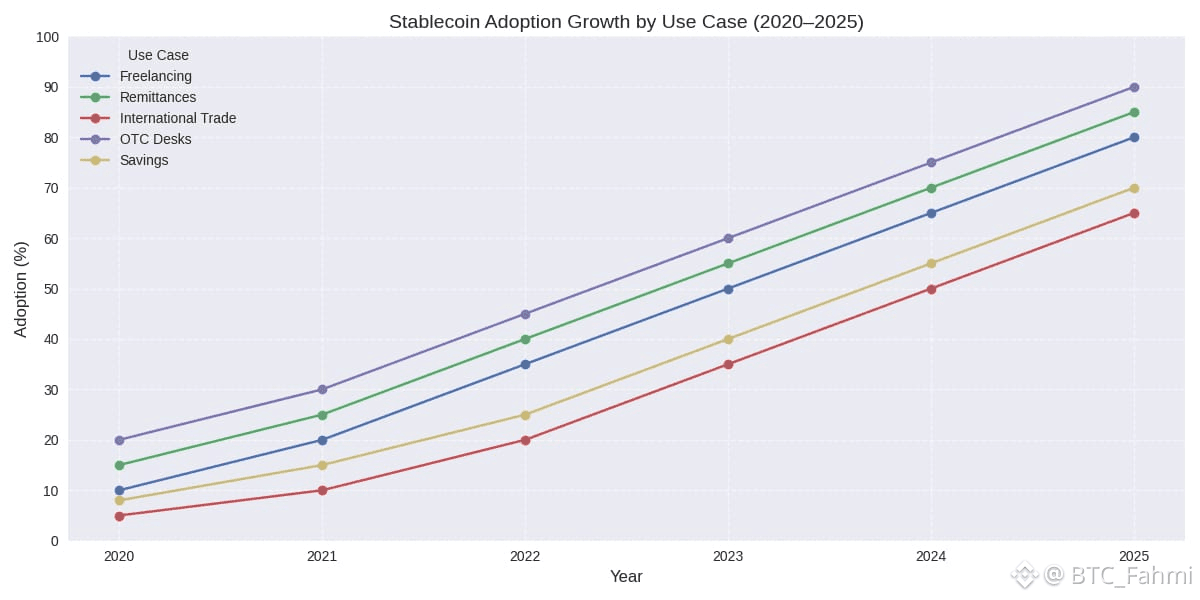

Most traders don’t wake up thinking about payment infrastructure. Price is loud, narratives are loud, and attention usually follows whatever is volatile. But stablecoins quietly changed the real-world use case of crypto long before most people admitted it. You can see it in freelancing, remittances, international trade, OTC desks, and even everyday savings behavior in countries where local currency feels unstable. People aren’t using stablecoins because they love blockchain. They use them because digital dollars move faster than banks, reach further than cards, and work at hours when the traditional system is closed.

That demand creates a simple question: if stablecoins are the product, why are they still forced to run on general purpose blockchains that were never designed for payments?

That’s the context Plasma is built around.

Plasma positions itself as a Layer-1 designed specifically for stablecoins and global payments, with USD₮ (Tether) as the core focus from day one. Instead of treating stablecoin transfers as just another transaction type competing with meme coin trading, NFTs, and on-chain games, Plasma’s design philosophy is that payments should not be a side quest. They should be the chain’s primary job. Plasma describes itself as a high-performance Layer 1 built for USD₮ payments “at global scale,” emphasizing near-instant settlement, low fees, and full EVM compatibility.

For investors, the important part isn’t the marketing line. It’s the implication: a payment chain is judged less by “how many apps launched” and more by whether it can handle repetitive, high-volume, low-margin money movement reliably. That’s a very different battlefield than the usual L1 race.

The biggest user-experience problem in stablecoins is also the most overlooked: gas. Most blockchains require users to hold a separate volatile token to move their stablecoin. In theory that’s normal crypto design. In reality it breaks the payment story at the exact moment it tries to become mainstream. Imagine sending someone $20 in USDT and then being told they also need to buy another coin first just to move it. For traders that’s trivial. For normal users it’s a deal-breaker.

Plasma tackles that problem directly with stablecoin-native mechanics. The chain supports gasless stablecoin transfers through a relayer/paymaster-style system, scoped specifically to direct USD₮ transfers, so the user can move stablecoins without thinking about gas tokens or fee management in the typical crypto way. That “gasless” detail sounds like product design, but it’s actually strategic infrastructure: it removes friction, reduces failed transactions, and makes stablecoin payments feel closer to how money should behave.

From a market structure perspective, that also changes onboarding economics. When fees and gas confusion disappear, stablecoins become easier to integrate into consumer apps, merchant checkouts, payroll systems, and remittance products. This is where Plasma’s “global payments” claim becomes more than branding, because payments don’t scale through enthusiasts. They scale through reduced friction.

Another key angle is compatibility. Plasma is EVM compatible, meaning developers can deploy with familiar Ethereum tooling and wallets rather than learning a brand new stack. In practical terms, Plasma isn’t asking builders to bet their careers on a niche environment. It’s asking them to bring payment applications into an environment optimized for what stablecoins actually do best.

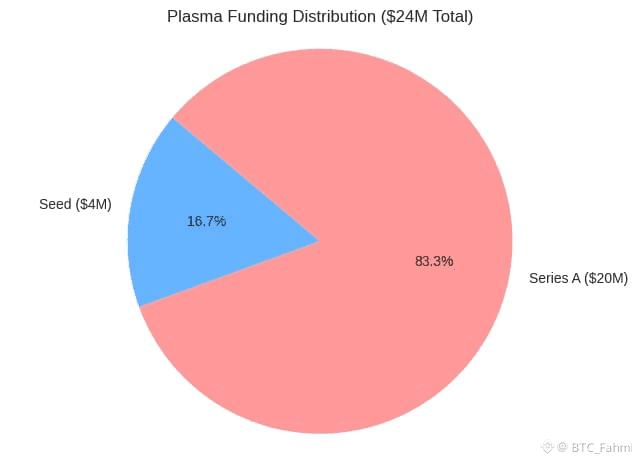

There’s also an institutional thread running through Plasma’s story. Not every “payments chain” is built with serious participants in mind, but Plasma’s public disclosures around funding show a mix of crypto-native investors and market makers. In February 2025, Plasma announced it had raised $24M across Seed and Series A led by Framework Ventures and Bitfinex/USD₮0, with participants including Cumberland (DRW), Flow Traders, IMC, Nomura, Bybit, and others, plus named angels such as Paolo Ardoino and Peter Thiel. CoinDesk also covered Plasma’s raise around the same time, describing a $20M Series A led by Framework following a $4M seed.

This matters because payments infrastructure isn’t only a technology problem. It’s also a liquidity and trust problem. Stablecoin movement at scale requires deep rails: market makers, exchange integrations, custody support, and credible partners who care about uptime more than hype.

What’s happening in the broader market supports the thesis that “stablecoins as payments” is not niche anymore. Major fintechs have been moving toward stablecoin experiments explicitly for cross-border efficiency. For example, the Financial Times reported Klarna launching a payment stablecoin (KlarnaUSD) to reduce cross-border costs, pointing to the reality that even large consumer fintechs now see stablecoins as a cost cutting tool rather than a speculative toy. When fintechs start copying crypto rails, it’s usually a sign that the old rails are too expensive and too slow for modern commerce.

On a personal level, I think the best way to understand Plasma is to imagine a very normal situation: you’re paying a supplier in another country, or receiving income from a foreign client, or sending money to family abroad. Today, the cheapest option is often still a painful compromise: bank wires are slow and expensive, card networks don’t work for direct transfers, and local remittance services take hidden spreads. Stablecoins already solved the “digital dollar teleportation” part. What hasn’t been fully solved is making that experience feel natural and safe for everyone, every time.

If Plasma succeeds, it won’t be because it created the next hot DeFi ecosystem. It will be because it quietly makes stablecoins behave like actual money rails: fast settlement, predictable cost, minimal friction, easy integration, and reliability under load.

For traders and investors, Plasma is a bet on a specific vision of crypto’s future: not “everything on-chain,” but money movement on-chain at scale. The upside is straightforward: if stablecoins continue becoming a default tool for payments, the chains designed around that flow could become critical infrastructure. The risk is also straightforward: payments is a brutal arena, where user acquisition is expensive, compliance is unavoidable, and trust is earned slowly.

But even with those risks, Plasma represents a mature shift in crypto thinking. It’s not asking, “what can we tokenize next?” It’s asking a more serious question: if stablecoins are already global digital dollars, what should the base layer look like when the world starts treating them that way?