The first time I realized “privacy” and “regulated finance” don’t have to be enemies was while watching a simple compliance process play out in real life. A friend who runs a small investment business was onboarding a client for a private placement. Nothing shady, nothing exciting. Just paperwork, identity checks, suitability questions, and audit trails. The funny part is that the most sensitive information wasn’t the money. It was the client’s identity, their holdings, and the private terms of the deal. In traditional markets, those details are protected by default, yet regulators still have a clear path to oversight. On most public blockchains, it’s the opposite: either everything is visible to everyone, or privacy becomes so absolute that compliance becomes impossible.

That exact contradiction is the gap Dusk Network is trying to close.

Dusk is a Layer-1 blockchain designed specifically for regulated financial activity, where confidentiality and compliance both matter at the same time. Instead of treating privacy as an optional add-on, Dusk treats it like a base requirement, while also acknowledging a reality many crypto narratives ignore: institutional markets cannot scale without auditability, lawful access, and settlement guarantees. Dusk’s core bet is simple but rare in this industry financial assets can move on-chain, but only if the chain is built to behave like real market infrastructure.

This is why Dusk’s positioning is different from the typical “privacy chain” story. Many privacy projects aim to maximize censorship resistance and anonymity, which appeals to a certain crypto audience but immediately becomes a red flag in regulated environments. Dusk’s philosophy is closer to the way regulated finance already works: sensitive information should remain confidential by default, while compliance requirements can be satisfied when needed. It’s not trying to remove rules from finance. It’s trying to make finance programmable without turning it into a surveillance machine.

From an investor perspective, the most important question is: how does Dusk enforce confidentiality without breaking trust and verification? The answer sits in its cryptographic stack and consensus design. Dusk supports privacy-preserving smart contracts, using zero-knowledge techniques so transactions and contract execution can be validated without exposing private inputs. In plain language, it aims to prove correctness without publishing everything to the world. That matters because regulated markets aren’t just about moving tokens. They are about enforcing rules—transfer restrictions, eligibility, disclosure triggers, and compliance workflows—while still keeping the underlying details protected.

Settlement also matters more than most retail traders admit. If you’re settling tokenized equities, funds, or bonds, finality is not a cosmetic metric. It’s a legal and operational requirement. Dusk emphasizes an institution-grade settlement model and highlights its Proof-of-Stake approach built around Succinct Attestation (SA), explicitly framing it as a consensus mechanism with settlement finality guarantees for financial use cases. In other words, it’s not only about throughput. It’s about being able to confidently say: the trade is done, final, and can’t be reversed by reorg drama.

The reason regulated finance keeps coming up is that “regulated assets” are fundamentally different from memecoins and open DeFi tokens. A regulated asset has rules attached: who can hold it, how it can be transferred, what disclosures are needed, what the issuer must report, and what authorities can request. If you put those assets on a completely transparent chain, you risk leaking private market information positions, flows, and counterparties. If you put them on a fully anonymous system, you create compliance dead-ends. Dusk’s entire narrative is built around that uncomfortable middle: privacy that survives regulation, and compliance that doesn’t destroy privacy.

A key signal that Dusk is leaning into “real infrastructure” rather than isolated ecosystem building is interoperability and market data standards. In November 2025, Dusk and NPEX announced adoption of Chainlink standards including CCIP interoperability and DataLink/data tools to bring regulated institutional assets on-chain with regulatory-grade data publishing. This matters because regulated markets don’t just need tokens—they need official price and reference data, reliable cross-chain settlement paths, and clean rails that can connect to broader liquidity without losing compliance boundaries.

Now let’s make it concrete with a realistic example.

Imagine a European SME issues tokenized shares through a regulated venue. Investors want on-chain settlement for speed and operational simplicity, but they do not want the entire market to see who bought, who sold, and how much. Regulators, meanwhile, need the ability to audit suspicious activity and ensure rules are followed. On most chains, you choose one side: transparency for everyone, or privacy that is too absolute to supervise. In Dusk’s ideal flow, transactions can remain confidential at the public layer while still being provably valid, and compliance conditions can be embedded into the smart contract logic itself. That’s the difference between “crypto trading” and programmable capital markets.

From a trader’s viewpoint, Dusk is not an easy project to analyze because it isn’t built for hype cycles. It’s built for slow trust accumulation. That can be frustrating in crypto, where narratives pump faster than infrastructure. But for long-term investors, that slow pacing is also the point. Regulated finance does not migrate based on vibes. It migrates once systems prove reliability, compliance readiness, and legal comfort.

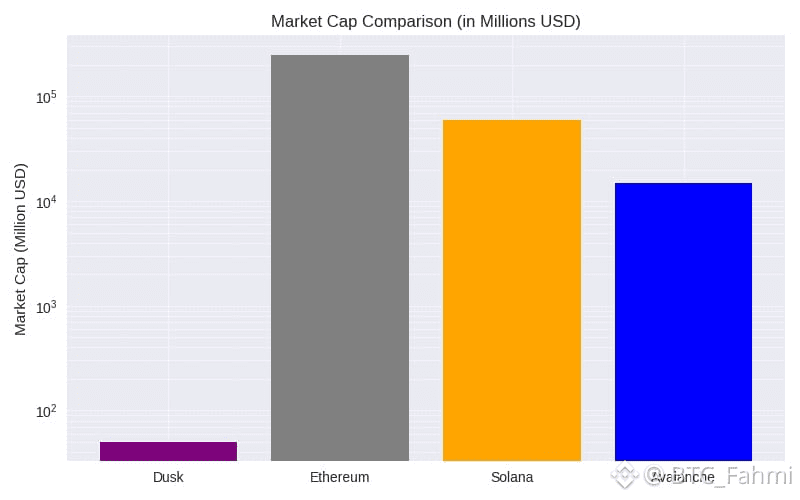

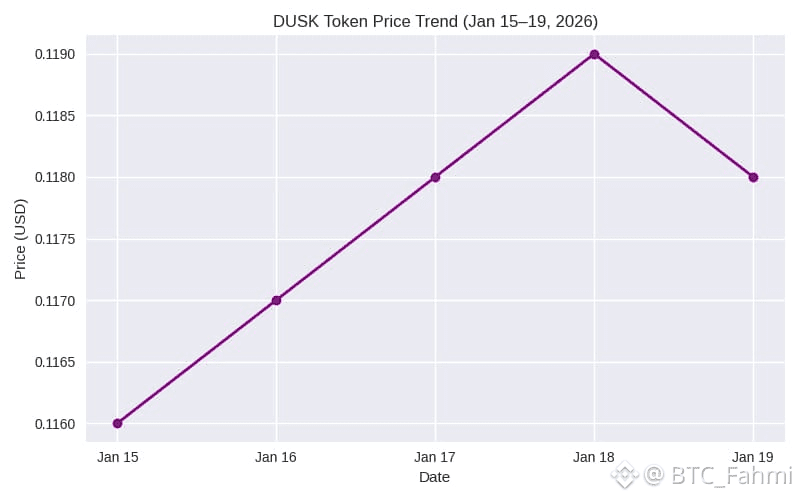

Market data also shows that Dusk is still valued like a niche infrastructure bet rather than a mainstream Layer-1. As of today (Jan 17, 2026), DUSK trades around $0.116–$0.119 with market cap around the mid-$50M range depending on source, and a maximum supply commonly listed at 1B DUSK. That’s small relative to general-purpose chains, which is exactly why some traders ignore it—and exactly why it remains interesting to others who look for asymmetric infrastructure plays.

The unique angle with Dusk isn’t that it promises the future. It’s that it’s designed around a boring but powerful truth: if on-chain finance ever becomes mainstream, it cannot run entirely in public view, and it cannot run outside regulation. Dusk is trying to be the Layer-1 that accepts both realities without compromising either one. That balance confidential and compliant is not just marketing. It’s arguably the core technical problem that decides whether tokenized securities become a serious market or remain a niche experiment.

And as someone who’s watched both crypto and traditional finance from close enough to see their flaws, I’ll say this carefully: if Dusk succeeds, it won’t look like a meme rally. It’ll look like quiet adoption. The kind you only notice after it’s already real.