As blockchain systems start being used for real financial activity, one thing becomes very clear very quickly. Rules cannot be vague. They cannot shift depending on context. They cannot rely on interpretation after the fact. Speculative environments can tolerate that kind of looseness. Financial infrastructure cannot. Dusk is built with this difference in mind, treating rule certainty as something that must exist from day one, not something discovered later.

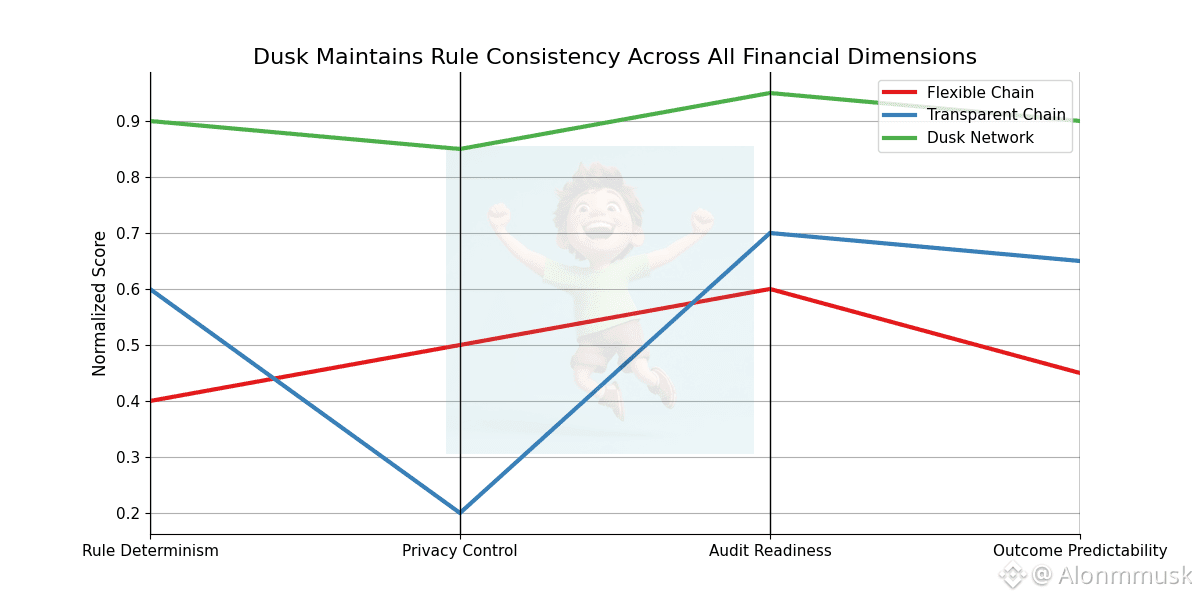

Many blockchains tried to solve trust by making everything visible. Transactions are public. Balances are exposed. The idea was simple: if everyone can see everything, bad behavior will be discouraged. In practice, this approach starts to fall apart once real money and real obligations are involved. Visibility creates new risks. Sensitive behavior is exposed. Positions become traceable. During stress, transparency often makes systems more fragile, not safer. Dusk approaches trust from a different angle by focusing on verifiable outcomes instead of constant exposure.

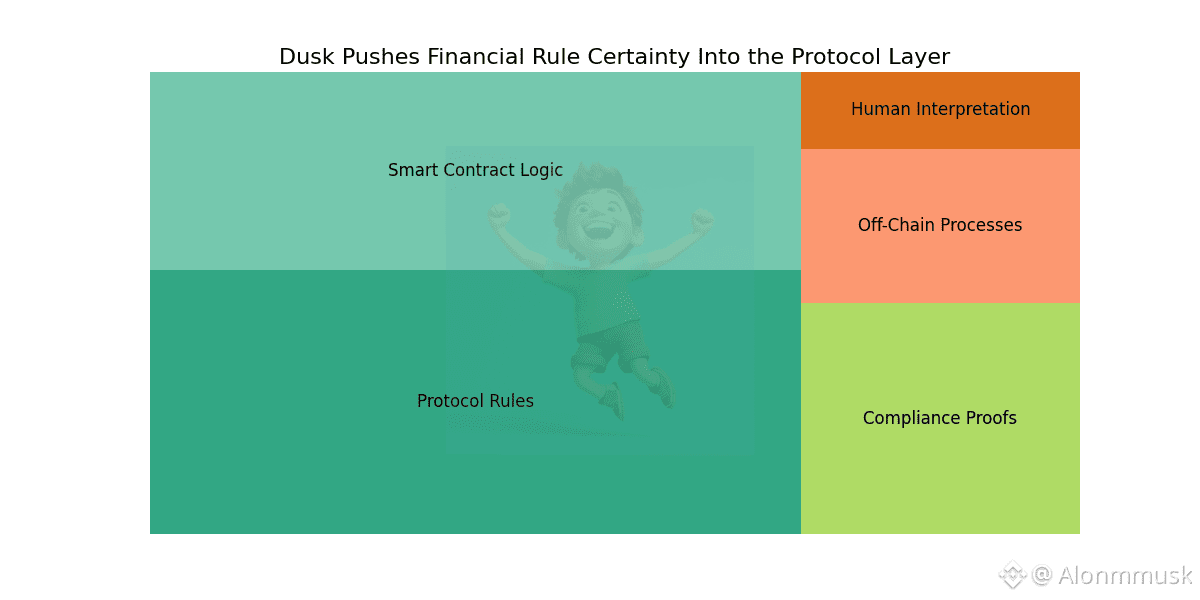

At the protocol level, this shows up as selective confidentiality combined with strict enforcement. Transactions and asset states do not need to be public to be correct. They can remain private while still being provably valid when verification is required. This is how financial systems already work in the real world. Not everyone sees everything, but audits are possible when needed. Dusk builds this structure directly into the protocol using cryptography instead of discretion.

This separation between visibility and verification changes how accountability actually works. Compliance is not something added later or handled offchain. It happens during execution. Rules are not guidelines. They are constraints. If requirements are not met, actions simply do not execute. That shift matters. It moves accountability from observation to prevention, which is critical in systems where errors are expensive and irreversible.

For developers, this creates a different kind of building environment. Working on Dusk means being explicit. Who is allowed to interact. Under what conditions. What must be proven and when. These rules are enforced by code, not by interpretation or external processes. This reduces ambiguity, which is where financial systems usually fail. Clear rules applied consistently are more dependable than flexible systems that rely on context.

Tokenized assets make this especially obvious. Real world assets brought onchain are not static tokens. They come with ongoing obligations. Ownership may need to stay private. Transfers may need to adapt over time. Disclosure requirements may change. Dusk allows these conditions to live inside the asset itself, governing behavior throughout its lifecycle instead of being patched on later.

The ecosystem forming around Dusk reflects this mindset. Builders are not chasing fast experimentation or short-term visibility. They are working on issuance frameworks, regulated DeFi primitives, and settlement systems that assume scrutiny. Audits are expected. Review is expected. Adversarial conditions are expected. As a result, systems are designed to be correct first, not flexible first.

Another important part of Dusk’s design is how it treats decentralization. Decentralization is often framed as the absence of rules. In reality, financial systems need structure. The real question is who enforces it. Dusk removes discretionary enforcement and replaces it with protocol-level enforcement. Rules apply the same way to everyone because they are enforced by code, not by judgment.

Censorship resistance also benefits from this approach. It is not only about preventing transactions from being blocked. It is about ensuring that rules cannot be selectively ignored when pressure increases. By encoding constraints directly into execution, Dusk reduces the space for arbitrary intervention. Transactions either meet conditions or they do not. Outcomes do not depend on attention or influence.

Economic design reinforces this stability. Systems built around short-term incentives often behave unpredictably when conditions change. Dusk prioritizes predictable economics in practice, that allow builders and users to plan over long timeframes. That predictability matters more than aggressive growth when systems are expected to support real financial activity.

Usability improves as a result. When rules are clear and enforced by code, users do not need to navigate edge cases or rely on offchain assurances. Complexity is handled by the protocol rather than pushed onto participants. This makes systems easier to in practice, use without sacrificing control, which is essential for broader adoption.

As the industry matures, the systems that last will be the ones that reflect how finance actually operates. Not fully opaque. Not fully exposed. But structured, enforceable, and resilient. Dusk is building toward this middle ground deliberately, accepting that credibility is earned slowly through consistency.

What ultimately defines Dusk Network is coherence. The direction does not change with narratives. Privacy remains selective. Compliance remains native. Enforcement remains automatic. The network stays focused on problems that become more important as onchain finance meets real markets.

In an ecosystem still shaped by experimentation, Dusk is building for permanence. Infrastructure that continues working when incentives shift, scrutiny increases, and attention fades. That approach is rarely loud, but it is often the one that survives.

For educational purposes only. Not financial advice. Do your own research.

@Dusk #Dusk #dusk $DUSK