Introduction: The Convergence of Two Worlds

The blockchain industry stands at a critical inflection point. On one side lies the original ethos of decentralization and permissionless innovation. On the other stands the multi-trillion-dollar world of traditional finance, governed by stringent regulations and demanding privacy, compliance, and institutional-grade security. Bridging this divide is perhaps the most significant challenge—and opportunity—facing the sector today. Enter Dusk Network, a pioneering Layer-1 blockchain protocol not seeking to replace traditional finance, but to upgrade its infrastructure for a new digital era. At the heart of this mission is its native token, $DUSK, which powers a unique ecosystem designed for the secure, compliant, and private tokenization of real-world assets (RWAs). This article delves into the technology, vision, and potential of Dusk Network, positioning it as a cornerstone of the coming financial revolution.

Beyond Speculation: A Protocol with Purpose

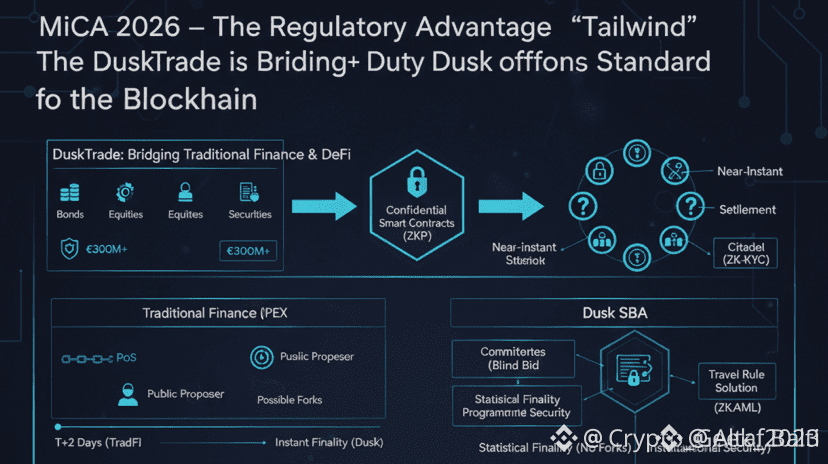

While many blockchain projects chase fleeting trends, Dusk Network is built to solve a concrete, complex problem: how can securities be issued, traded, and managed on a public blockchain while fully complying with global financial regulations like MiFID II and the EU's MiCA framework? The answer lies in its core design principle: privacy-by-default through zero-knowledge cryptography.

Unlike fully transparent chains like Ethereum, where every transaction detail is public, Dusk allows for confidential transactions and selective disclosure. This means an institution can tokenize a bond or equity, prove regulatory compliance to authorities, and keep sensitive trading data private from competitors—all on the same public ledger. This technological leap is achieved through Dusk's innovative Zero-Knowledge Proof (ZKP) system, specifically the PLONK proof system, which allows for efficient, confidential smart contracts.

The Technical Backbone: SBA & Citadel

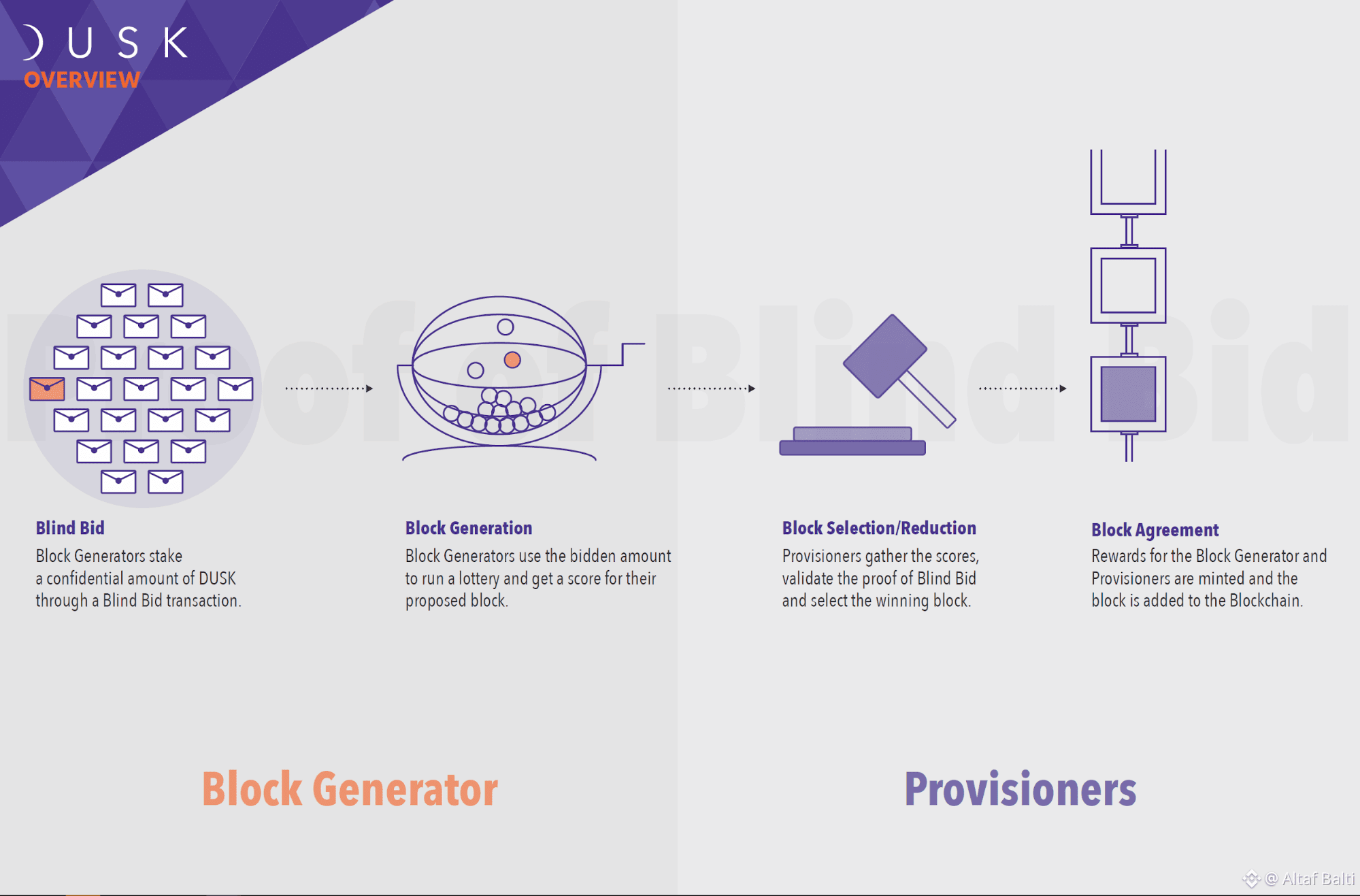

Dusk's architecture rests on two groundbreaking components:

1. The Segregated Byzantine Agreement (SBA) Consensus: This proprietary consensus mechanism is the engine of the network. It is designed for high throughput, finality, and energy efficiency. SBA separates the process of block production from validation, allowing the network to scale securely while enabling thousands of nodes to participate through a unique staking model. This ensures the network remains decentralized and robust, a non-negotiable requirement for institutional trust.

2. The Citadel Protocol: This is Dusk's regulatory gateway. Citadel is a privacy-preserving Know Your Customer (KYC) and Accredited Investor verification framework. It allows users to obtain a zero-knowledge certificate from a licensed provider, proving they are compliant without ever revealing their personal identity on-chain. This "passport" can then be used to access regulated DeFi applications and security token offerings (STOs) across the Dusk ecosystem. Citadel doesn't just bolt compliance onto the chain; it bakes it directly into the protocol's access layer.

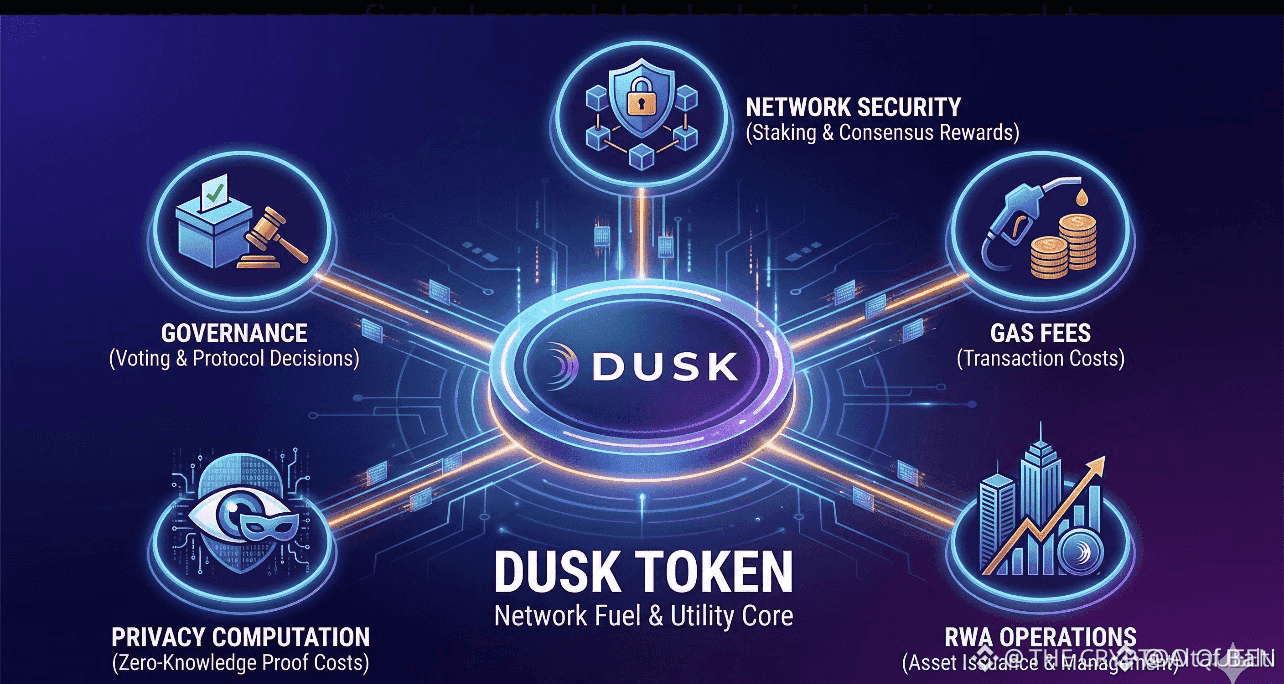

The dusk Token: More Than Just a Coin

The dusk token is the essential utility and governance key to this entire ecosystem. Its functions are multifaceted:

· Staking and Network Security: Participants stake dusk to operate a node within the SBA consensus, earning rewards for securing the network. This staking model is designed to be accessible, with a relatively low minimum threshold.

· Transaction Fuel: All computations, smart contract executions, and asset settlements on the network require $DUSK to pay for gas fees.

· Settlement Asset: dusk acts as the primary medium of exchange and settlement for transaction fees and services within applications built on Dusk.

· Governance: Token holders will have the right to participate in the future governance of the protocol, voting on key upgrades and treasury management.

The tokenomics are designed for long-term sustainability. With a fixed total supply of 1 billion tokens, emissions are carefully scheduled over decades, rewarding early stakers and network builders while mitigating inflationary pressure.

From Theory to Practice: Real-World Applications and Partnerships

Dusk's vision is already moving from whitepaper to reality through strategic partnerships:

· Tokenized Securities with NPEX: A landmark partnership with NPEX, a regulated Dutch stock exchange, aims to migrate over €200 million in listed securities onto the Dusk blockchain. This will create a fully compliant secondary market for these tokenized assets, demonstrating Dusk's core use case in a live, regulated environment.

· Institutional Custody and EURQ Stablecoin: Collaboration with Quantoz leverages their MiCA-ready custody solution and their Euro-pegged stablecoin, EURQ. This provides the essential fiat on-ramp/off-ramp and secure, regulated custody that institutional players require.

· Oracle Infrastructure with Chainlink:

The integration of Chainlink's industry-standard oracles ensures that smart contracts on Dusk can securely and reliably interact with real-world data and price feeds, a critical component for complex financial instruments.

These partnerships validate Dusk's "compliance-first" approach and provide a clear pipeline for real-world usage and value accrual to the $DUSK token.

Opportunities and the Road Ahead

The potential for Dusk Network is intrinsically tied to the explosive growth forecast for the RWA tokenization market, projected to reach into the tens of trillions of dollars over the next decade. Dusk's first-mover advantage in providing a specialized, compliant layer for this activity is significant.

The near-term roadmap is focused on accelerating adoption:

1. Mainnet Scalability: Continued optimization of the mainnet for higher throughput.

2. Ecosystem Grants: Funding and supporting developers to build the next generation of confidential DeFi (PriFi) applications, from lending protocols to decentralized exchanges, on Dusk.

3. Regulatory Expansion: Deepening compliance frameworks to meet requirements in key jurisdictions beyond Europe.

However, challenges remain. The project must successfully execute its technical roadmap, navigate an ever-evolving global regulatory landscape, and outpace growing competition from other chains eyeing the RWA sector.

Conclusion: A Strategic Bet on the Future of Finance

Dusk Network ($DUSK) represents a profound thesis: that the future of finance is not a war between traditional and decentralized systems, but a synthesis powered by blockchain technology that respects the rules of the old world while unlocking the efficiencies of the new. It is not merely a cryptocurrency for speculation; it is a digital utility token for a new financial infrastructure.

For investors and observers, Dusk offers exposure to the high-conviction narrative of institutional blockchain adoption through a protocol built with that explicit purpose from the ground up. Its success will not be measured in short-term price spikes, but in the volume of real-world assets settled on its chain and the fidelity of its institutional partnerships. In the grand architecture of tomorrow's financial system, Dusk Network is positioning itself not as a decorative feature, but as a foundational load-bearing wall. As the race to tokenize the world's assets accelerates, Dusk, with its blend of privacy, compliance, and robust technology, is uniquely equipped to be at the forefront.@Dusk #dusk $DUSK