BNB was launched in 2017 as the native token of the Binance ecosystem, at a time when crypto was still experimental, expensive, and difficult for everyday users. In its earliest form, BNB existed as an ERC-20 token on Ethereum, designed with a very practical purpose: reduce trading fees and make participation in crypto more affordable. There was no grand ideology attached to it — just efficiency, accessibility, and utility.

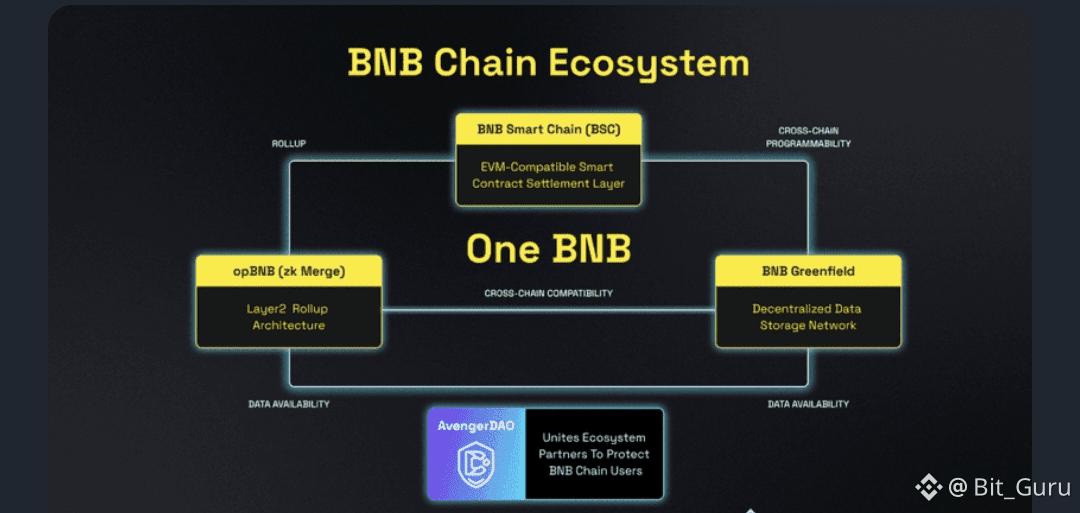

As the ecosystem evolved, BNB migrated off Ethereum and onto its own infrastructure, eventually becoming the backbone of what we now call BNB Chain, including BNB Smart Chain. Built to be EVM-compatible, fast, and cost-efficient, the network adopted a Proof of Staked Authority (PoSA) model — a pragmatic balance that favors speed and affordability over maximal decentralization. This decision shaped everything that followed.

Why this matters to people is simple: BNB lowered the barrier to entry. High gas fees price users out of experimentation. BNB made DeFi, NFTs, gaming, and on-chain payments usable for ordinary people. Transactions that cost tens or hundreds of dollars elsewhere could be executed for cents. Fast confirmations made applications feel usable, not theoretical. Developers could deploy, test, and scale without massive upfront capital.

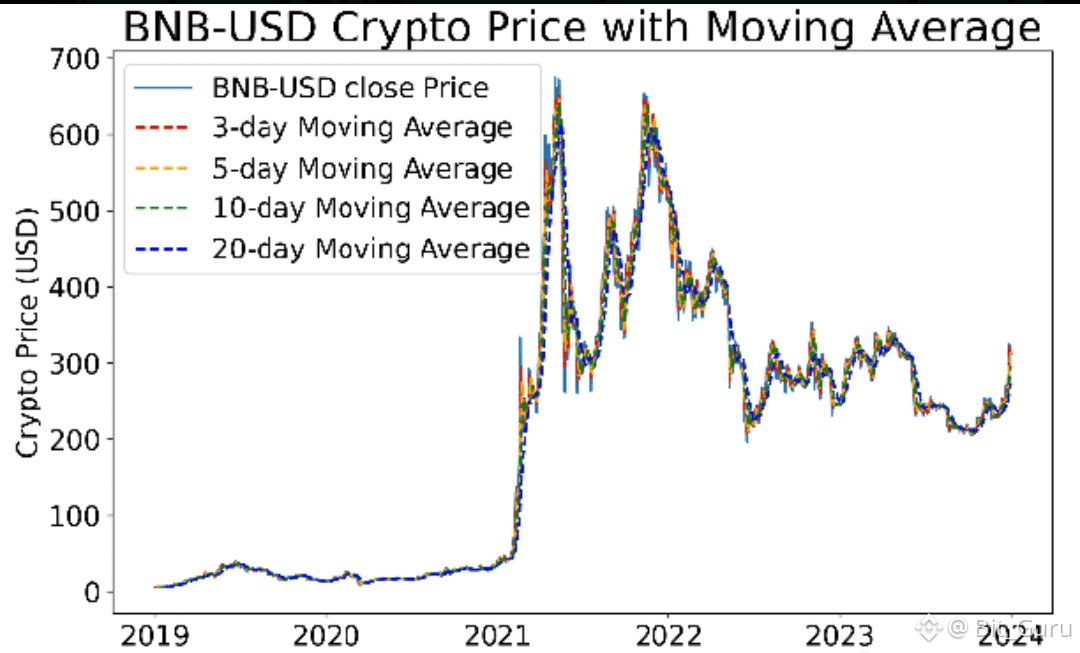

The growth of BNB followed a clear arc. From 2017 to 2018, it served as a fee-reduction tool tied closely to Binance. Between 2019 and 2020, infrastructure expanded and developers began experimenting. In 2021, BNB Smart Chain exploded in real usage as DeFi, GameFi, and NFTs found a home where fees didn’t kill participation. During the 2022–2023 bear market, weaker ecosystems faded — BNB endured. By 2024–2025, the chain matured into robust infrastructure, and today in 2026, BNB stands as a widely used, deeply integrated utility asset.

BNB’s strength isn’t marketing — it’s operational reality. Ultra-low fees enable real usage. High throughput supports consumer-grade applications. EVM compatibility removes developer friction. Deflationary burns align long-term token economics. A deeply integrated ecosystem compounds utility with every new wallet, bridge, marketplace, or application.

If Bitcoin introduced digital scarcity, BNB represents digital infrastructure. It is not trying to replace Bitcoin, nor does it need to. Its value comes from being embedded in everyday blockchain activity — powering transactions, applications, and onboarding at scale. These opportunities don’t appear often, and when they do, they reward understanding over hype.

BNB isn’t an idea. It’s an engine. For those who position with knowledge, discipline, and long-term perspective, it represents one of the most practical assets in the modern crypto economy.