@Dusk and the Chain That Proves Everything Without Telling Everything

In serious finance, privacy isn’t some nice-to-have feature—it’s the invisible shield that keeps regular business from exploding into everyone’s business. A portfolio manager isn’t trying to be sneaky when they guard client holdings, trade sizes, or strategy details; they’re just trying to avoid getting front-run, leaked, pressured, or quietly damaged when too many eyes can see the full picture. Dusk was born exactly for that kind of world. It starts with one simple conviction: you should be able to run markets that are completely provable and compliant without forcing every participant to hang their laundry out for the whole internet to see.

Spend a little time around Dusk and you quickly realize “regulated” isn’t a buzzword slapped on marketing—it’s the actual blueprint for how everything is designed. They didn’t just drop mainnet in one big flashy moment; they walked through careful, traceable phases—migrating stakes, setting up genesis, then finally locking in that first unchangeable block. It feels like a group that knows auditors, regulators, and time itself will come knocking years down the road, not just a crowd hyping the launch.

The real magic isn’t the schedule—it’s the sense of safety Dusk is trying to give people. Nobody hates transparency on principle; they hate what total openness does when things get nasty—targeted attacks, legal headaches, reputation damage. Dusk’s big idea is that you can prove “we followed every rule” without revealing who holds what, who’s planning what, or where the weak spots are. Zero-knowledge goes from being fancy cryptography to something practical and almost protective: a clean, confident “this is legit” without the part where “legit” means “exposed to the world.”

Of course, that only works if the proofs are actually usable—fast enough, cheap enough, and strong enough to survive real life. Dusk keeps their Rust-based proving system fully open and constantly refined—small proofs, super-quick verification, smart polynomial tricks, custom logic gates—because privacy dies the second it becomes too slow, too expensive, or too fragile. If it lags, people quit using it. If it costs a fortune, only the huge players get any dignity. If it breaks under weird conditions, compliance teams vanish the first time something odd happens in live trading.

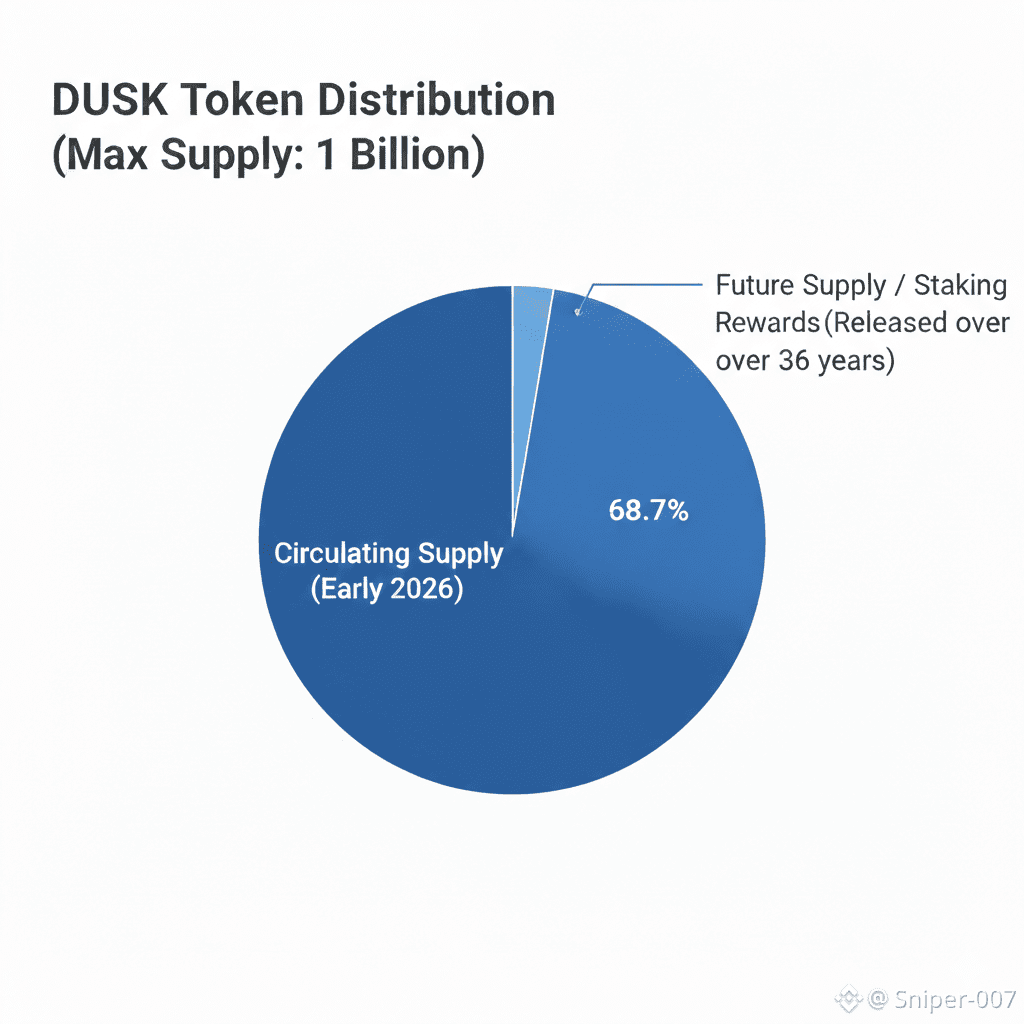

Finance isn’t only math and code, though—it’s people and incentives wearing professional clothes. That’s why DUSK isn’t just another coin; it’s the glue that keeps everyone aligned. The token setup is straightforward: 500 million to start, another 500 million released slowly over 36 years to reward people who stick around and stake, topping out at 1 billion. The gradual fade-out rewards early security without flooding the future. Even the staking minimum feels thoughtful—low enough for real people to join, high enough that it actually means something.

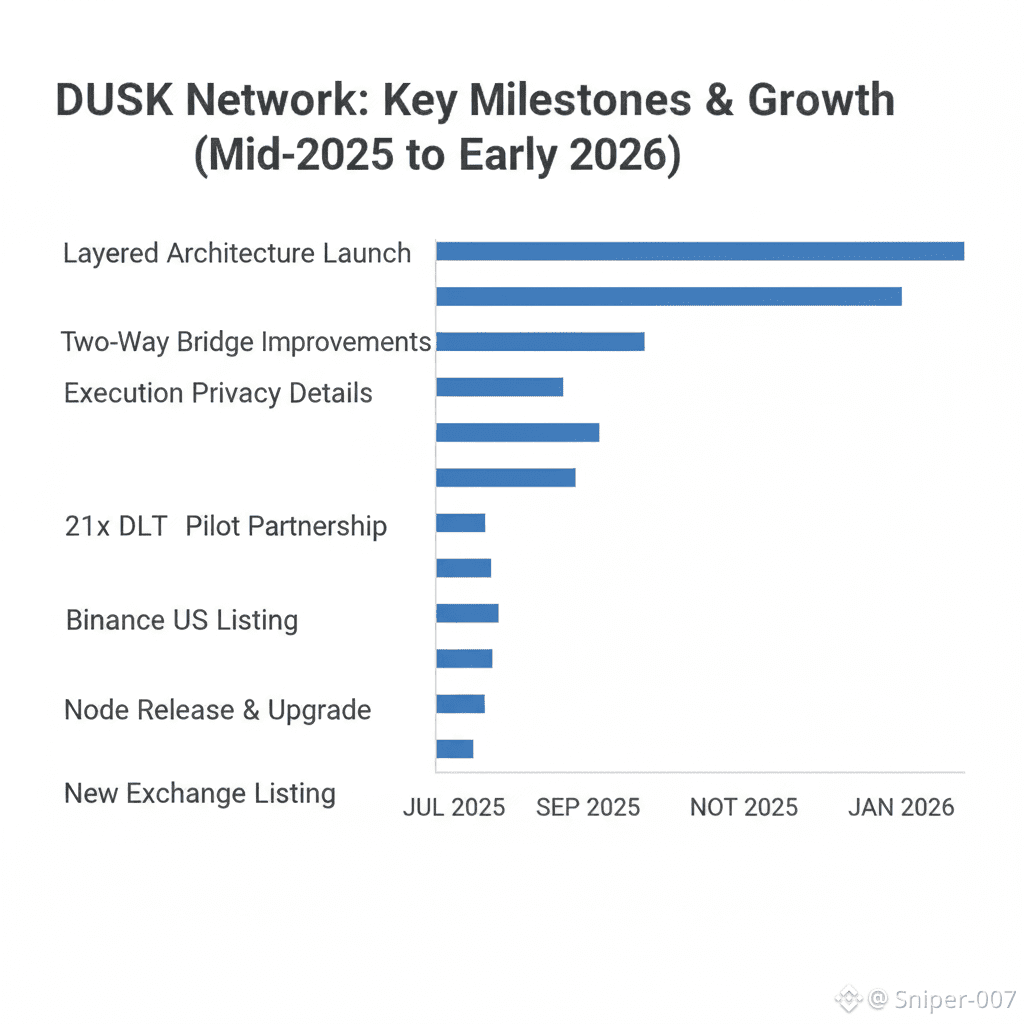

When you zoom out, you see Dusk quietly reshaping itself around how big institutions really operate. Mid-2025 laid out a clean three-layer model: the base does consensus, data, and final settlement; the app layer gives developers tools they already know; and privacy gets its own dedicated upgrade soon. One token ties it all together, with bridges guarded by validators—because in regulated flows, the point where value switches layers is usually where trust breaks.

Moving tokens around safely is one of those unglamorous but make-or-break details. The two-way bridge improvements weren’t headline-grabbing, but they quietly said something huge: Dusk wants DUSK to flow freely in and out without pretending the chain is the only place that matters. When native tokens can leave securely and come back the same way, it admits the world is messy, liquidity has its own paths, and winning means making movement easy and safe, not locking everyone in.

Real privacy in finance has very specific rules: hidden from the public by default, but open to the right eyes when legally required. In June 2025, Dusk shared details on their execution privacy system—ZK proofs mixed with encrypted calculations—so balances and amounts stay secret while everything still proves correct, and audits can happen when needed. That balanced approach is what actual institutions want: not complete darkness, just smart, controlled visibility.

You can’t claim you’re for regulated markets and then run from regulated players. The tie-up with 21X under the EU’s DLT Pilot Regime stands out because it’s real oversight territory. Updates and reports show Dusk coming in as a full trade participant, with plans to go even deeper. That kind of partnership forces the privacy model to grow up fast—it has to handle governance checks, supervision, and potential fights without falling back on blind trust.

You see the same seriousness in the NPEX relationship and the adoption of Chainlink standards for market data and cross-chain settlement. Most finance arguments start with “what was the real price, when did we know it, who knew first.” Bringing verified exchange data on-chain and standardizing the rails cuts down on gray areas that turn into huge blame battles later.

Even the token carries a different feel these days. Getting listed on Binance US in October 2025 opened the door to a market that takes compliance seriously. Listings don’t prove the tech works, but they do change the energy—liquidity gets deeper, more people can touch it easily, and the whole thing starts feeling less like an exclusive club and more like a working market.

As of January 16, 2026, DUSK is sitting around $0.085 on live feeds, with the kind of daily swings that remind you this story is still young. CoinMarketCap shows about 487 million circulating against a 1 billion max supply. That remaining gap isn’t just numbers—it’s a promise of time. Dusk is quietly telling stakers, builders, and institutions: we’re here for the long game, not the quick flip.

The toughest thing about privacy in regulated finance is accepting that problems aren’t rare—they’re inevitable. People mess up. Counterparties disagree. Regulators show up late. Auditors want proof that doesn’t rely on anyone’s word. Dusk’s recent track record—layered architecture, better bridging, regulated partnerships, privacy execution progress, steady prep for what’s next—feels like a team preparing for the hard days, not just the smooth ones.

In the end, Dusk’s most powerful idea is also the quietest: the future of on-chain finance won’t go to the loudest voices. It’ll go to the ones that handle sensitive value without making people targets, prove everything is right without forcing confessions, and reward steady honesty over temporary excitement. Quiet reliability doesn’t make great videos. But it’s what real markets actually survive on—and if Dusk earns its place, it’ll be because responsibility ended up meaning more than the spotlight.