When cryptopersons discuss the concept of real-world assets, they tend to make it simple: take a stock, print a token, and that is it. Regulated assets are not used as regular crypto tokens. In order to have real stocks or bonds on-chain, you must have the entire system that surrounds them to be robust or institutions will not trust it.

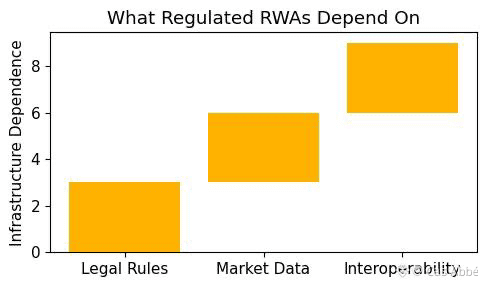

In practice, three things simultaneously are required of regulated assets. First, the legal regulations: who should be permitted to make purchases, who may bear them, what are the transfer restrictions, and what are the compliance inspections. Second, sound market data: the prices and trading data have to be provided by a source that an institution can trust is not an independent random feed that can be manipulated. Third, secure inter-network mobility: when an object can be transferred to new ecosystems, it must be transferred in a restrained manner without issuer policies or compliance restrictions.

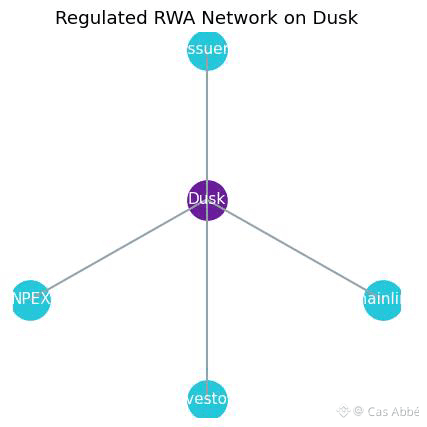

It is here that Dusk comes in. It is not just the Dusk continuing to construct a token. It is attempting to establish a complete regulated pipeline in which issuance, data and interoperability are collaborative. It is a more difficult issue than simply introducing an RWA story.

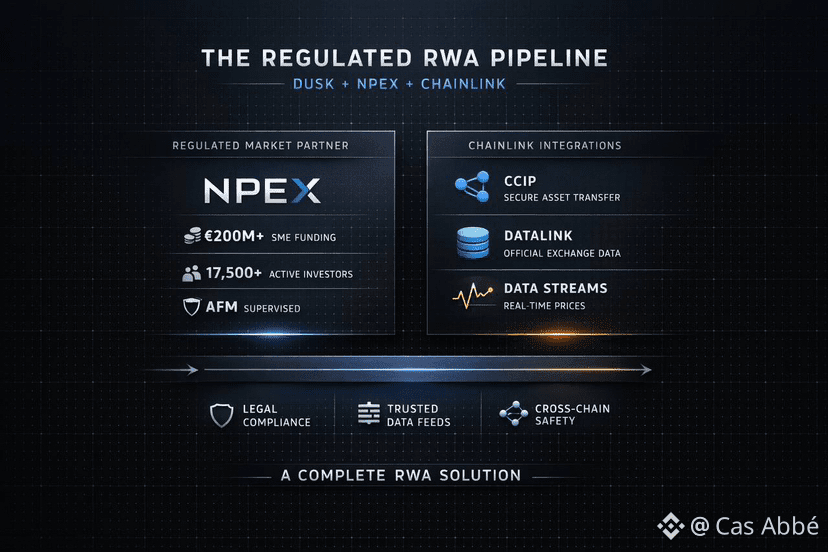

The best illustration is what Dusk has outlined around NPEX + Chainlink. NPEX is a managed Dutch platform and Dusk has disclosed that NPEX has facilitated some of the best SME fundraising and is a vibrant investor platform. It is not really about the specific numbers, but rather what these numbers are: this is not crypto collaborating with crypto. This becomes crypto attempting to reach a real regulated market place.

Now consider what they are incorporating and what each element is important. Chainlink CCIP concerns the transfer of tokenized assets across chains in a safe manner and maintaining controls (such as rate limits or other protections of issuers). Chainlink DataLink is concerning making the official exchange data on-chain so that it has a definite answer to the question of where the price came from. Chainlink Data Streams covers low-latency updates, since trading applications can not operate effectively on sluggish or slow-moving pricing.

The lesson learned here is that regulated markets do not just require privacy. They require incriminating responses to the trust questions: Where was the price formed? Who controls the asset rules? Will it be able to cross ecosystems without becoming in violation? Dusk is becoming infrastructure in which such solutions can be found in a form that institutions can live with.

A simple example helps. Consider an equity instrument that is a European issue. Provided that the price feed is not trusted, lending and trading constructed on top of it can be attacked. In case the asset cannot be transported safely across the ecosystems, it gets disconnected and liquidity becomes impaired. Dusk is attempting to resolve the two - trusted data and safe interoperability - such that regulated RWAs may be made practical