NPEX is a fully licensed Dutch stock exchange that has been operating since 2008. Over the years, it has supported real companies in raising capital and has served thousands of investors under strict regulatory oversight. So when I came across the fact that NPEX is choosing to bring regulated assets on-chain using Dusk’s infrastructure, it stood out to me — not as breaking news or marketing hype, but as a meaningful signal worth exploring.

Not because this was something new or secret, but because institutions like NPEX do not make decisions lightly.

Licensed exchanges operate in an environment where every move is scrutinized. Their decisions are shaped by regulation, legal accountability, risk management, and long-term sustainability. Innovation is important to them, but only when it fits within existing frameworks. That’s why, when a regulated exchange engages with blockchain infrastructure, it’s worth asking why this approach is being considered seriously.

I’ve spent a long time observing the crypto space, mostly from the outside, watching project after project promise to “replace” or “disrupt” traditional finance. Many of these ideas sounded convincing at first. Faster settlement, global access, fewer intermediaries — all valid goals. But over time, most of these projects struggled to move beyond theory.

Not because innovation was lacking, but because regulation was treated as an obstacle instead of a core requirement.

The collapses we’ve seen over the years made this point painfully clear. Unregulated markets can grow fast, but they are fragile. When things go wrong, there is often no protection, no accountability, and no clear framework for recovery — neither for users nor for institutions. That reality makes banks, exchanges, and asset managers extremely cautious about embracing most public crypto markets in any meaningful way.

This caution is exactly what the “Internet of Assets” podcast episode titled Unregulated Markets Are Out, Here’s What’s In explores — featuring Florian Glatz, a blockchain lawyer, in conversation about the broader regulatory environment post-major collapses like FTX. The episode discusses why purely unregulated markets are no longer sustainable and how compliant, regulated infrastructure is becoming not just relevant but necessary in the evolution of digital finance.

The podcast doesn’t dive into marketing slogans — it frames the conversation around real legal and compliance challenges that financial institutions face when integrating blockchain technology, especially after regulatory failures have shaken confidence. It’s an early example of how conversations in the space are shifting from speculation to governance, legal certainty, and institutional readiness.

This context is critical to understanding why $DUSK ’s approach started to make sense to me.

Instead of positioning itself against regulation, Dusk’s foundational philosophy appears to be that regulated finance will eventually move on-chain — and when it does, both privacy and compliance will be required. One cannot realistically exist without the other. This shift away from unregulated markets toward infrastructure that supports legal requirements is not just an abstract idea — it’s now being discussed at a thought-leadership level among practitioners, lawyers, and institutional thinkers in the ecosystem.

Founded in 2018, Dusk spent several years developing its technology before launching mainnet in January 2025. What stood out wasn’t aggressive promotion or exaggerated claims, but intent. The network seems designed specifically to handle regulated assets from the beginning, rather than retrofitting compliance after the fact. Its architecture incorporates privacy-enabling cryptography with mechanisms for authorized verification — a balance that many blockchains have struggled to achieve.

Privacy is often misunderstood in crypto discussions. It’s frequently framed as secrecy versus regulation, as if choosing one automatically excludes the other. From what I’ve learned, Dusk challenges that assumption by using cryptographic proofs that allow transactions to remain private while still being verifiable when required by law. Participation doesn’t require exposing personal information publicly, yet compliance checks can still be satisfied when necessary — a model that aligns closely with emerging regulatory expectations.

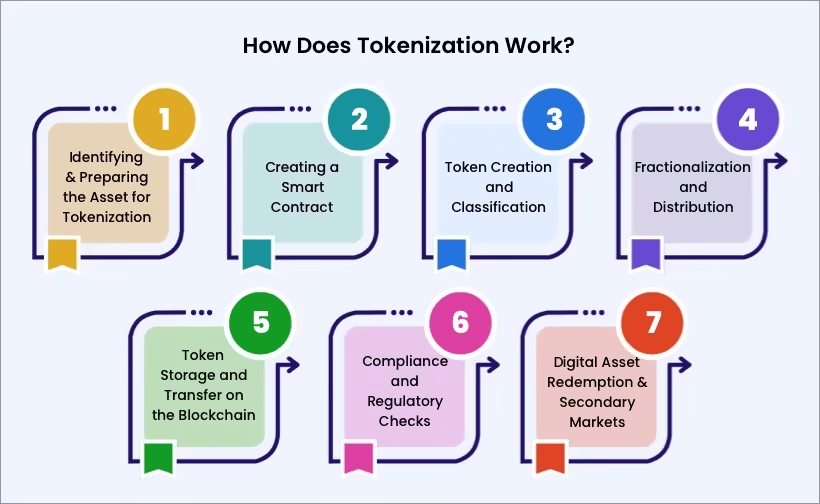

This same philosophy carries through to how regulated assets are handled on-chain. Traditional financial markets rely heavily on manual compliance processes — legal reviews, paperwork, intermediaries, and settlement delays — to ensure regulatory obligations are met. While effective, these systems are slow, costly, and difficult to scale. Dusk’s approach suggests that many compliance rules can be enforced directly via protocol-level logic, allowing them to become automatic, consistent, and transparent.

That’s more than theory — it’s practical alignment with regulation, which institutions have been waiting for.

What gives this approach weight isn’t just architectural design. It’s engagement. NPEX engaging with Dusk’s infrastructure is not about experimentation for the sake of innovation. It is an example of a regulated entity exploring how blockchain can be used without compromising compliance, investor protection, or operational control. That distinction matters deeply in a market where many projects still feel detached from institutional realities.

Beyond issuance and settlement, Dusk is also designed to interact with a broader financial ecosystem. Through interoperability and oracle integrations, assets issued on Dusk are intended to operate within a larger landscape of blockchains and financial systems, while still respecting regulatory boundaries.

The $DUSK token reflects this infrastructure-focused design. It plays a role in securing the network through staking, paying transaction fees, enabling governance participation, and supporting the creation of regulated assets. Its purpose appears tied to network function more than speculative narratives.

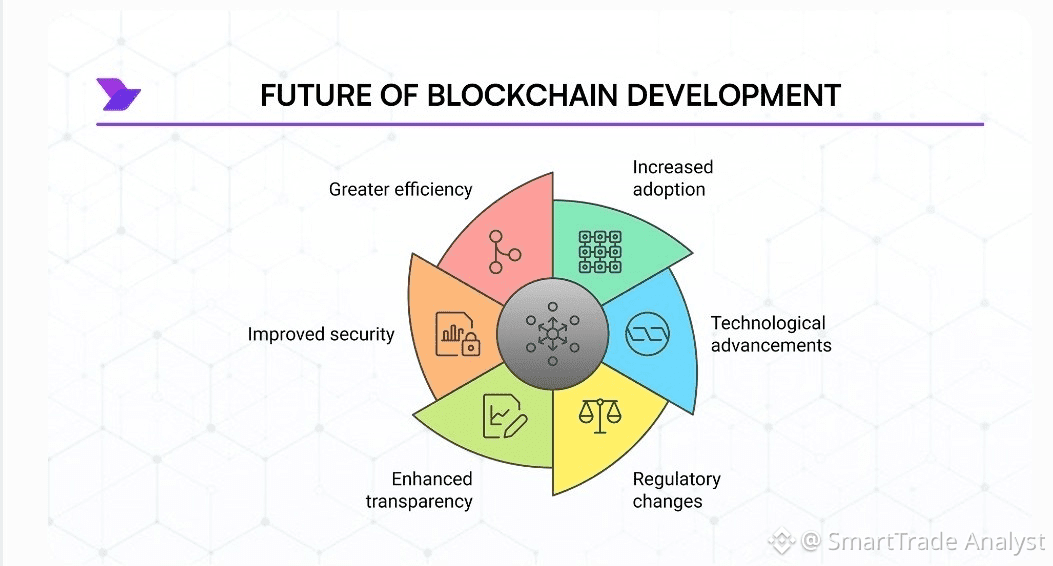

Regulated finance moving on-chain will not happen overnight. It will be gradual, cautious, and shaped by legal and institutional realities. But when that transition accelerates, it will likely depend on systems that were designed with regulation, privacy, and real institutions in mind from the start.

From what I can see, Dusk appears to be building toward that future.

As always, it’s worth exploring the documentation, listening to the conversations shaping this space, and forming your own conclusions. In a landscape full of noise, understanding why something is built matters more than headlines.

Understanding Why NPEX and Regulated Finance Are Choosing Dusk Network

Aviso Legal: inclui opiniões de terceiros. Não se trata de aconselhamento financeiro. Poderá incluir conteúdos patrocinados. Consulta os Termos e Condições.

DUSK

0.1205

+44.65%

101

1

Fica a saber as últimas notícias sobre criptomoedas

⚡️ Participa nas mais recentes discussões sobre criptomoedas

💬 Interage com os teus criadores preferidos

👍 Desfruta de conteúdos que sejam do teu interesse

E-mail/Número de telefone