Agar tum Dusk Network ke recent news updates ko ek saath dekhte ho, to ek baat clearly samajh aati hai. Ye project na to trending crypto topics ke peeche bhaag raha hai, na hi short-term hype create karne ki koshish kar raha hai.

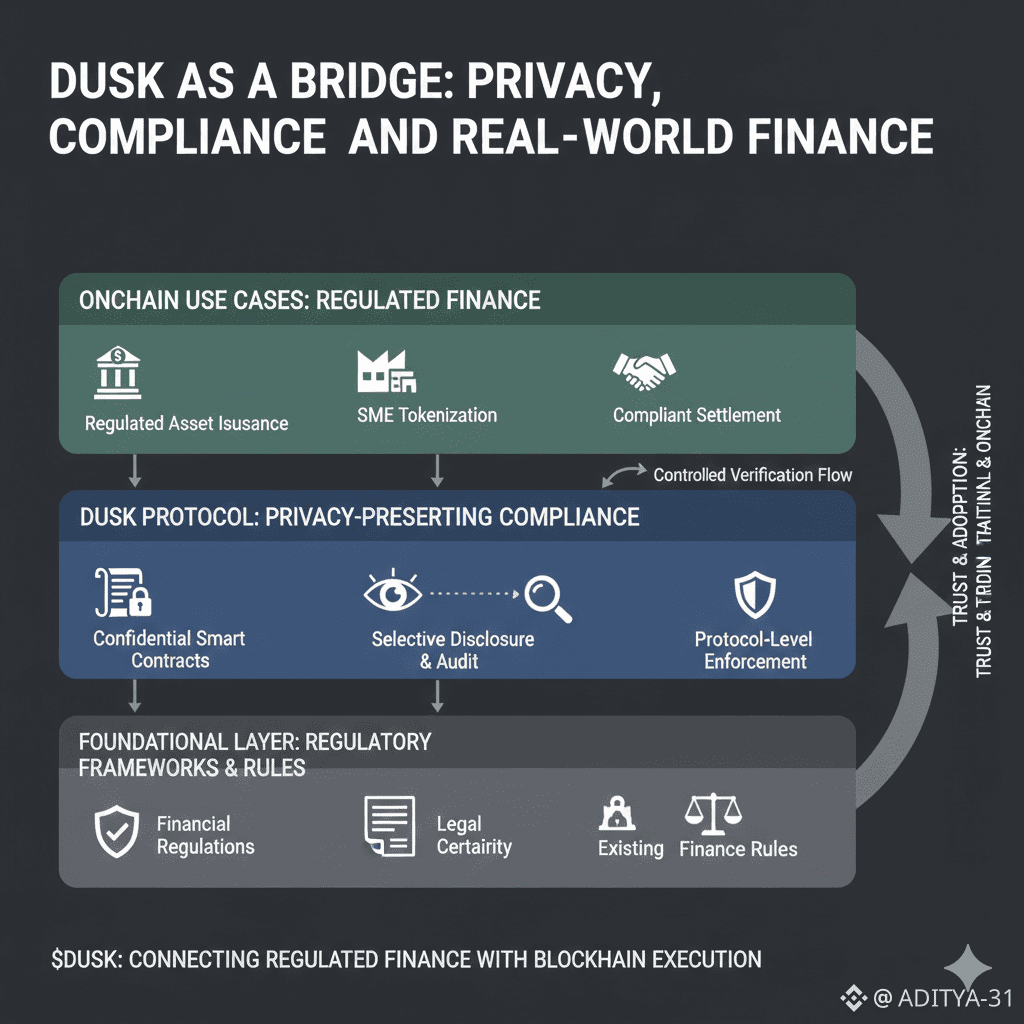

Dusk ka focus kaafi clear hai: regulated finance ke liye blockchain infrastructure banana.

Har announcement usi direction ko reinforce karti hai.

Regulated Assets Ko Onchain Lane Par Serious Work

Recent updates ka sabse strong signal Dusk ka traditional financial infrastructure ke saath kaam karna hai. November 2025 me Dusk ne announce kiya tha ki wo Chainlink ke interoperability standards adopt kar raha hai, saath hi Netherlands ke regulated exchange NPEX ke saath collaborate kar raha hai.

Iska matlab simple hai. Dusk sirf crypto-native tokens ke liye build nahi kar raha. Wo regulated European securities ko onchain issue, settle aur track karne ke liye infrastructure create kar raha hai — wo bhi compliance ke saath.

Ye approach clearly dikhata hai ki target audience institutional workflows hain, na ki sirf consumer DeFi ya retail speculation.

Privacy Yaha Optional Nahi Hai

Recent news me privacy ko kabhi bhi “extra feature” ki tarah present nahi kiya gaya. Message hamesha ye raha hai ki agar institutions ko blockchain use karna hai, to privacy mandatory hai.

Public blockchains by default sab kuch expose kar dete hain — balances, transactions, histories. Regulated entities is environment me comfortably operate nahi kar sakti. Dusk isi problem ko directly address karta hai.

Uska approach ye hai: sensitive data confidential rahe, lekin jab compliance ya audit ki zarurat ho, tab verification possible ho. Ye balance — privacy ke saath accountability — Dusk ko kaafi networks se alag banata hai.

SMEs Aur Private Companies Ke Liye Tokenization

Late 2025 ke kuch updates ek aur interesting angle dikhate hain — small aur medium businesses ke liye tokenization.

Dusk ka point yaha simple hai: blockchain sirf large institutions ya speculative assets ke liye nahi hona chahiye. Agar chhoti companies ko capital markets tak access chahiye, to unke shares aur assets ko onchain represent karna possible hona chahiye — bina privacy aur compliance todhe.

Isse ye clear hota hai ki Dusk broader financial ecosystem ke liye soch raha hai, sirf traders ya big players ke liye nahi.

Regulation Ko Avoid Nahi, Accept Kiya Ja Raha Hai

Dusk ke news updates me regulation ko uncomfortable topic nahi banaya gaya. MiCA jaise European frameworks ko openly discuss kiya ja raha hai.

Tone ye hai ki regulation future ka problem nahi, present reality hai. Aur jo blockchains is reality ko ignore karte hain, unke liye institutional adoption mushkil ho jaata hai.

Dusk regulation ko design constraint ke taur par treat karta hai — baad me fix karne wali cheez ke taur par nahi.

Overall Picture Kya Batati Hai?

Agar saari updates ko ek saath dekha jaye, to picture kaafi clear ho jaati hai:

Dusk regulated financial infrastructure ke saath align ho raha hai

Privacy aur compliance ko core value maana ja raha hai

Tokenization hype ke liye nahi, real businesses ke liye discuss ho rahi hai

Regulation ko samajh kar build kiya ja raha hai, avoid nahi

Iska matlab ye hai ki Dusk apne aap ko ek bridge ki tarah position kar raha hai — jaha traditional finance aur blockchain realistically connect ho sakein.

Ye project loud nahi hai.

Par ye wahi cheez build kar raha hai jiske bina regulated finance onchain aa hi nahi sakta.