximum supply of 5 billion. At launch, 1.25 billion was in circulation. Most of the tokens (over 60%) are set aside for the community: 43% for a community reserve, 10% for user drops, and 10% for subsidies. The rest is 30% for core contributors and 7% for investors.

The long horizon is not cosmetic either. Walrus describes portions unlocking linearly out to March 2033 for the community reserve, with user drops spanning pre- and post-mainnet distributions, and investor tokens unlocking 12 months after mainnet. That timeline is the network admitting what most people prefer to ignore: storage is not a weekend relationship. Data asks you to stay. WAL’s release structure is a way of forcing the ecosystem to keep earning trust over years instead of harvesting it in months.

Underneath all of this is the uncomfortable truth that storage isn’t just about “can we store it,” but “can we prove we kept it available.” Walrus leans into verifiability by pushing the audit trail onto Sui: proofs are recorded and settled as onchain transactions, and economic logic coordinating staking and rewards lives onchain as well. That architecture matters because it reduces the space for private excuses. When availability is observable and accountable, operators can’t rely on vibes. Users don’t have to rely on hope.

Mainnet launch also wasn’t presented as a solitary event. Walrus publicly framed it as the start of a “decentralized storage economy” with WAL liquidity live and accessible through DeFi venues on Sui, turning access to storage resources into something market-driven rather than permissioned. That cuts both ways: it gives users options, but it also exposes Walrus to the rawness of markets, where pricing and sentiment can turn quickly. The point is that Walrus chose to live in that reality instead of pretending storage can stay insulated from economic weather.

And the market does have weather. As of January 16, 2026, CoinMarketCap lists WAL around $0.155 with 24-hour volume around $22.8M and a market cap around $245M, alongside a circulating supply figure around 1.577B and the same 5B max supply. Those numbers aren’t “the story,” but they are part of the pressure the story must survive—because token volatility changes how people stake, how operators plan, and how patient users feel when something is slow at the worst possible moment.

Walrus has also been honest about the resources behind the push. Reporting around the mainnet window described a $140M token sale ahead of launch, with Walrus originally developed by Mysten Labs and built on Sui. Funding doesn’t guarantee reliability, but it changes what failure means: it makes it harder to hide behind scarcity as an excuse, and it raises the expectation that the project will keep showing up when the network needs maintenance more than applause.

The deeper thing Walrus is doing, though, is redefining what “programmable storage” feels like to a human being. It’s not about novelty. It’s about reducing the number of times a user has to wonder whether their data is real. When a blob’s identity, duration, and ownership are anchored in an onchain control plane, you don’t just get coordination—you get a way to stop arguing about what exists. In systems without this kind of shared reference, every dispute becomes interpersonal. In Walrus, disputes are pushed into protocol space, where they can be settled without forcing users to beg a platform for mercy.

That’s also why Walrus cares so much about long-term staking behavior and penalties for short-term shifts. The project explicitly frames rapid stake movement as a negative externality because it forces expensive data migration across operators, and it proposes penalty fees that are partially burned and partially redistributed to longer-term stakers. Read that slowly and you’ll see the real intent: Walrus is trying to engineer emotional stability into the network by discouraging the kind of jittery behavior that turns infrastructure into a crowd.

Even the idea of burning here isn’t a marketing trick; it’s a threat model expressed in financial language. Walrus describes mechanisms where penalties and future slashing can burn WAL, creating deflationary pressure “in service” of network performance and security. That phrasing matters. It admits that token value is not the goal; reliable behavior is the goal, and token mechanics are being shaped as tools to punish the kinds of actions that make data less safe.

You can feel the project’s posture in small operational details too.

Walrus uses two-week epochs on mainnet. Think of it like a steady checkpoint system: every couple of weeks the network can evaluate operators and rebalance trust, keeping things controlled rather than chaotic.

Over time, Walrus itself has reinforced the story that mainnet was the beginning of obligation, not the end of building. In its 2025 year-in-review, the project frames mainnet’s March 2025 launch as Walrus becoming a key component of the Sui stack for building with real trust, ownership, and privacy expectations. That isn’t a victory lap. It’s a claim that the system is now part of how other things stay real.

This is what Walrus mainnet ultimately unlocked: not “storage,” but accountability for storage, bound to WAL incentives and to an onchain source of truth that doesn’t care who is shouting. It’s a system designed for the moments people try to rewrite what happened, when a provider shrugs, when a team disappears, when the market turns and everyone starts cutting corners. Walrus is trying to make those corners harder to cut, and more expensive to pretend they don’t matter.

And that’s the quiet responsibility at the center of it. Walrus doesn’t ask for attention the way consumer apps do. It asks for something more difficult: to be trusted without being loved, to keep serving data through boredom and conflict, to keep the promise intact even when nobody is clapping. Infrastructure like this doesn’t get remembered for how thrilling it sounded at launch. It gets remembered for how little it asked from users when things went wrong how invisible it stayed, how reliably it held, and how calmly it kept the world from slipping into “we’ll fix it later.”