In the critical infrastructure race underpinning Web3, decentralized data storage has emerged as a foundational battleground. While early pioneers proved the concept possible, the industry now demands solutions that are not just decentralized, but also scalable, cost-effective, and seamlessly programmable. The Walrus Protocol, built on the high-performance Sui blockchain, represents a decisive engineering-led response to this demand. Moving beyond the binary choices imposed by earlier models, Walrus leverages a breakthrough in storage mathematics—the RedStuff engine—to deliver a uniquely flexible and efficient data layer. With elite institutional backing exceeding $140 million and rapid adoption by over 120 leading projects, Walrus is strategically positioned to become the indispensable data backbone for dynamic applications, autonomous AI, and the next generation of digital ownership. This analysis delves into the protocol's technological differentiation, its sophisticated economic model, and its pivotal role in transitioning Web3 from theoretical promise to practical, user-centric reality.

1. The Infrastructure Gap: Why Web3 Needs a New Storage Primitive

The vision of a verifiable, user-owned internet stumbles without a reliable and agile data layer. First-generation decentralized storage networks, such as Filecoin and Arweave, provided groundbreaking proof of concepts but exposed critical limitations for mainstream development. Filecoin’s deal-based market, while innovative, can introduce complexity and unpredictable retrieval costs, creating friction for applications requiring frequent data access. Conversely, Arweave’s permanent storage model, though ideal for archival, is fundamentally mismatched with the mutable state requirements of gaming, social media, or evolving financial records.

This creates a stark infrastructure gap. Developers are forced to choose between permanence and practicality, often sacrificing performance or incurring prohibitive costs. The Walrus Protocol was conceived explicitly to fill this gap. It aims to provide a storage experience analogous to enterprise cloud services—predictable, low-latency, and cost-efficient—but built on decentralized principles. This vision attracted a formidable $140 million private funding round co-led by Standard Crypto and Electric Capital, with participation from Andreessen Horowitz (a16z) and a notable strategic investment from global asset manager Franklin Templeton, signaling powerful institutional confidence in its architectural thesis.

2. Core Innovation: The RedStuff Engine and Engineering Superiority

Walrus’s competitive moat is rooted in deep technical innovation, primarily its proprietary RedStuff engine. To appreciate its advancement, one must understand the inefficiencies of traditional erasure coding. Standard one-dimensional schemes, while space-efficient, can require reconstructing an entire dataset from widely distributed fragments if a node fails, leading to massive bandwidth consumption and slow recovery.

RedStuff introduces a novel two-dimensional matrix approach. Data is encoded into a grid of "slivers," where any intersecting row and column can facilitate reconstruction. This architecture enables Byzantine fault tolerance—data remains secure and recoverable even with the simultaneous failure of a majority of network nodes—while achieving an unprecedented storage replication factor of just 4x to 5x. Compared to the 10x-30x overhead required by less advanced networks for similar security guarantees, RedStuff’s efficiency is transformative. It directly translates to lower costs for end-users, faster and more reliable data retrieval, and a sustainable economic model capable of scaling to exabyte-level demand without exponential cost increases.

3. The WAL Token Economy: Aligning Incentives and Unlocking Liquidity

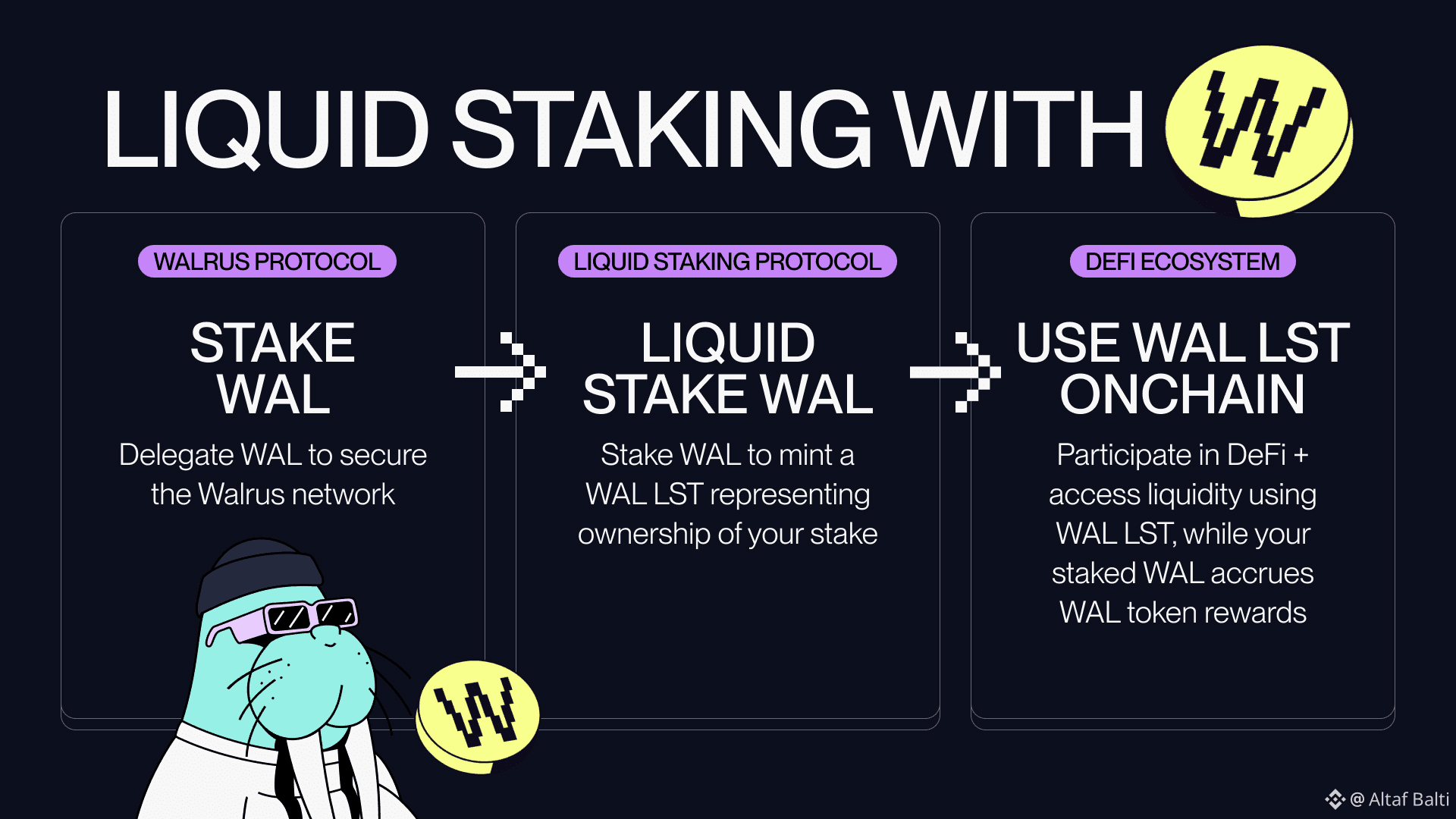

The WAL token is the cryptographic instrument that harmonizes the protocol's ecosystem. Its multifaceted design ensures all participants are incentivized toward network health and growth:

· Medium of Exchange: All storage and computation fees are payable in WAL, creating continuous, utility-driven demand anchored to real network usage.

· Security Collateral: Node operators ("Sealers") must stake WAL to provide storage resources. This stake is subject to slashing for provable misconduct, guaranteeing service reliability and aligning operator behavior with long-term network integrity.

· Governance Right: WAL confers voting power on protocol upgrades and treasury management, progressively decentralizing control over the network's future.

A pivotal development within the ecosystem is the advent of liquid staking derivatives (LSDs). Through partners like Haedal and Winter Walrus, users can stake WAL and receive a liquid token (e.g., haWAL) in return. This derivative can be deployed across Sui’s DeFi landscape—for lending, liquidity provision, or collateral—while the underlying WAL continues to earn staking rewards and secure the network. This mechanism elegantly solves the capital opportunity cost problem, enhancing investor yield and strengthening the network’s security staking base.

4. Strategic Market Positioning and Competitive Analysis

Walrus does not seek to be a monolithic replacement for all storage needs; instead, it strategically dominates the niche for dynamic, performance-sensitive data.

· Versus Filecoin: Walrus competes on simplicity and performance. It abstracts away complex storage deals, offering a unified, API-friendly interface with consistently low retrieval latency and cost, making it superior for active dApps and interactive media.

· Versus Arweave: Walrus’s defining advantage is programmable mutability. It supports secure data updates and deletions—a non-negotiable requirement for applications like games (player states), social feeds, and AI (model parameters). This positions it as the storage layer for the living, breathing internet, not just its permanent archive.

Its native integration with the Sui blockchain is a masterstroke. It enables "programmable storage," where smart contract logic can autonomously manage data lifecycles. For instance, an NFT’s metadata can be updated by a game contract, or an AI agent’s memory can be stored and verified on-chain, unlocking previously impossible application designs.

5. Ecosystem Traction: From Theory to Live Adoption

Technology alone does not guarantee success; adoption does. Walrus has demonstrated remarkable early traction, with its mainnet hosting over 120 live projects. This ecosystem validates its utility across high-growth verticals:

· AI and Autonomous Agents: Serving as the verifiable memory layer for platforms like FLock.io (decentralized AI training) and elizaOS, where agents require persistent, mutable state.

· Gaming and Dynamic NFTs: Adopted by flagship Sui NFT projects including Pudgy Penguins and Claynosaurz, and integrated by the leading Sui marketplace TradePort for scalable metadata solutions.

· Institutional Validation: The involvement of Franklin Templeton transcends mere investment; it represents a bridge between traditional finance and decentralized infrastructure, exploring use cases in verifiable audit trails and asset tokenization.

6. Risk Assessment and Forward Trajectory

A professional analysis must account for headwinds. Walrus operates in a competitive arena against well-established, well-funded incumbents. Its early success is correlated with the growth of the Sui ecosystem, presenting both a synergistic opportunity and a potential concentration risk. The protocol’s tokenomics, while well-designed, will face their first major test during the scheduled investor token unlocks beginning in March 2026, which will require robust market demand to absorb new supply smoothly.

The project’s roadmap correctly focuses on core infrastructure: enhancing the RedStuff engine, expanding the Seal framework for granular access control and private data, and pursuing strategic multi-chain expansions. The long-term vision is clear: to evolve from a Sui-optimized service into the default programmable data availability layer for a multi-chain Web3.

7. Conclusion: Building the Bedrock

The Walrus Protocol transcends the category of a mere "storage coin." It is a critical piece of infrastructure engineering that addresses a fundamental bottleneck in Web3’s evolution. By combining the mathematical elegance of RedStuff with a thoughtful token economy and strategic market focus, Walrus delivers a data layer that is not only decentralized but also superior in key performance metrics to legacy alternatives. It enables the dynamic, user-owned applications that define Web3’s promise. As the industry matures from speculative fascination to utility-driven adoption, protocols like Walrus that provide essential, robust, and elegantly designed infrastructure will form the unshakable bedrock upon which the future digital economy is built. Its journey is a compelling case study in how deep technical innovation, when paired with clear market vision can create foundational public goods.