A lot of people hear “Plasma” and think it’s the old scaling concept (side-chains, checkpoints, etc.). $XPL in this context is different — it’s positioning itself as a stablecoin-first Layer 1 where sending dollar-value (like USDT) is treated as the main job, not a side feature.

Why Plasma exists (and why this niche is getting crowded fast)

Stablecoins are already how most crypto “payments” actually happen. But the UX is still messy: you open a wallet to send USDT, and suddenly you need another token just to pay gas. Or you wait longer than you should. Or fees spike at the worst time. Plasma’s whole pitch is basically: make stablecoin transfers feel normal — fast, predictable, and not dependent on users holding a separate gas token.

The design focus: fast finality + gas abstraction + EVM familiarity

Plasma is EVM-compatible, so it’s trying to be “easy mode” for builders: same tooling, same contract mindset, less friction moving existing apps over.

But the bigger part is the payment experience:

Zero-fee USDT transfers (via a paymaster-style approach): the idea is users can do simple stablecoin transfers without juggling gas.

High-performance goals: Plasma has publicly framed itself around high throughput and low block times (the “payments rail” angle only works if it stays quick under load).

If you zoom out, it’s basically trying to become:

“the chain you’d actually use when you just want to move stablecoins quickly.”

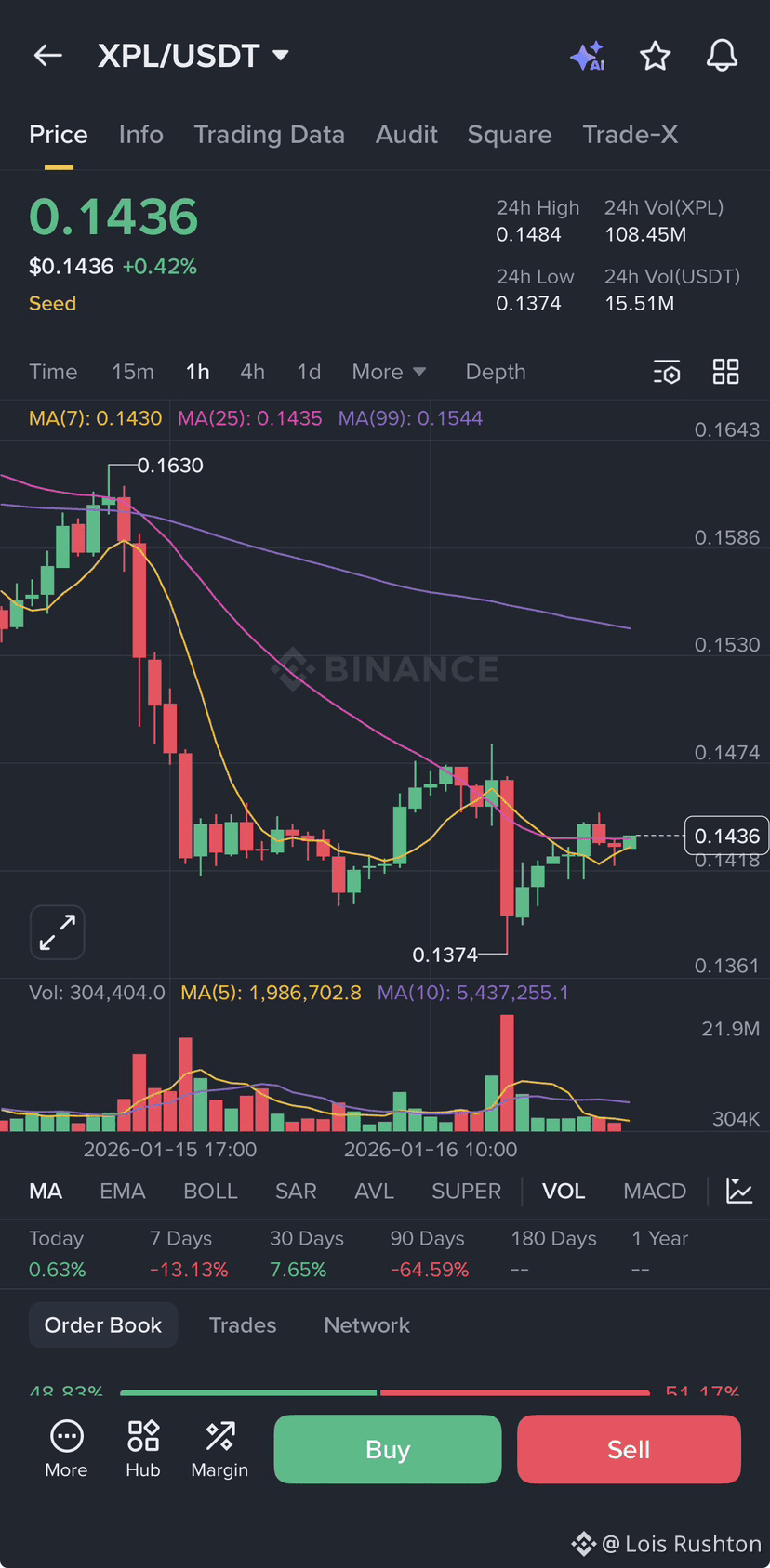

What the launch signals actually were (beyond the hype posts)

The most interesting part isn’t people tweeting charts — it’s the liquidity + usage narrative Plasma pushed right around its mainnet beta launch. Multiple reports around late September 2025 highlighted that Plasma would debut with $2B+ in stablecoin liquidity, and shortly after there were claims of stablecoin supply passing $7B within two days. Whether someone trades XPL or not, those are the kinds of numbers that explain why attention snapped to it so quickly.

And this matters because stablecoin chains live or die on one thing: can they attract enough liquidity and integrations to feel “real” from day one? If a payments chain launches with empty pipes, nobody routes value through it.

Binance exposure: what it did (and what it didn’t)

Binance visibility helped, obviously. The clearer piece here is that Binance announced a HODLer Airdrop allocation (75M XPL) and also described additional XPL set aside for marketing activities after listing. That’s a distribution lever and an attention lever — it doesn’t guarantee long-term success, but it definitely accelerates discovery.

So what is XPL actually for?

Here’s the clean way I think about it:

Stablecoins are the “money.”

XPL is the “network fuel + security + coordination.”

$XPL role is the typical Layer 1 set: securing the network (staking/validators), paying for more complex transactions, and aligning incentives so the chain stays reliable when volume ramps. Plasma’s main “user story” might be stablecoin transfers, but the chain still needs a native asset for security and governance-like coordination.

The real question after the buzz: does it become a habit?

A payments chain doesn’t win by being trendy. It wins when people stop thinking about it. The best-case scenario for Plasma is boring in the best way: wallets integrate it, merchants route through it, apps choose it by default for stablecoin moves, and users don’t even notice they’re “switching chains.”

If @Plasma keeps leaning into the two things it’s shouting the loudest — stablecoin UX + real liquidity rails — then it’s not competing with “random alt L1s.” It’s competing with the default stablecoin routes people already use.

And that’s a serious game.