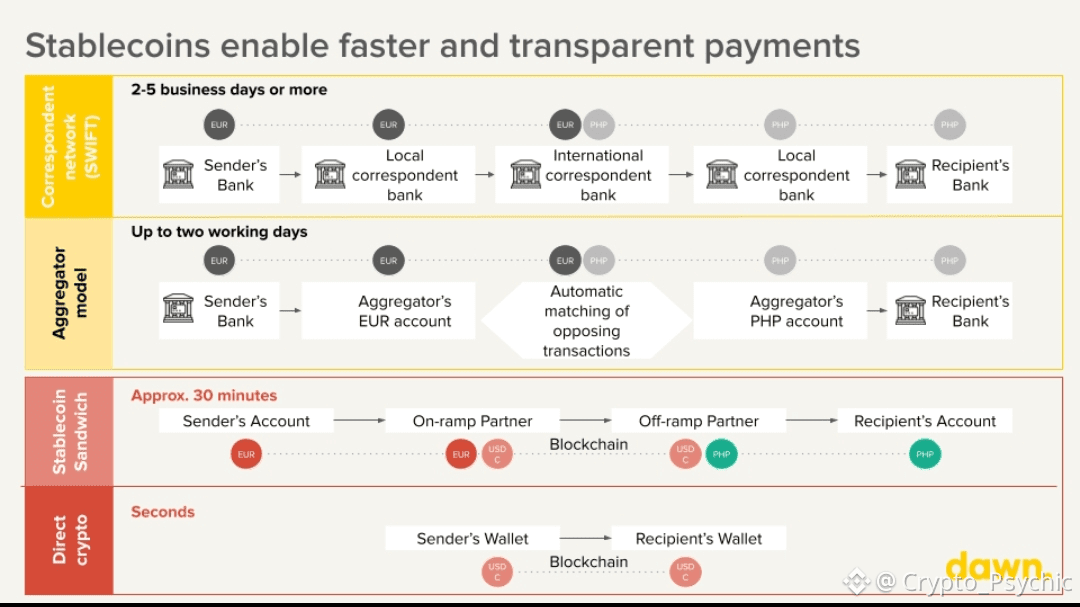

What once felt like a test now stands solid. Billions cross borders every day through these digital coins, flowing into exchanges and payment systems without pause. Still, the systems behind them creak under strain, split apart, working harder than they should. On many chains, stablecoins get tossed in with everything else, making people face unpredictable costs, delays piling up, and platforms that do not care about smooth money movement. Imagine starting fresh. Seeing how things actually get used. Building the ground level not for every idea at once but shaped only for one job - letting stablecoins settle fast, cheap, clean. That foundation does not exist yet. This tries to become it.

A Layer One Designed for Finalizing Transactions Instead of Broad Stories

What if speed, low cost, and reliability came first? That idea shaped Plasma - a foundational blockchain built just for shifting stable value. Instead of chasing every possible function, it does one thing seen working today: treating stablecoins like digital dollars. By zooming in tight, extra steps fade out. Other systems keep those hurdles, calling them normal. Not here. Efficiency rises when purpose stays narrow.

Fundamentally, Plasma runs on a unique setup for execution and agreement, built to be fast and predictable, yet still fully matches the EVM standard. Because of this design, familiar Ethereum tools work right away - no changes needed - for those building on it. Meanwhile, people using it experience confirmations so quick they resemble everyday digital payments more than typical blockchain delays.

EVM Compatible with Near Instant Finality

Faster by design, Reth powers Plasma's ability to run Ethereum Virtual Machine code without changes. Because it uses this updated execution layer, familiar tools like MetaMask or Hardhat just work right away. Contracts written in Solidity deploy smoothly, no rewrites needed. Builders jump in quickly, since their usual workflows fit perfectly. Institutions find fewer roadblocks when moving projects over.

Finality comes through PlasmaBFT, a system built to withstand faulty nodes while moving quickly. Settlement happens in less than one second, bypassing the wait times seen on most chains where certainty grows slowly. This speed matters deeply for stablecoins - it shapes how much users believe, businesses rely, and institutions match records.

This time around, payments move quickly while staying locked in place. When money changes hands, everything clears right away without delays, doubts, or rollbacks hanging over it.

Features That Matter for Stablecoins

What Plasma brings online shifts meaning once stablecoins stop being afterthoughts. Features click differently when these tokens sit up front, not off to the side.

What stands out? Gasless USDT transfers. Sending USDT doesn’t require owning another token for fees. It works like regular money should. The payment covers its own cost, not relying on some outside coin that jumps in price every day.

What happens with Plasma is that gas works around stablecoins first. Fees show up in stablecoin amounts right away, people pay them that way too. For regular users where crypto use is common, one big problem just fades out. Institutions find their bookkeeping easier now. Predictable costs? That simply becomes how things work.

What looks minor actually tackles stubborn problems blocking stablecoins from working like regular cash online. Though small in appearance, these tweaks hit core issues head-on - ones that kept digital dollars stuck despite their promise. Real change hides in what appears quiet at first glance.

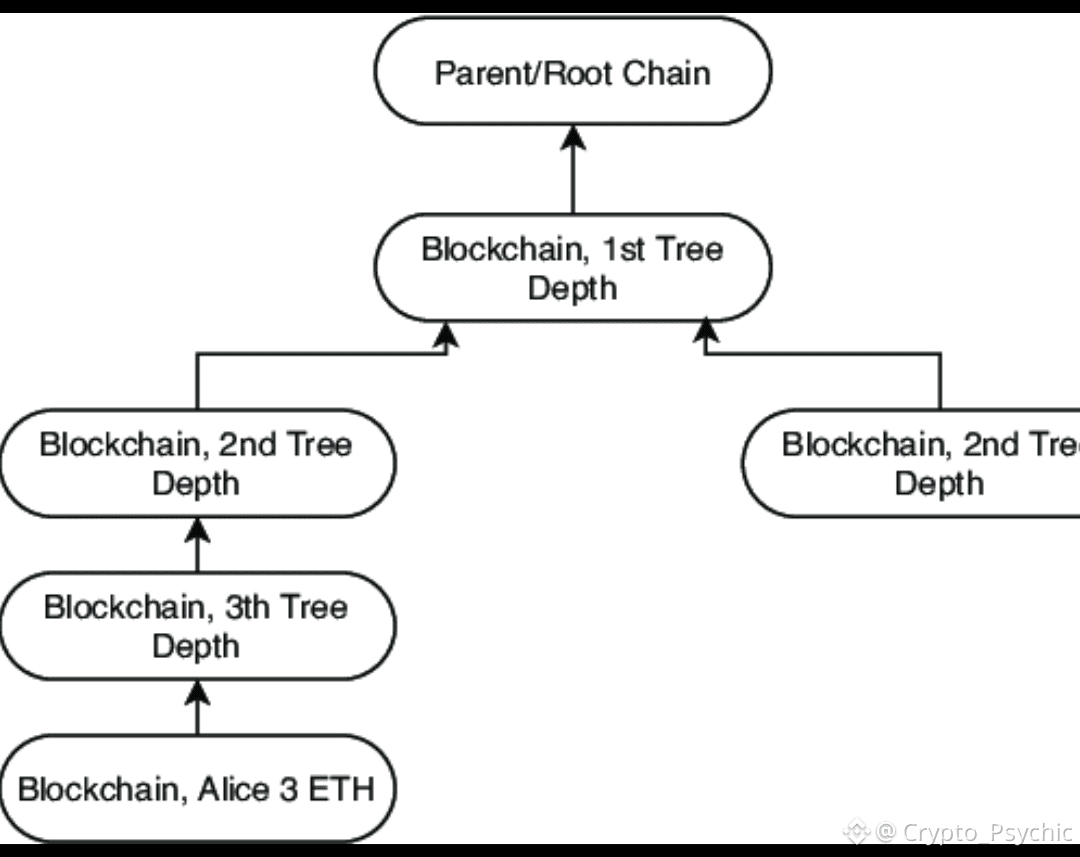

Bitcoin Anchored Security and Neutrality

Security tied to Bitcoin shapes much of Plasma’s future thinking. When parts of its system lock into Bitcoin, it becomes harder for any group to control outcomes. Trust shifts toward code instead of committees. The strength and impartial nature of Bitcoin act like a foundation others build upon. Decisions stay predictable because they depend less on human choices. Power stays distributed by design.

What happens here affects banks and money services. Systems that handle payments need stability - both in code and in policy. Tying it to Bitcoin helps Plasma act like a base layer, not just another test on top. Predictability isn’t only about tech - it’s shaped by rules too.

People Using Crypto Every Day And Big Companies Settling Transactions

Apart from typical setups, Plasma targets two distinct communities. These groups hardly ever fit together well on current blockchains.

Where people already rely on stablecoins to send money home, save, or pay for groceries, that is where it steps in. Not dealing with wild price swings matters there - not a small issue, but a dealbreaker. High network costs? Slow transactions? They stop progress cold. A smooth experience built around stablecoins changes the game fast.

Fees you can count on. That matters when money moves fast. Settlements happen quick here - no waiting around. Think of it like this: a system that works where it needs to, without rewriting the rules. Built right into today’s financial flow, not bolted on after. Neutral ground for closing deals, no favoritism baked in. Runs on familiar tech, so teams don’t trip over new puzzles. Treasury shifts? Smooth. Global payouts? Normalized. Even fintech tools find their place naturally inside this setup.

Plasma Stands Apart

Starting wide doesn’t always work. Many chains aim big at first, expecting payment use to grow on its own. Not Plasma. It begins tight, focused where real need shows up. Instead of chasing new forms of cash, it improves what's already flowing. Movement matters more than invention here.

What sets Plasma apart is its narrow focus on stablecoin transactions. Instead of trying to handle everything, it zeroes in on what matters most right now. The busiest type of transfer shapes its design. Efficiency comes from ignoring distractions. This path sidesteps compromises others face. One purpose drives every choice. Not every chain needs to do it all.

Looking Ahead

When stablecoins get used more than other cryptocurrencies, what holds them up becomes key. Not stories. Speed matters. So does fairness. Predictability too. That is where Plasma fits in. Built for how folks really handle digital cash. A foundation ready for what comes next.

Should crypto start serving daily transactions instead of feeding bets, Plasma's work fits right there. Not chasing trends, just shaping tools for what comes after the noise fades.