I still remember the first time I tried to explain tokenized bonds to a friend who trades traditional fixed income. He didn’t argue about the technology. He asked a more practical question: “So who makes sure the buyer is allowed to hold it, the issuer follows the rules, and regulators can audit it when needed?” That question is exactly why regulated tokenization has moved slower than DeFi. In real markets, “on-chain” doesn’t matter if the asset can’t legally travel.

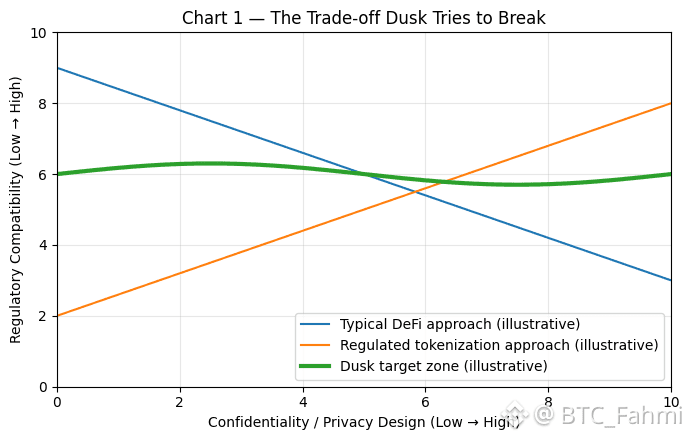

This is the gap Dusk Network has been built for since 2018: tokenization that keeps financial data confidential without breaking compliance. The core idea is simple, but difficult in execution—make it possible to issue and trade regulated instruments (like tokenized bonds, equities, funds, and stablecoin-like cash instruments) in a way that preserves privacy for market participants while still giving institutions and regulators the controls they require. Dusk’s positioning is not “privacy at all costs.” It’s selective privacy with auditability, designed for real financial workflows.

To understand why this matters, think about how bonds actually trade. There’s identity verification (KYC), eligibility constraints (who can buy), transfer restrictions, corporate actions (coupon payments), and reporting. These are not optional extras they’re the product. If tokenization ignores these constraints, the asset might move faster, but it becomes non compliant and unusable for serious issuers. That’s why tokenized bonds in a regulated context need more than a smart contract. They need a compliant lifecycle.

Dusk’s approach revolves around what it calls confidential smart contracts smart contracts designed to keep sensitive transaction details hidden while still allowing correctness to be proven cryptographically. The practical win is that you can run regulated finance logic on-chain without exposing every balance, trade size, identity attribute, or counterpart relationship to the public internet. That privacy is not just personal preference. For institutions, it’s market structure. In traditional finance, order books, dealer inventories, and client flows are protected for a reason. If everything is visible, market participants change behavior, and the market itself degrades.

But privacy alone isn’t enough. The “regulated tokenization” piece lives in the way Dusk tries to embed identity and compliance directly into token standards and transaction flows. Dusk has described mechanisms aimed at digital identity and compliance-aware security tokens (often discussed under its RWA / security token narrative). The takeaway for investors is not the branding it’s the direction: issuers must be able to enforce who can hold the asset, under what conditions it can transfer, and how reporting can be satisfied.

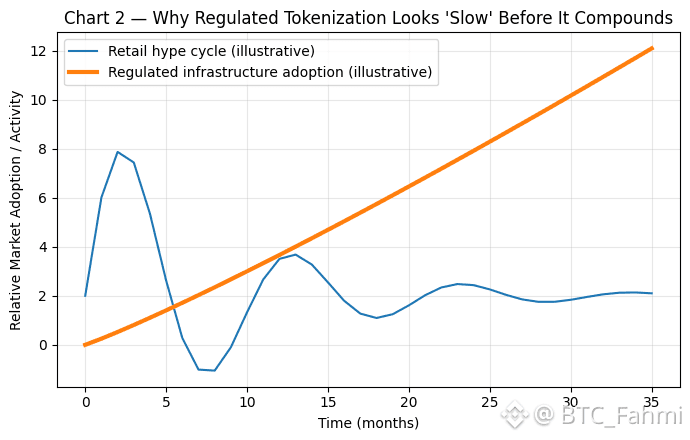

The most convincing part of Dusk’s story, in my view, is not theoretical. It’s who they are aligning with. In April 2025, Dusk announced work with 21X, described as the first company to receive a DLT-TSS license under European regulation for a fully tokenized securities market. Whether someone is bullish or bearish on Dusk as a token, that direction matters: it signals that the project is trying to plug into the regulated issuance and trading world rather than competing for retail DeFi attention.

Dusk has also pointed to its partnership with NPEX, a Dutch exchange ecosystem, emphasizing that this isn’t simply a “crypto integration.” It’s framed around regulated market infrastructure and licensing alignment, including references to MTF, Broker, ECSP and future DLT-TSS positioning. If these pieces are real and sustained, that’s a different category of adoption than chasing liquidity incentives.

So where do stablecoins fit into “bonds to stablecoins”?

Stablecoins are often treated like a separate universe payments, remittances, crypto rails. But in a regulated tokenization roadmap, stablecoins (or tokenized cash equivalents) become the settlement layer for everything else. If tokenized bonds and tokenized equities are the instruments, then compliant stablecoins are the “cash leg” that makes Delivery-versus-Payment possible at scale. This is where Dusk’s confidentiality angle becomes more important than people initially think. In institutional settlement, hiding counterparty exposure and settlement flows is not a luxury it’s part of risk management.

A useful mental model is: tokenized bonds are “regulated value,” and stablecoins are “regulated movement.” Without the movement layer, tokenization remains mostly a demo. With it, tokenization becomes a market.

There’s another layer here: data integrity. Regulated markets depend on reference data, prices, corporate event info, and verifiable reporting. In late 2025, Dusk and NPEX announced adoption of Chainlink interoperability and data tooling, with language focused on “regulatory grade financial information.” That kind of integration suggests a push toward institutional standards: not just tokenization, but tokenization that can be priced, verified, reported, and audited with credible data feeds.

For traders and investors, the trend is pretty clear entering 2026 the RWA narrative has matured. It’s not just tokenized treasuries in a few DeFi pools anymore. There’s growing seriousness around regulated market venues, licensing regimes, and compliant issuance pipelines. Dusk’s unique angle is that it’s trying to combine that regulated direction with confidentiality-by-design, instead of retrofitting privacy later. That matters because in real capital markets, transparency is controlled, not absolute.

My neutral take: this is a slower game, and that’s both the risk and the signal. Regulated tokenization doesn’t move at meme speed. It requires legal alignment, institutional trust, and infrastructure reliability. If Dusk succeeds, it won’t look like a sudden explosion it will look like a gradual increase in real issuers, real settlement activity, and real market participants. If it fails, it will likely fail quietly: institutions just won’t adopt it, and liquidity will drift elsewhere.

But the direction itself building rails where bonds, equities, and cash-like stablecoin settlement can exist together under compliance matches where the most durable adoption seems to be heading. And in crypto, durability is rare enough that it’s worth paying attention when a project chooses the boring path on purpose.

Artigo

From Tokenized Bonds to Stablecoin Settlement: Why Dusk Built for Regulated Markets

BTC_Fahmi

--

Aviso Legal: inclui opiniões de terceiros. Não se trata de aconselhamento financeiro. Poderá incluir conteúdos patrocinados. Consulta os Termos e Condições.

DUSK

0.1946

+32.83%

87

7

Fica a saber as últimas notícias sobre criptomoedas

⚡️ Participa nas mais recentes discussões sobre criptomoedas

💬 Interage com os teus criadores preferidos

👍 Desfruta de conteúdos que sejam do teu interesse

E-mail/Número de telefone