Dusk Network has always lived slightly off the main road of crypto narratives. While much of the industry chased speed, hype, or short-term liquidity, Dusk kept returning to a quieter question. What does it actually take to move real-world finance on-chain without breaking the rules that keep markets functioning? The recent shift toward a multilayer architecture is not a cosmetic upgrade. It is a philosophical correction. Instead of forcing every function into a single blockchain, Dusk is separating concerns. Settlement, execution, and privacy are no longer fighting for space inside one system. Each gets its own layer, its own logic, and its own purpose. This approach reflects a broader realization across infrastructure design: complexity becomes manageable only when it is organized. Like modern cities that separate power grids, transport, and communication, Dusk is choosing structure over shortcuts.

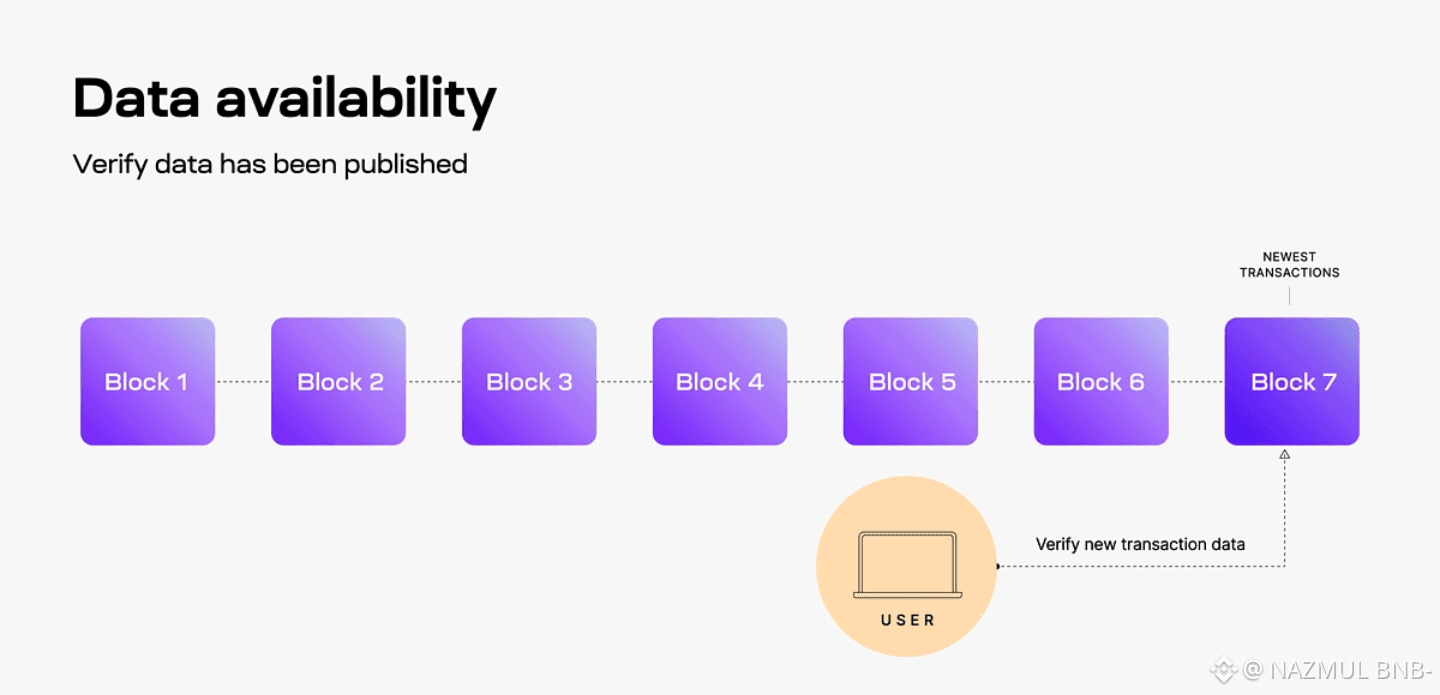

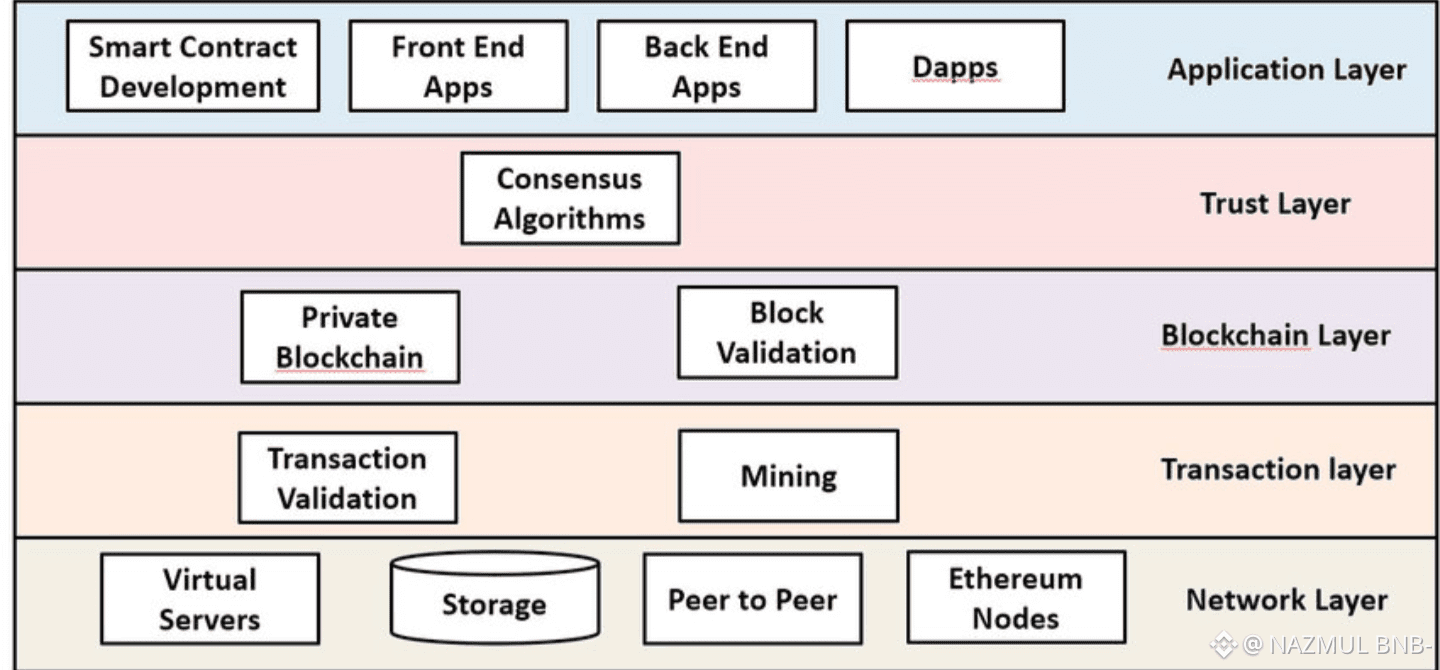

At the base sits Dusk’s data and settlement layer, designed to do the unglamorous but essential work. This is where consensus happens. This is where data availability and final settlement live. It is deliberately conservative, focused on reliability and correctness rather than experimentation. On top of that comes the EVM execution layer, a practical move that lowers the barrier for developers. Ethereum tools are familiar. Wallets, contracts, and workflows already exist. By supporting EVM execution, Dusk is not asking builders to relearn everything from scratch. It is inviting them to bring what already works into a system designed for regulated environments. Above that sits the planned privacy-focused execution layer. This is where Dusk’s long-term vision becomes clearer. Some applications do not need privacy. Others absolutely do. Tokenized securities, identity-aware financial products, and regulated marketplaces often require selective disclosure rather than full transparency. By making privacy an optional layer instead of a universal requirement, Dusk allows applications to choose their own balance between openness and confidentiality.

What makes this evolution interesting is not the technology alone, but the restraint behind it. Dusk is not claiming to replace Ethereum, nor to outpace high-throughput chains in raw numbers. The message is quieter and more grounded. Infrastructure should fit its use case. Financial markets care about auditability, rules, and long time horizons. They care less about experimental features that change every six months. By isolating execution from settlement, and privacy from general computation, Dusk creates a system that can evolve without destabilizing its core. For institutions, this reduces integration risk. For developers, it offers flexibility without chaos. For the network itself, it provides a clearer path to scaling through layers rather than constant rewrites of the base chain.

In many ways, this multilayer shift reflects a maturing mindset across crypto. Early blockchains tried to do everything at once. The result was often trade-offs hidden behind marketing. Dusk’s approach is more transparent. It acknowledges that different applications need different guarantees. Some need speed. Some need privacy. Some need regulatory clarity. Instead of pretending one design can satisfy all of them equally, Dusk is building a stack where each layer is honest about its role. The real test will not be announcements or diagrams, but usage. Adoption will come slowly, through pilots, integrations, and quiet deployments rather than viral moments. If it works, Dusk will not feel revolutionary in the loud sense. It will feel dependable. And in financial infrastructure, that is often the highest compliment.