Getting the Most from the Walrus Staking Calendar

Understanding How Timing Impacts Your WAL Earnings

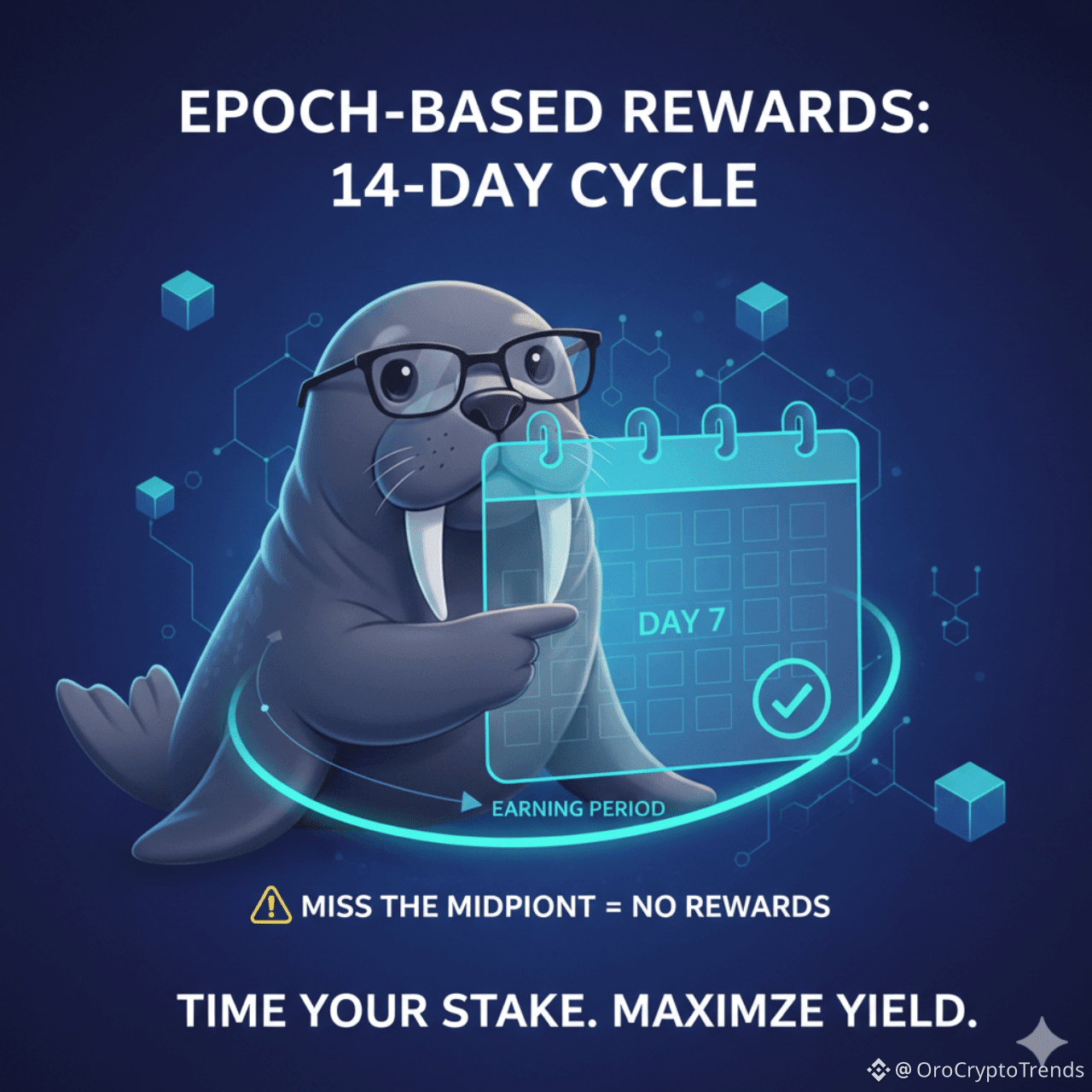

If you’re stepping into the Walrus (WAL) ecosystem, it’s important to realize that rewards don’t flow in constantly. Instead, Walrus operates on a fixed 14-day schedule known as epochs. As we move into 2026, grasping how this timing structure works can significantly affect your staking returns. With the right approach, you’ll see consistent rewards landing in your wallet. But if you overlook the timing, your tokens might just sit idle, not earning anything, for weeks at a stretch.

So, what exactly is an epoch? Within the Walrus protocol, an epoch is a 14-day period during which a designated set of storage nodes is tasked with safeguarding the network’s vital data. This system helps maintain both security and efficiency, but it also means stakers must follow specific participation rules if they want to maximize their rewards.

How the 14-Day Cycle Plays Out

Think of an epoch as a two-week contract between you, your fellow stakers, and the network. Once an epoch begins, participants are effectively locked in until the period ends, and what you do within that window determines when your rewards start flowing.

- The Midpoint Rule: This is crucial. To qualify for rewards in the upcoming epoch, you must stake your WAL tokens before the end of Day 7 of the current cycle. If you miss this window, you’ll have to wait through the remainder of the current epoch and all of the next one before you start earning.

- The Activation Gap: If you stake on Day 8 or later in the cycle, your tokens end up in a holding pattern—unable to earn—for nearly three weeks. This means your assets are unproductive until the next-but-one epoch begins.

- The Transition Phase: At the end of the 14 days, the protocol calculates storage fees and distributes rewards based on your node’s performance and participation. This is when you’ll see your staking income hit your account.

Why a 14-Day Cycle? The Logic Behind the Timing

At first glance, a two-week epoch might seem lengthy compared to other blockchain networks, but there are solid technical and strategic reasons for this approach:

- Data Sharding: Walrus is responsible for moving and organizing vast amounts of data, often spanning many terabytes. The 14-day window allows enough time to securely reallocate data chunks across nodes when participants join or leave, minimizing risks of data loss or downtime.

- Predictable Governance: All significant protocol changes—such as adjustments to storage pricing—can only be enacted at epoch boundaries. This ensures that users and operators aren’t surprised by mid-cycle changes, allowing for better planning and stability.

- Enhanced Security: Longer epochs make it harder for opportunistic actors to rapidly move capital in and out to manipulate the system. Slower cycles help dampen volatility and protect the protocol from potential exploits, ultimately making the network sturdier for everyone involved.

Pro Tips for Walrus Stakers

- Consult the Dashboard: Before staking, always check the official Walrus dApp dashboard. It will display the exact number of days remaining in the current epoch and whether you’re still on time to qualify for the next cycle’s rewards.

- Plan Withdrawals Carefully: Entering and exiting the protocol both involve time delays. Unstaking typically locks your funds for another 14 days, so don’t commit tokens you may need to access in the near future.

- Compounding Your Earnings: WAL rewards are distributed every two weeks, but they aren’t automatically re-staked. To maximize your returns, you’ll need to manually re-stake your rewards after each epoch. Alternatively, you can use Liquid Staking Tokens (LSTs), which automate the compounding process, allowing your earnings to grow hands-free.

The Big Picture

The 14-day epoch is the heartbeat of the Walrus protocol, setting a deliberate pace that differentiates it from many faster-moving DeFi platforms. This slower rhythm is what gives Walrus its reliability and resilience. By staking before the midpoint cutoff, your WAL tokens will begin earning right away in the next cycle. If you miss the cutoff, you’ll be waiting significantly longer before your tokens start working for you.

A final tip: If you find yourself just missing the staking window, check out Liquid Staking providers. These platforms often maintain buffer pools, allowing your tokens to start earning rewards more quickly than if you staked directly with a node, reducing the time your assets spend idle.

Disclaimer: This is not financial advice. Staking involves locking your tokens and accepting protocol-related risks. Always confirm current epoch timing and staking policies through official Walrus channels.