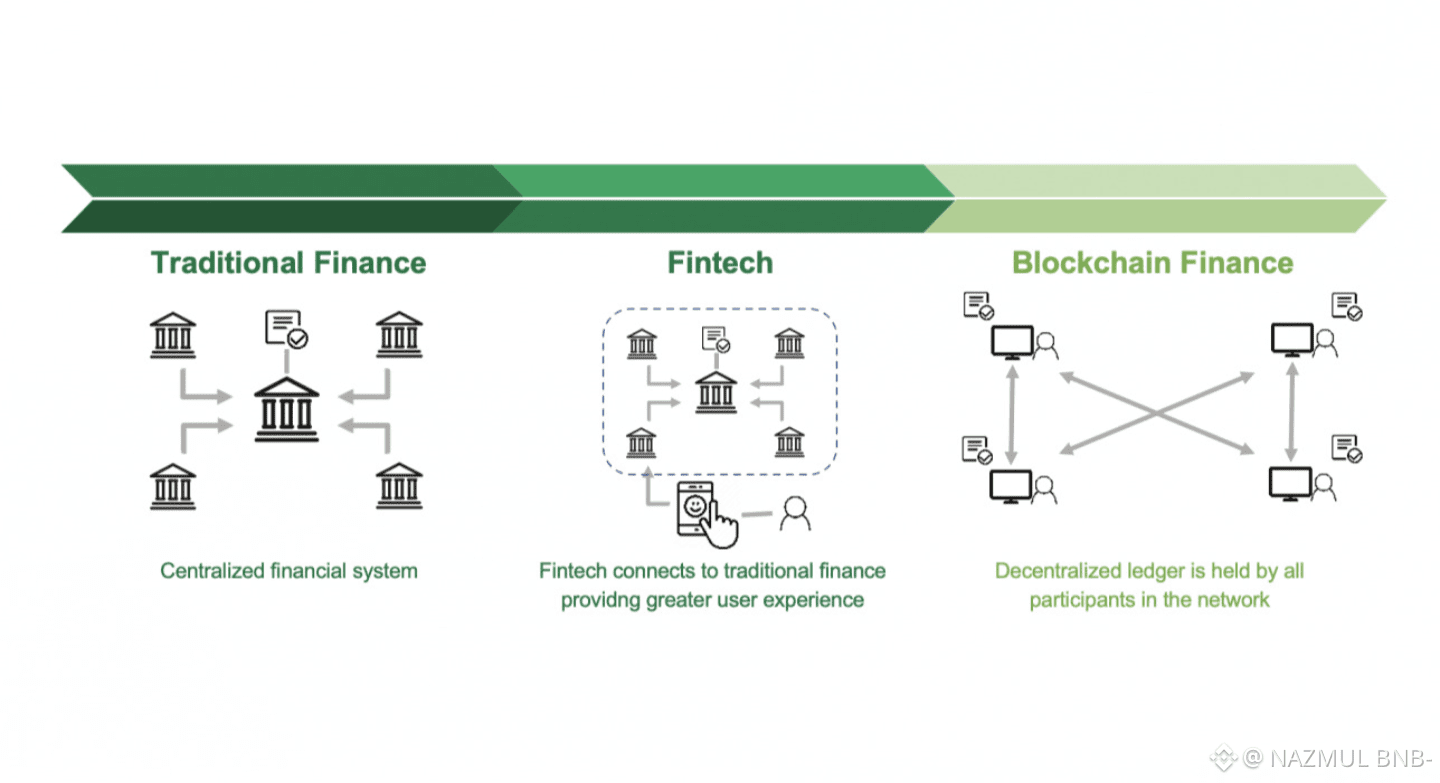

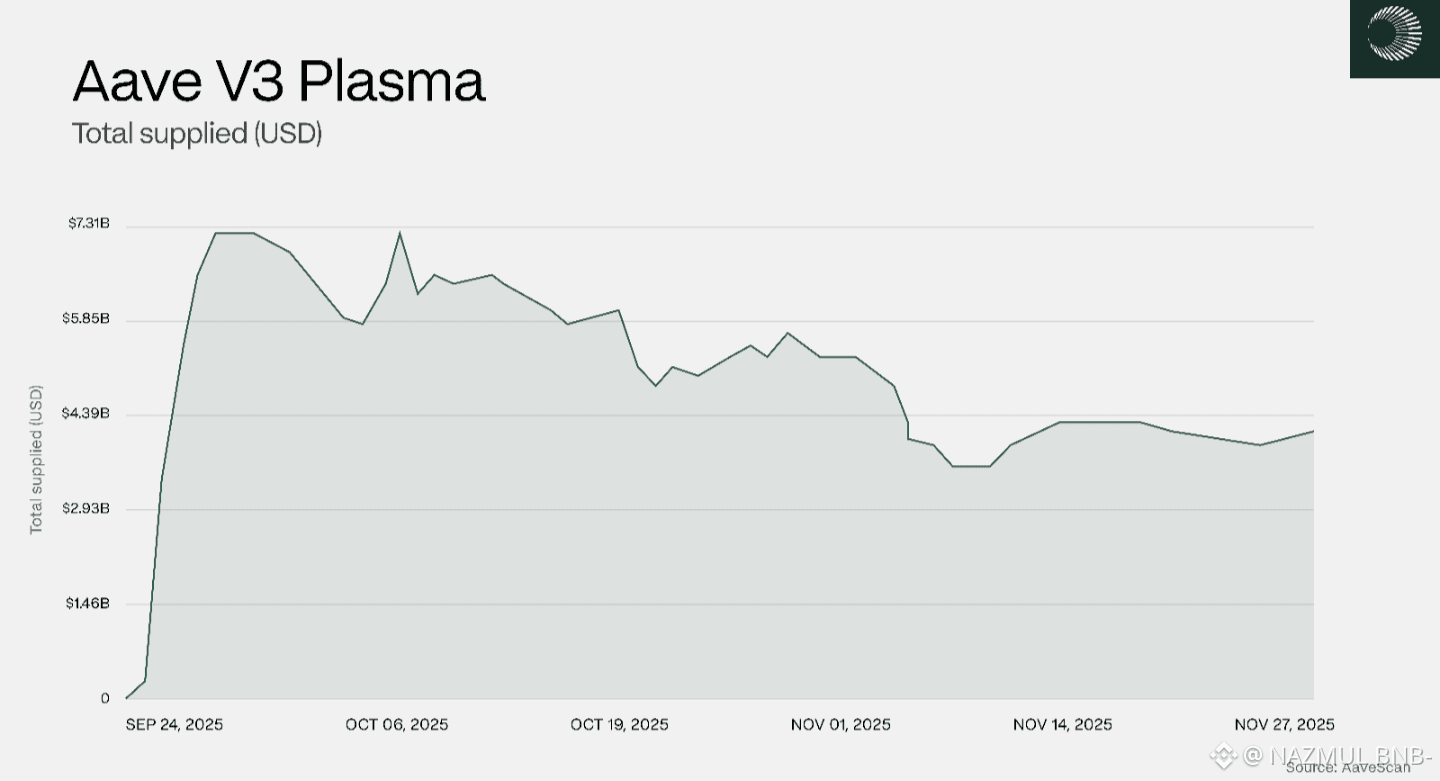

The crypto market has spent years proving it can move money fast. What it has struggled to prove is whether it can offer something more boring, and therefore more useful: reliable credit. Most lending markets in crypto still behave like weather systems. Rates spike when demand rushes in, collapse when capital leaves, and force builders to design products around instability rather than utility. Plasma starts from a different question. What if onchain credit did not need to be exciting? What if it simply needed to work, quietly and predictably, the way credit does in mature financial systems. By deploying Aave as a core primitive, Plasma is not trying to reinvent lending. It is trying to anchor it. The idea is simple to explain, but difficult to execute: gather deep, stable liquidity in one place, limit what can be borrowed, and let rates settle into a narrow, dependable range. In practice, this means large stablecoin deposits acting less like speculative fuel and more like infrastructure. The early data suggests that when capital understands the rules, it behaves differently. Liquidity stops hopping chains for short-term yield and starts staying put, because the system rewards patience over timing.

At the center of this design is restraint. Instead of opening the floodgates to dozens of borrowable assets, Plasma keeps the borrow side tight. Stablecoins like USD₮0 and a small set of major assets such as ETH do the heavy lifting, while other tokens are positioned as supply-only collateral. This concentration may look conservative, but it is intentional. When too many assets compete for borrowing, liquidity fragments and rates become noisy. By narrowing the focus, Plasma creates depth where it matters. The result is a lending market where utilization stays high and borrow costs move slowly, even as total deposits change. For builders, this matters more than flashy numbers. If you are designing a leveraged yield strategy, a treasury operation, or a settlement flow, you care less about peak APY and more about knowing what your cost of capital will look like next week. Plasma’s use of mature Aave risk tooling and oracles adds another layer of familiarity. There is comfort in building on something battle-tested. It lowers cognitive load. You spend less time worrying about edge cases and more time designing products that people can actually use. In that sense, Plasma is not asking developers to learn a new philosophy. It is offering them a calmer environment to apply an old one.

The deeper implication is cultural. Crypto often celebrates volatility as proof of life, but real economies are built on predictability. Plasma’s early traction, marked by high utilization and steady borrowing demand, hints at a shift in priorities. Capital here is not chasing novelty. It is testing whether onchain credit can behave like a utility. Of course, risks remain. Concentrated markets must be managed carefully, and incentive-driven liquidity always faces the question of durability once rewards fade. Plasma does not eliminate these challenges, but it does frame them honestly. The experiment is not about promising infinite growth or revolutionary yields. It is about seeing whether disciplined design can change how credit behaves onchain. If it succeeds, the win will not be loud. It will show up in quieter dashboards, steadier rates, and builders who stop talking about “yield opportunities” and start talking about “costs.” That may not sound glamorous, but it is how financial systems grow up.