And Why Dusk Treats It as Non-Negotiable Infrastructure

Public blockchains changed how value moves. They did not change how finance actually works.

That distinction explains why, despite years of innovation, most real financial activity still happens off-chain. Not because institutions are slow or resistant, but because core financial assumptions were never built into public blockchain infrastructure.

In traditional finance, confidentiality is foundational.

Trades are private. Positions are protected. Settlements occur behind controlled access layers. Transparency exists, but it is selective, permissioned, and purpose-driven. Regulators see what they need to see. Counterparties reveal only what is required. This structure is not a flaw — it is what allows markets to function.

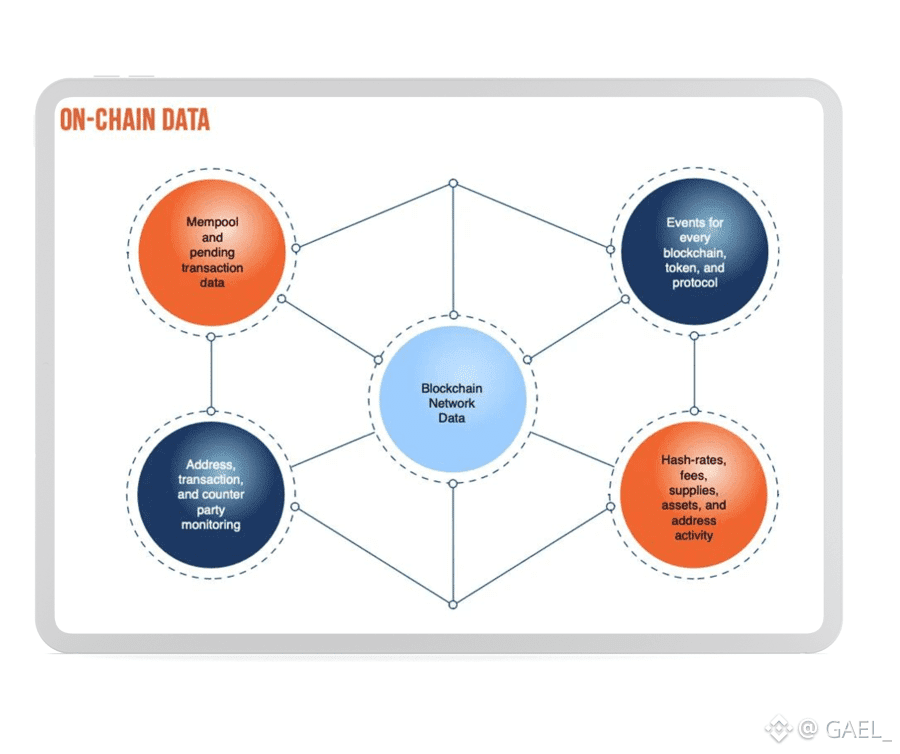

Most blockchains invert this logic.

On-chain transparency is absolute. Every transaction is public, permanent, and globally accessible. This works well for open experimentation and trustless value transfer, but it breaks financial logic at scale. When strategies, balances, and transactional relationships are fully exposed, risk increases rather than decreases.

This is the real reason regulated finance has not fully moved on-chain. The issue is not a lack of innovation or tooling. It is an infrastructure mismatch.

@Dusk was built to address this gap directly, without trying to redefine finance or ignore regulation. Instead of assuming transparency is always beneficial, Dusk starts from a more realistic premise: financial systems require controlled visibility.

Using zero-knowledge proofs and encrypted transaction models, Dusk enables confidential execution while maintaining on-chain verifiability. Transactions can be proven valid without exposing sensitive data. Settlement occurs on-chain, but disclosure is conditional, not default.

This matters because privacy and compliance are often misunderstood as opposing forces. In practice, they are complementary. Regulators need accountability, not surveillance. Institutions need auditability, not constant exposure. Users need protection, not obscurity.

@Dusk ’s architecture supports audits when required, without forcing continuous disclosure. Oversight exists, but it is intentional. Confidentiality is preserved, but it is not absolute or unaccountable.

What truly differentiates Dusk is where it began.

It did not start with applications or narratives. It started with assumptions. The assumption that finance needs privacy. The assumption that compliance must be native, not external.

The assumption that infrastructure should support both without compromise.

If on-chain finance is meant to scale beyond speculation and experimentation, confidentiality cannot be optional. It must be designed into the foundation.

@Dusk treats it that way — not as a feature, but as infrastructure.