One of the most overlooked drivers of short-term Bitcoin price behavior is option Gamma exposure (GEX). At its core, GEX answers a critical question: when BTC moves, do option market makers counteract the move or amplify it?

Market makers are not directional traders. Their edge comes from spreads and liquidity provision. However, once they sell or buy options, they become exposed to Delta and Gamma risk. As price changes, Delta changes instantly this sensitivity is Gamma. To remain market-neutral, market makers must hedge continuously by buying or selling BTC in spot or futures markets.

In a Long Gamma environment, the hedging behavior is stabilizing. When price drops, market makers are forced to buy BTC. When price rises, they sell BTC. This creates what traders often call Gamma gravity — price is naturally pulled back toward key levels, reducing volatility.

In contrast, a Short Gamma environment flips this dynamic entirely. Here, market makers must sell as price falls and buy as price rises. Instead of absorbing volatility, they magnify it. Price moves accelerate once these zones are entered.

Looking at the January 30 options expiry, three major Gamma clusters stand out. The $88,000 and $90,000 levels sit firmly in Long Gamma territory, with GEX values around $628M and $1.2B respectively. These zones act as powerful short-term stabilizers effectively “super Gamma pin levels” that are difficult to break without sustained pressure.

Above them, $92,000 represents a notable Short Gamma zone, carrying approximately -$622M GEX. Once price enters this area, the hedging behavior shifts from resistance to momentum. If acceptance occurs, upside acceleration becomes likely. If rejected, price is rapidly drawn back toward the Long Gamma zones below.

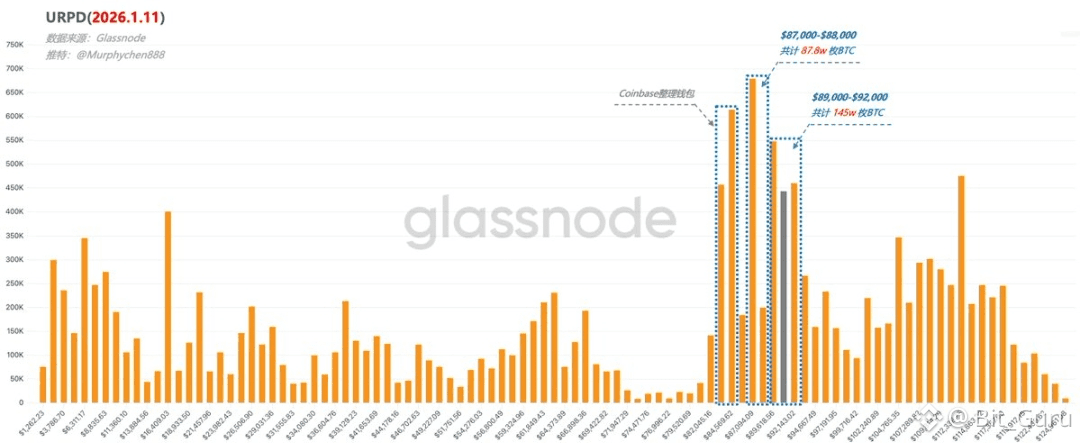

When this Gamma structure is combined with URPD (UTXO Realized Price Distribution) data, the deeper market logic becomes clear. Capital flow shapes position concentration, position concentration forms support and resistance, and these levels ultimately guide market direction.

The frequent turnover observed in short-term positions is not random speculation or internal transfers. It is a structural necessity driven by hedging mechanics. From both a funding-flow and position-structure perspective, downside risk remains limited in the near term, while upside resistance is comparatively thin requiring only time and a catalyst for momentum to expand.