In @Walrus 🦭/acc Walrus, you can tell who’s new by how they talk about governance. Newcomers expect dramatic votes, loud proposals, and the kind of public struggle that makes markets feel alive. People who actually operate around Walrus expect something else: small adjustments that arrive like weather, not like sirens. The system is built around the idea that incentives are never “done.” They’re living settings, tuned by evidence, and the evidence is the part most people don’t see.

The thing that changes you, once you’ve lived inside the ecosystem long enough, is realizing that storage is an emotional service before it’s a technical one. People don’t wake up thinking about availability. They wake up assuming it. A creator uploads something and moves on. A team pushes an update and expects users to load it. A protocol commits to a reference and expects it to resolve. When those assumptions break, the failure doesn’t feel like “a bug.” It feels like betrayal. Walrus sits under that trust. And governance, in this world, isn’t a debate club. It’s the quiet work of preventing betrayal from becoming normal.

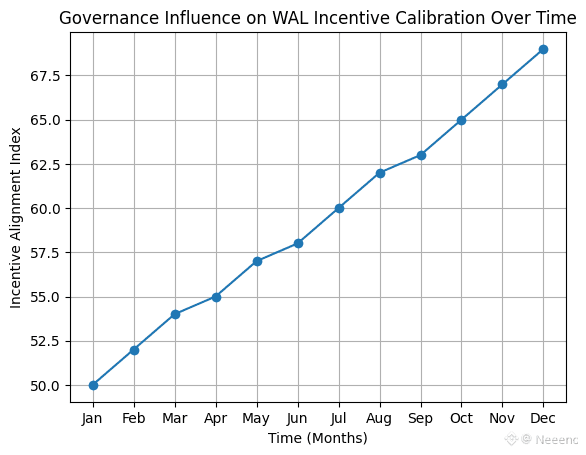

That’s why the most meaningful governance influence on Walrus doesn’t look like reinvention. It looks like calibration. The network’s culture leans toward incremental changes to rewards and penalties, based on operational reality, not ideology. The official framing is explicit that governance exists to adjust parameters through the WAL token, with stake-weighted voting and a clear focus on setting penalty levels in a way that reflects the real costs operators bear when others underperform.

If you’ve never run infrastructure, it’s easy to miss what that sentence implies. Underperformance is not an abstract moral failure. It creates spillover. Data has to move. Work has to be redone. Latency becomes a user-facing problem. A small percentage of sloppy behavior can tax everyone else, and the bill shows up as reputation loss first, revenue loss second, and exhaustion all the time. Walrus governance is designed to treat those externalities as first-class facts. Not as drama, not as shame, but as something you price into the system until the system stops tolerating it.

WAL is where this becomes real, because WAL is not just a token people hold. It is the handle governance uses to touch behavior. Walrus’ own description makes the relationship plain: stake shapes where data gets assigned, and rewards follow behavior, not vibes. When you live with that, you stop thinking of governance as “community direction” and start thinking of it as an instrument panel. The point isn’t to steer into new narratives. The point is to keep the machine stable when conditions change.

Some of the best evidence that Walrus takes this seriously is in how it talks about discouraging short-term stake movement. Walrus doesn’t treat sudden shifts as harmless preference changes. It treats them as a network cost, because stake movement can force expensive data migration and destabilize expectations. That’s why the project has publicly described penalties for short-term stake shifts, with part of those fees burned and part redistributed to long-term participants. Even before you care about token economics, that’s a governance philosophy: reduce noise, reward patience, and make it expensive to treat the network like a revolving door.

That philosophy matters most when things go wrong. In calm markets, people behave generously because they can afford to. Under stress, people optimize defensively. They chase yield, they move support, they blame others, and they try to exit risk faster than the system can absorb it. A network that cannot survive defensive behavior is not infrastructure. Walrus governance is shaped around the expectation that defensive behavior will happen, and that the best time to prepare is before the panic arrives. So the work becomes quiet: adjust thresholds, refine weights, reduce the payoff of opportunistic movement, and keep incentives aimed at consistent delivery rather than short-lived performance spikes.

You can see the broader context in how Walrus described its token distribution and long-term alignment. The project states a max supply of 5,000,000,000 WAL and an initial circulating supply of 1,250,000,000 WAL, with over 60% allocated to the community through mechanisms meant to support real participation rather than decorative decentralization. When you blend that with the stance on stake movement penalties and future slashing, the picture becomes sharper: Walrus is building a culture where “being aligned” isn’t a slogan. It’s a cost structure you can’t easily escape.

People sometimes misunderstand this and assume it means governance is slow. It’s not slow. It’s deliberate. Walrus launched its public mainnet on March 27, 2025 and described the start of a storage economy powered by WAL, with rewards and penalties shaping operator behavior and early subsidies making adoption less fragile. The governance posture shows up here too: instead of pretending the system is mature on day one, Walrus explicitly used subsidies to bridge the early phase, so operators can cover real fixed costs while usage is still developing.

Subsidies are not charity. They’re a tool for smoothing the emotional experience of early users. Early users are the most sensitive to friction and the least forgiving of outages, because they are taking social risk by building on something not yet boring. Subsidies reduce the chance that adoption stalls for reasons that have nothing to do with product value and everything to do with the awkwardness of early economics. But subsidies also create a governance responsibility: you have to decide how support is distributed, what behavior it rewards, and how quickly it should fade as real fees take over. That’s incentive calibration in its most consequential form, because it decides what kind of participant the network trains itself to attract.

Walrus has been clear that a portion of WAL is earmarked to accelerate adoption in early phases, with subsidies designed to make usage cheaper while still making sure operators earn enough to cover fixed costs. That is an honest admission that infrastructure doesn’t run on ideology. It runs on margins, maintenance, and people showing up when the work is repetitive. Governance that ignores those realities ends up with the kind of decentralization that looks good until someone stops paying attention.

The recent updates around Walrus reinforce how this governance style compounds over time. In August 2025, Walrus announced a partnership designed to improve bandwidth and reduce latency in high-traffic environments and underserved regions, explicitly referencing Pipe’s large distributed footprint as a way to make performance less dependent on a few centralized corridors. This wasn’t presented as a reinvention of Walrus. It was framed like operational reinforcement: the network should keep working when usage spikes and when geography becomes a constraint instead of a detail.

That kind of partnership is also governance-adjacent even when it isn’t a vote. It changes the pressure landscape. It changes what “reliability” means in practice. And it creates new data for incentive calibration: if performance improves in underserved regions, how should that be reflected in what the network rewards? If better delivery reduces user frustration, how do you prevent that benefit from being captured by operators who aren’t actually doing the work? This is the real governance question: not “what should we build,” but “what behavior should be profitable after the world changes.”

By late 2025, the project’s own year-in-review leaned into the theme that visibility and adoption arrived alongside token evolution. It pointed to institutional access through the Grayscale Walrus Trust in June 2025, and it also emphasized a deflationary direction for WAL through burning mechanisms tied to network activity. Whether you love token narratives or not, the governance implication is concrete: once burning and penalties exist, parameter choices stop being cosmetic. They shape participant psychology. They decide whether people feel safe committing to long-term behavior, or whether they feel pushed into short-term extraction.

Early January 2026 brought another explicit articulation of the decentralization problem: networks tend to centralize quietly as they grow, unless you design against it. Walrus’ own writing emphasized keeping decision-making distributed, rewarding verifiable reliability rather than reputation, discouraging fast stake movement during sensitive moments, and making accountability real through financial consequences. Even if you ignore the rhetoric, the outline is consistent with the governance philosophy you described: steady calibration, not disruptive change, aimed at preventing volatility that governance itself can cause.

And then reality does what it always does: it gets messy in ways no roadmap can fully predict. One of the clearest “infrastructure moments” recently was the Tusky sunsetting extension, where Walrus support helped extend the timeline to March 19, 2026 for users to retrieve data. This isn’t a marketing story. It’s a stress story. Something external changes. Users feel urgency. Data becomes emotional. And suddenly the promise of “availability” becomes a human deadline with consequences.

Moments like that are where incentive calibration stops being a theory and becomes a kind of ethics. If an ecosystem relies on a storage layer during a migration deadline, reliability isn’t a nice-to-have. It’s the difference between a calm exit and a damaging scramble. Governance, in this context, is not about winning arguments. It’s about making sure the system rewards the kind of operators who remain steady when everyone else is rushing.

Even the market-facing data tells a story about maturity under constraint. CoinGecko currently lists WAL at around $0.158 with a circulating supply of about 1,577,083,333 and a max supply reference of 5 billion, alongside daily volume in the ~$10M range. Numbers like these don’t prove anything by themselves, but they do signal that WAL is liquid enough for incentives to matter, and visible enough that governance mistakes would be punished socially and financially. That kind of visibility creates a different kind of discipline. It forces governance to avoid theatrics, because theatrics create uncertainty, and uncertainty is the first thing infrastructure cannot afford.

The most important part of all this is that Walrus is building a relationship between data and accountability that doesn’t rely on trust in one party’s goodwill. The project’s own materials frame the network around onchain verification of custody and ongoing rewards tied to sustained fulfillment of obligations, with future penalties for failures. You don’t have to memorize the mechanism names to understand the human meaning: the network is trying to make it emotionally safer to depend on data you cannot personally babysit.

And that’s what incentive calibration is really doing over time. It’s translating messy reality into disciplined economics. It’s accepting that participants will disagree, that operators will vary in quality, that users will panic when deadlines appear, and that markets will tempt people into shortcuts. Then it quietly adjusts the cost of shortcuts until the network trains itself out of fragility.

If you live inside Walrus long enough, you stop looking for a single moment where governance “proves itself.” Instead you notice the absence of sudden shocks that governance caused. You notice that expectations stay stable even while parameters evolve. You notice that the system gets stricter in the places where failure hurts most, and gentler where experimentation needs room. That is what effective governance feels like when it’s working: not loud, not performative, just consistently protective.

In the end, Walrus governance influence on WAL incentive calibration isn’t a headline. It’s a posture. It’s the choice to treat reliability as something you cultivate slowly, through compounding decisions, rather than something you announce once and hope becomes true. WAL becomes the medium through which that posture touches human behavior, nudging participants toward consistency when inconsistency would be easier. Quiet responsibility is not glamorous, but it is what lets invisible infrastructure hold steady while everything above it argues, rushes, and breaks. And in systems that people depend on, reliability will always matter more than attention.