The evolution of blockchain technology is approaching a critical inflection point. Beyond the speculative fervor lies a monumental challenge: how to integrate the multi-trillion-dollar world of regulated, institutional finance with the efficiency and transparency of decentralized systems. This integration demands more than just a faster blockchain; it requires a fundamental rethinking of privacy, compliance, and settlement for professional use cases. Stepping into this breach is Dusk Network, a Layer-1 protocol not built for memecoins, but engineered as the foundational infrastructure for a new era of regulated, private finance.

While other projects chase fleeting trends, Dusk has carved out a singular, ambitious mission: to unlock economic inclusion by bringing institution-level assets to anyone's wallet. Its thesis is simple yet profound—for real-world finance to move on-chain, it must meet the non-negotiable standards of the old world: confidentiality for trading strategies, ironclad regulatory compliance, and instant, final settlement. Dusk isn't just another smart contract platform; it is a purpose-built financial rail designed to bridge two worlds without compromise.

Core Architecture: Privacy and Compliance by Protocol Design

Dusk’s technical architecture is its most compelling argument. It moves beyond the "everything is public" model of early blockchains by embedding zero-knowledge cryptography directly into its protocol layer. This allows for a revolutionary dual approach: transactions can be completely confidential, shielding balances and counterparty details, yet remain fully auditable and transparent to authorized regulators when required.

This is achieved through its unique two-layer modular design:

· DuskDS (Data & Settlement Layer): The bedrock of the network, handling consensus, data availability, and final settlement using its Succinct Attestation proof-of-stake protocol.

· DuskEVM (Execution Layer): An Ethereum Virtual Machine-compatible environment where developers can build using familiar tools like Solidity.

The recently launched DuskEVM mainnet is a game-changer. It allows existing Ethereum applications to port over seamlessly, automatically inheriting Dusk's native privacy features. This solves a major adoption hurdle, enabling projects in DeFi, Real-World Assets (RWA), and beyond to offer compliant privacy without rebuilding from scratch. Innovations like the Hedger module use homomorphic encryption to keep transaction details private from everyone except the involved parties and designated overseers.

The NPEX Partnership: A Blueprint for Regulated DeFi

Technology alone is insufficient. Dusk's strategic masterstroke is its partnership with NPEX, a fully licensed Dutch securities exchange. This collaboration embeds a suite of critical financial licenses—including Multilateral Trading Facility (MTF) and Broker licenses—directly into the protocol's legal framework.

What this partnership unlocks:

· Native Tokenization of Regulated Assets: NPEX is working to bring over €300 million in traditional securities (like equities and bonds) onto the Dusk blockchain.

· A Fully Licensed dApp (DuskTrade): This creates a regulated secondary market for trading these tokenized assets, a real-world application moving beyond theory.

· Protocol-Level Compliance: Unlike other networks where compliance is bolted onto individual applications, on Dusk it is woven into the fabric of the network itself. This enables "composable compliance," where licensed assets and applications can safely interact.

By integrating with regulated custodians like Cordial Systems, Dusk provides the institutional-grade custody solutions that banks and asset managers require, completing the end-to-end infrastructure for traditional finance.

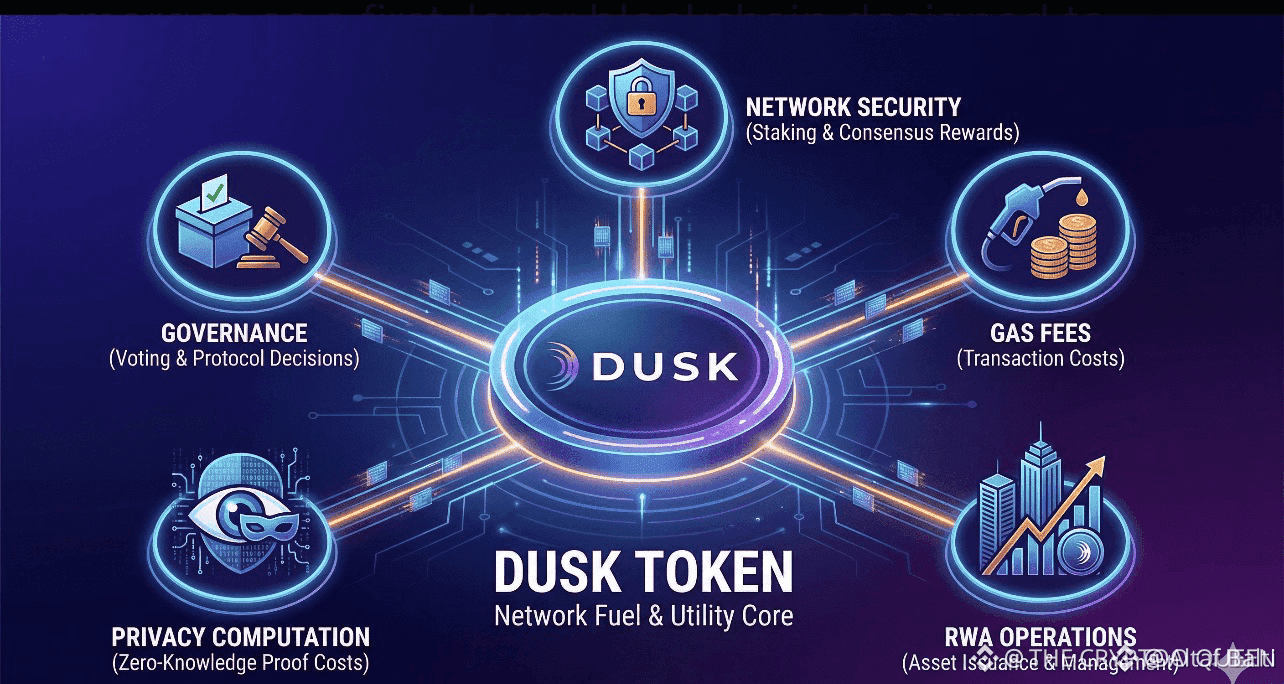

The DUSK Token: Fueling the Financial Ecosystem

The native DUSK token is the utility and governance heart of this ecosystem. Its role is multifaceted and directly tied to network usage:

Primary Utilities:

· Network Security & Staking: DUSK is staked by validators to secure the Succinct Attestation consensus mechanism.

· Transaction Fees (Gas): DUSK is used to pay for all computation and smart contract execution on the DuskEVM layer.

· Governance: Token holders will guide the future development and parameters of the protocol.

· Settlement Medium: It acts as the medium of exchange for fees and services within the Dusk economy.

Market Position and Technical Outlook

Entering 2026, Dusk Network is at a pivotal juncture. The crypto market has taken note of its unique positioning, with DUSK experiencing a significant technical breakout in early January 2026, breaking a multi-month downtrend on substantial volume. Analysts attribute this to growing recognition of its "regulated DeFi" narrative and anticipation around the DuskEVM mainnet launch.

Key Catalysts for 2026:

· Successful DuskEVM Mainnet Adoption: Driving developer activity and liquidity.

· Scale of NPEX Integration: The volume and variety of assets tokenized will be a critical proof point.

· Regulatory Clarity: The full implementation of the EU's MiCA framework plays to Dusk's core strengths as a compliant-ready blockchain.

Conclusion: A Foundation for the Next Financial Era

Dusk Network presents a compelling, high-conviction thesis for the future of finance. It is not merely a speculative asset, but a fundamental bet on the institutional adoption of blockchain technology. By solving the critical triad of privacy, compliance, and efficiency, Dusk is building the indispensable rails upon which tokenized securities, institutional DeFi, and confidential settlements will run.

Its success will be measured not in short-term price swings, but in the tangible volume of real-world assets settled on its chain and the depth of its integration with the established financial system. In a crowded landscape, Dusk’s focused execution on this specialized, high-value niche positions it not as a participant in the race, but as a potential architect of the finish line. As the trillion-dollar movement of assets on-chain accelerates, Dusk Network has strategically placed itself as a foundational pillar of the new financial infrastructure.