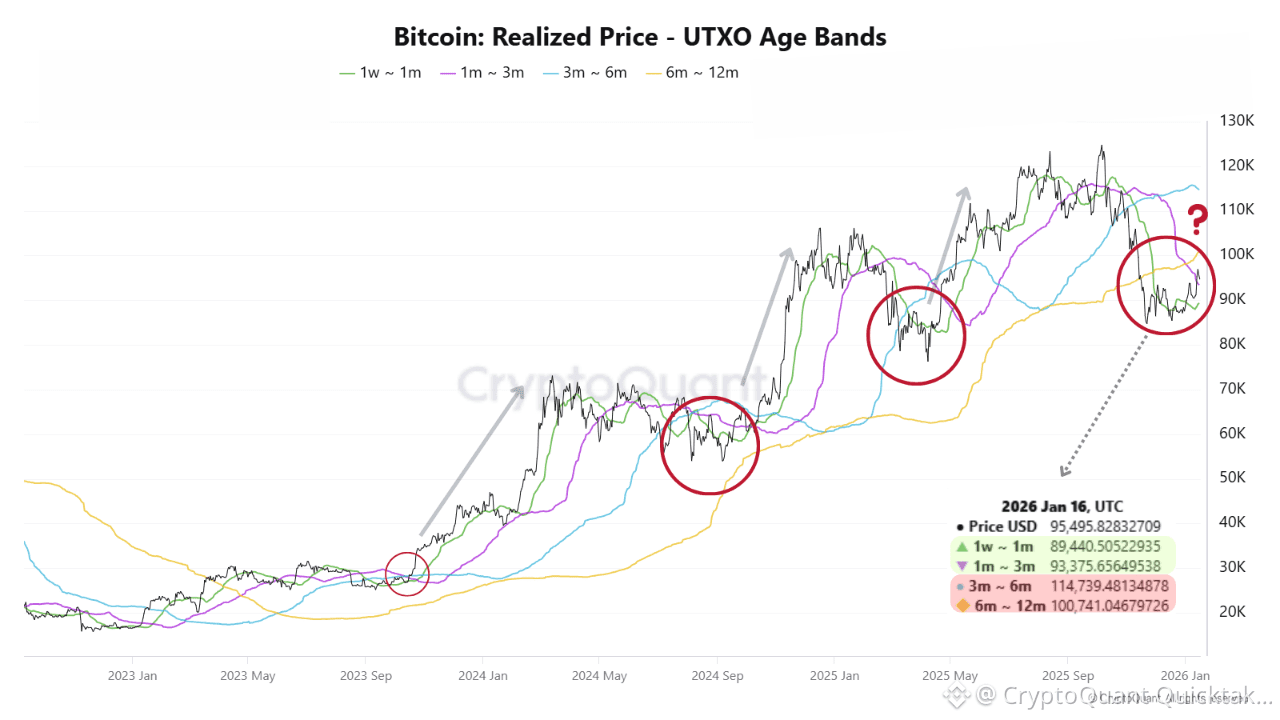

Realized Price by UTXO Age Bands reveals where latent selling pressure sits, which cohorts remain psychologically comfortable, and which ones need price to move higher just to break even.

When we analyze Bitcoin through Realized Price by age bands, we are not searching for trend signals. We are mapping where psychological stress is accumulating across holders.

And right now, that stress is unevenly distributed.

The Current Setup:

Spot Price: $95,583

1w~1m cohort: $89,255

1m~3m cohort: $93,504

3m~6m cohort: $114,808

6m~12m cohort: $100,748

Short-term holders (1w–1m and 1m–3m) have a realized price below spot, meaning recent buyers are in profit. This matters. New capital entering after the pullback is being rewarded, not punished. Historically, this dynamic limits reflexive downside, as fear is not reinforced at the margin.

The pressure sits elsewhere.

Both the 3m–6m and 6m–12m cohorts hold a realized price above current spot, placing them underwater. This tells us coins are not being redistributed aggressively at lower levels. There is discomfort, but not capitulation. Losses are being absorbed through patience rather than forced selling.

So, what’s next?

If spot price starts to reclaim the 6m–12m realized price, pressure on this cohort begins to ease. Losses move back toward neutral territory, reducing the incentive to sell into strength. However, for it to hold, this cohort must continue to interpret the drawdown as temporary discomfort, not as a structural exit signal after spending extended time underwater. That distinction is critical. When mid-term holders reframe patience as a mistake rather than a strategy, selling pressure tends to emerge regardless of price levels.

This is why broader market sentiment matters here. A supportive narrative and constructive price behavior give these investors a reason to stay engaged rather than seek relief through exit. Without that psychological reinforcement, time alone is not enough.

Written by MorenoDV_