Hey folks, if you've been paying attention to the crypto space lately, you've probably heard whispers about Plasma turning heads with its focus on making stablecoins the backbone of everyday finance. As someone who's been knee-deep in blockchain projects for years, I can tell you Plasma isn't just another Layer 1 chain chasing hype—it's engineered from the ground up to solve real problems in how money flows globally. Let's break it down step by step, pulling in the latest facts and numbers to give you solid insights you can actually use, whether you're a builder, a business owner, or just curious about where digital dollars are headed.

First off, Plasma is a high-performance Layer 1 blockchain tailored specifically for stablecoin infrastructure. Launched its mainnet beta back in September 2025, it's designed to handle instant payments at a massive scale. We're talking over 1,000 transactions per second with block times under one second—that's the kind of speed that makes legacy systems like SWIFT look archaic. And the fees? Super low, often fractions of a cent for USD₮ transfers, which is Tether's stablecoin and Plasma's primary fuel. This isn't theoretical; as of January 2026, the network has processed over 28.7 million transactions, marking a whopping 5,200% year-over-year growth. That's real traction, showing how Plasma is already moving billions in value without breaking a sweat.

What sets Plasma apart is its laser focus on stablecoins as the core asset class. Right now, the total stablecoin market cap on the chain sits at about $1.91 billion, with USD₮ leading the pack as the dominant player. But it's not just holding value—Plasma's total value locked (TVL) across DeFi protocols is hovering around $3.37 billion, according to DefiLlama data from early 2026. This includes bridged assets worth $7.23 billion and native liquidity at $4.82 billion, making it one of the top chains for stablecoin activity. In the last week alone, weekly trading volume hit $309 million, up 107% from the prior period. These numbers aren't fluff; they reflect deep liquidity pools that let users lend, borrow, and swap stablecoins efficiently. For instance, the largest onchain liquidity pool for syrupUSDT—a yield-bearing version of USDT—holds over $200 million, powering everything from institutional lending to everyday transfers.

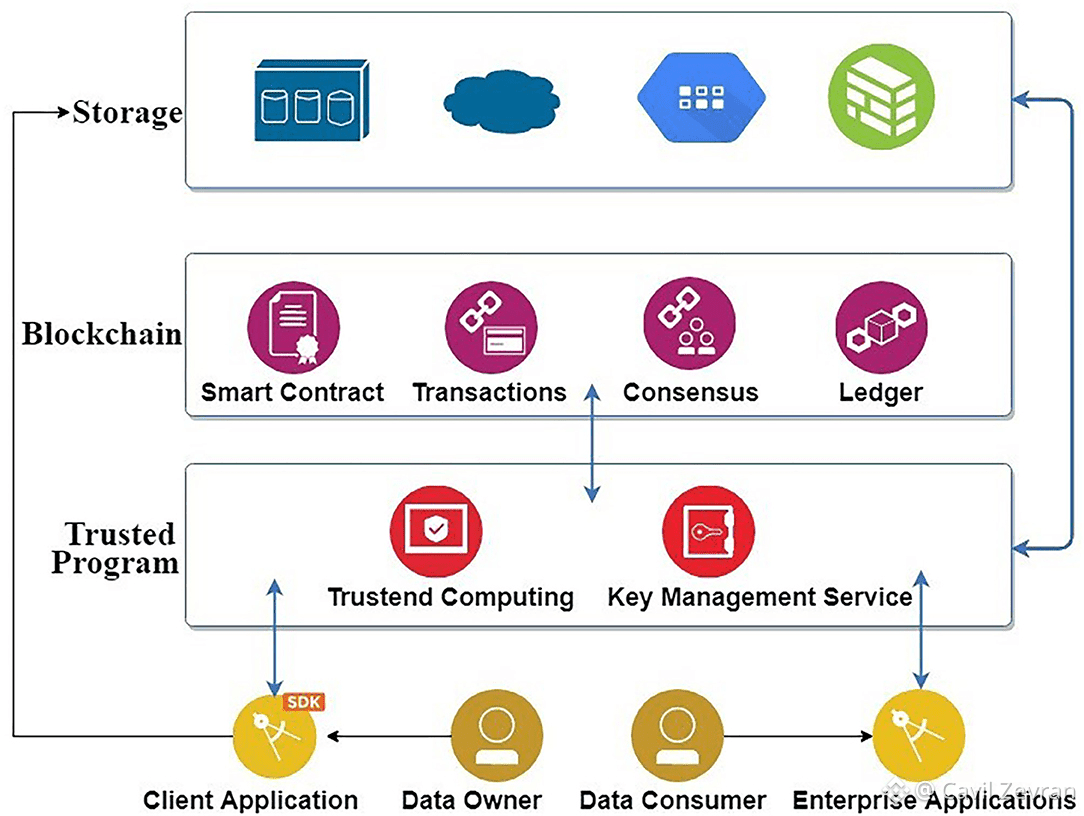

Now, let's talk tech because that's where Plasma shines for developers and enterprises. It's fully EVM-compatible, meaning you can deploy Ethereum-smart contracts here without a hitch, but with way better performance. The architecture supports sharding-like scaling, which helps it maintain high throughput even as adoption grows. Recent upgrades in December 2025 hardened the chain further, pushing core features into production and setting the stage for even faster settlements. One standout is Plasma One, the world's first stablecoin-native neobank, which rolled out in private beta late last year. It offers virtual and physical cards with 4% cashback, instant digital dollar transfers, and direct stablecoin payments—no need to convert to fiat every time. This is huge for users in regions like Southeast Asia or the Middle East, where traditional banking is clunky and expensive.

On the use case front, Plasma is all about bridging crypto to the real world, and the integrations prove it. Take payments: Through partners like Rain Cards, users can spend USD₮ at over 150 million merchants worldwide. Oobit, backed by Tether, lets you tap into 100 million Visa-accepting spots directly from your wallet, with instant payouts for merchants. In Southeast Asia, LocalPay and AliXPay open up QR-based payments to 34 million merchants serving 200 million consumers, converting USD₮ to local currencies like VND or THB on the fly. MassPay connects to global merchant payouts in 200+ countries, while Basal Pay targets Vietnam's $14 billion remittance market and its 12 million annual visitors. These aren't pie-in-the-sky ideas; they're live, handling real volume and reducing cross-border friction that costs businesses trillions annually.

DeFi on Plasma is equally robust, providing tools for anyone looking to optimize their stablecoin holdings. Protocols like Aave V3 have Plasma as their second-largest chain for TVL, with the highest ratio of stablecoins supplied to borrowed across markets. Fluid offers capital-efficient lending and borrowing, while Pendle and Ethena add advanced yield strategies. Maple Finance's SyrupUSD₮ has ballooned to over $1.1 billion in TVL since launch, giving access to institutional-grade asset management. Then there's Axis with its USDx token, delivering resilient arbitrage returns without directional bets—perfect for businesses holding dollars long-term. CoWSwap brings MEV-protected, gas-free swaps, and Upshift's vaults like K3 EURØP cater to Euro-backed stablecoins from issuers like Schuman. Even Daylight Energy is innovating by turning stablecoin deposits into credits for efficient energy grids, with a $50 million USDS and USD₮ vault that opened in December 2025.

Exchanges and custodians are piling in too, which speaks to Plasma's reliability. Kraken, serving millions globally, added USD₮ support in December 2025, joining over 30 other exchanges. Cobo, a top APAC custodian, enables 500+ institutions to run stablecoin payments with predictable settlements. Holyheld lets users in 30+ countries pay bills via SEPA from personal IBANs using Plasma USD₮. And for explorers, Etherscan is now natively integrated, making it easy to track everything onchain.

Looking at recent moves, Plasma's December 2025 update was pivotal. They shipped integrations with Bridge for enhanced payment infrastructure, COPR by Tellura for 24/7 fractional copper trading settled in USD₮, and expanded education via the Plasma Learn Center—a free resource covering stablecoin basics like issuance, reserves, and regulation. The "Where Money Moves" newsletter dropped its 18th edition in early December, noting global stablecoin volume at $2.9 trillion across 1.5 billion transactions monthly, with over 205.7 million wallets holding them and USD₮ commanding 60.17% market share at $184.6 billion supply. Plasma's piece of that pie is growing, accounting for a notable chunk of onchain activity.

Why does this matter to you? If you're in fintech, Plasma offers rails that cut costs on remittances and payouts—think instant, low-fee transfers that beat wire fees by miles. For DeFi enthusiasts, it's a playground with sticky liquidity and yields that actually make sense for stable assets. Businesses get tools like tokenized assets (e.g., Euro stablecoins with institutional yield) without the volatility headaches. And for everyday users, especially in the Global South where QR payments rule, it's a gateway to spending digital dollars seamlessly. Plasma's 100+ partnerships and support for 25+ stablecoins across 100+ countries and currencies mean it's not isolated—it's interconnected, pulling in 200+ payment methods to make stablecoins as usable as cash.

In a world where stablecoins now represent over 1.37% of the US M2 money supply, Plasma is positioning itself as the go-to infrastructure. Backed by heavyweights like Tether's CEO Paolo Ardoino, US Treasury Secretary Scott Bessent, former CFTC Chairman Chris Giancarlo, and Crypto/AI Czar David Sacks, it's got the credibility to push boundaries. Recent headlines, like S&P's rating tweak on Tether (which the team pushed back on strongly) or Klarna's new stablecoin launch, underscore the sector's momentum, and Plasma is right in the mix with resilient features that weather market shifts.

As we roll into 2026, Plasma's focus on scaling distribution, native DeFi apps, and core upgrades promises even more utility. Whether it's hardening the chain for enterprise-grade reliability or expanding to new assets like tokenized gold (Tether's become the biggest non-central bank holder), this project is building a foundation for a new financial system. If you're exploring ways to leverage stablecoins, dive into Plasma's docs or testnet—it's straightforward and packed with value.

To wrap it up, Plasma isn't reinventing the wheel; it's greasing it for faster, cheaper global money movement. Stay tuned—this is just the beginning of stablecoins going mainstream.