In the early years of Web3, blockchains were judged by how many things they could do at once. The more use cases a network promised to support, the more “complete” it appeared. Smart contracts, NFTs, gaming, social, governance, DeFi, identity, and everything else were stacked into a single narrative. Over time, however, a different reality emerged. Most networks did not fail because they lacked features. They failed because they tried to serve too many priorities without mastering any of them.

Plasma appears to have learned from that history. Instead of presenting itself as a chain for everything, it frames itself around one responsibility that matters more than most people initially realize: stablecoin settlement. That framing is not a marketing shortcut. It is a design constraint that influences how the network behaves, who it is built for, and what kind of economic activity it expects to support over time.

Stablecoins are already the most widely used product in crypto by real users. Daily transfer volumes regularly exceed hundreds of billions of dollars across networks. In many regions, especially in high-inflation or capital-restricted economies, stablecoins are not speculative instruments. They are working money. People use them to save, to remit, to pay suppliers, and to hedge against local currency risk. Despite this, most blockchains still treat stablecoin transfers as just another transaction type competing with everything else for blockspace.

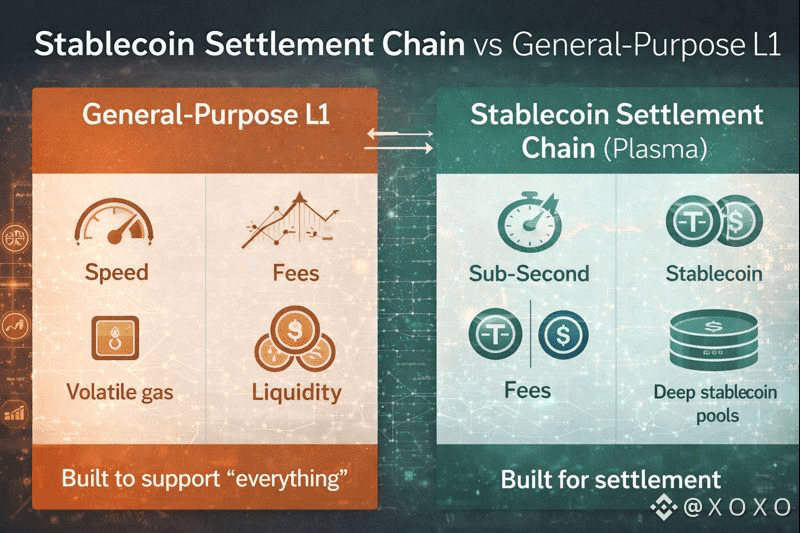

@Plasma takes a different view. It treats stablecoins as the primary reason the chain exists. That choice immediately simplifies certain questions and complicates others. When settlement is the goal, finality matters more than theoretical throughput. Fee predictability matters more than peak performance. Reliability under stress matters more than feature breadth. This is why Plasma emphasizes sub-second finality and deterministic execution rather than chasing maximum transactions per second. For a payment or a loan settlement, knowing that a transaction is final almost immediately is more important than knowing that the network can handle millions of unrelated actions in parallel.

This settlement focus also explains why Plasma prioritizes gas abstraction and stablecoin-first fees. For most end users, paying transaction fees in a volatile asset introduces friction and uncertainty. When fees are denominated in the same unit being transferred, mental accounting becomes simpler. The user experience starts to resemble familiar financial systems rather than experimental software. That may sound unexciting to crypto natives, but it is exactly what makes infrastructure usable at scale.

Another consequence of this design philosophy is how Plasma approaches liquidity. A settlement chain without deep liquidity is a contradiction. Money cannot settle efficiently if it cannot be borrowed, lent, or routed through markets when needed. Plasma’s rapid emergence as one of the largest onchain lending venues reflects this alignment. High stablecoin supply and borrow ratios indicate that capital is not just parked on the network. It is actively being used. That is a sign of economic relevance rather than speculative curiosity.

What is particularly important here is not the raw size of these markets, but their composition. When a large share of both supplied and borrowed assets are stablecoins, it suggests that users are treating the network as a place to manage cash-like positions. That behavior is closer to traditional financial usage than to short-term yield farming. It also creates a feedback loop. As more stablecoin liquidity concentrates, spreads tighten, rates become more competitive, and the network becomes even more attractive for settlement-heavy applications.

Plasma’s architecture reinforces this loop by reducing uncertainty. Sub-second finality minimizes settlement risk. EVM compatibility lowers integration costs for builders. Gasless transfers remove friction for retail users. Together, these choices reduce the cognitive and operational load on participants. Over time, systems that reduce friction tend to attract more serious usage than systems that simply advertise optionality.

It is also worth noting what Plasma does not emphasize. It does not compete aggressively on narrative innovation. It does not position itself as the home for every emerging crypto trend. This restraint may appear limiting, but it is often a sign of maturity. Financial infrastructure that lasts rarely tries to entertain. It tries to disappear into the background while doing its job consistently.

In this sense, Plasma’s one-sentence description as a stablecoin settlement chain is not reductive. It is clarifying. It signals to users and builders what the network optimizes for and what trade-offs it is willing to make. That clarity reduces misaligned expectations and attracts participants who actually need what the network offers.

The broader implication is that Web3 may be entering a phase where specialization matters more than ambition. As usage grows and consequences become real, the chains that survive are likely to be those that understand their role and execute it reliably. Plasma’s focus on settlement suggests that it is not trying to win the first wave of attention. It is positioning itself for the phase when reliability matters more than novelty.

In closing, the most important thing about Plasma may not be any single feature. It is the discipline of choosing what not to be. By committing to stablecoin settlement as its core identity, Plasma aligns its design with how money is actually used today. That alignment is quiet, practical, and difficult to replicate. Over time, those qualities tend to matter more than loud promises.