SETTLEMENT HAS A COST BEFORE IT HAS A PRICE

There’s a problem that shows up only once finance gets serious on-chain. Not price swings. Not hype cycles. The cost of proving, cleanly and defensibly, that something actually settled. Once. Under rules that an auditor can look at later without a long explanation attached.

On Dusk, that proof isn’t a document or a reconciliation file. It’s the moment DuskDS finalizes a block. That’s it. And once you see settlement that way, it becomes hard to ignore what that implies for how DUSK itself behaves when real asset volume starts to matter.

Dusk never tried to be a chain where activity is driven by mood. Every transaction is treated like a legal state change. A bond transfer, a fund unit movement, an equity issuance, they all go through the same path. Phoenix handles confidentiality. Moonlight enforces who is allowed to do what. DuskDS locks the result in place. None of that is free. Validators do work. Zero-knowledge proofs get verified. Consensus rounds happen. DUSK isn’t symbolic here. It’s how that work is accounted for.

EMISSIONS THAT IGNORE NOISE BY DESIGN

Earlier today I was watching validator stats instead of charts. Block timing, committee rotation, ratification intervals. Everything looked calm. What stood out wasn’t speed. It was how steady everything felt.

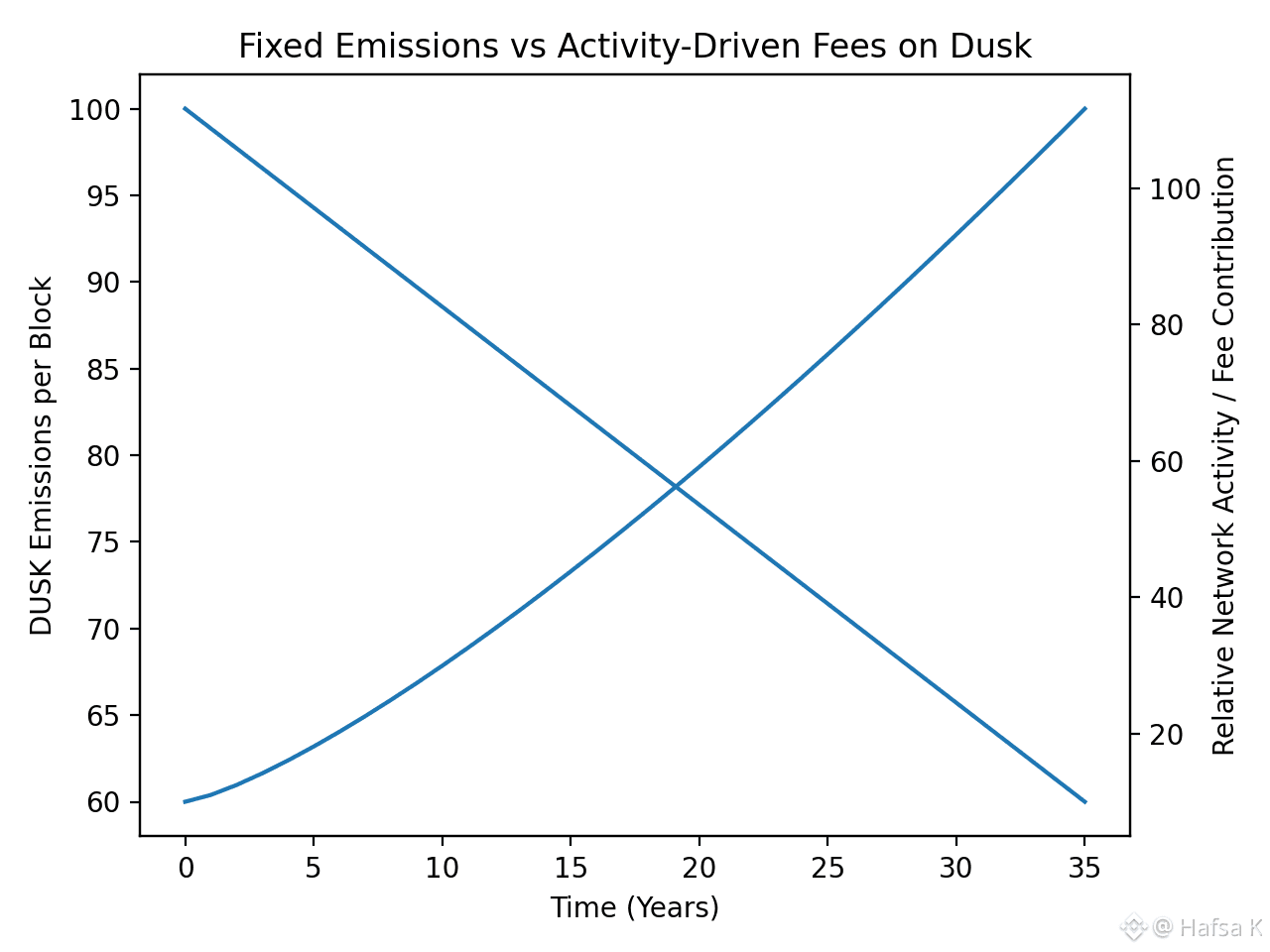

Dusk emits DUSK on a 36-year schedule. That number always makes people pause. But it lines up with the kind of assets the network is built for. Bonds don’t care about quarterly narratives. Funds don’t reprice every season. Institutions want predictability more than excitement.

The emission curve just keeps doing its thing. Same release per block, slowly decaying, no matter how busy the network gets. When activity is low, validator rewards mostly come from emissions. When activity picks up, fees start to matter more. On Dusk, those fees are paid in DUSK, down to LUX units, and split across the SBA participants. The protocol doesn’t react to demand. It lets demand express itself through fees.

WHY PRIVACY CHANGES FEE DYNAMICS

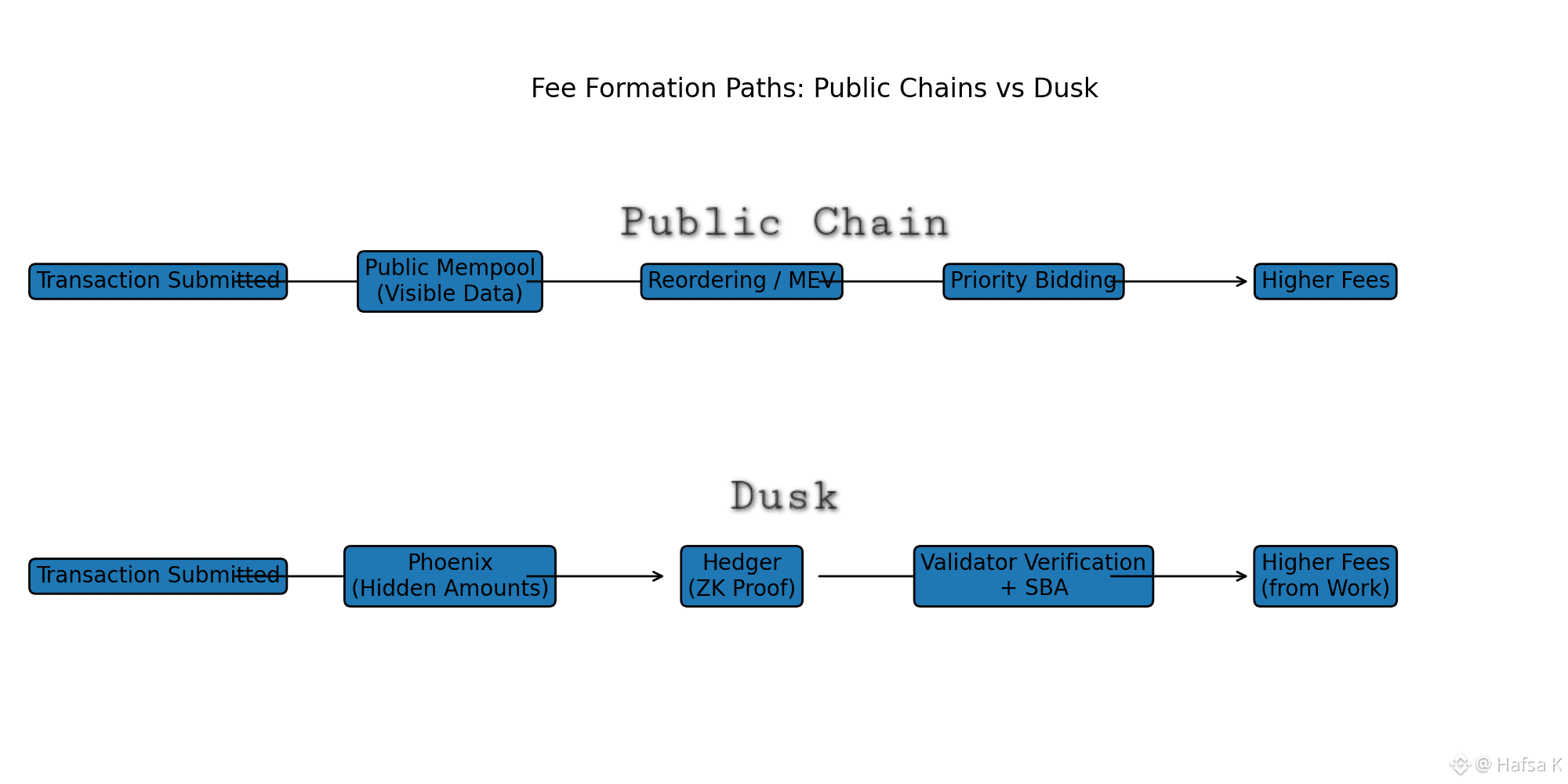

I caught myself thinking about this while making lunch. One of those moments where you’re waiting for something to heat and your brain drifts. On most chains, more activity means more noise. Public mempools, MEV games, people paying extra just to get in first.

Dusk doesn’t work that way because Phoenix hides the parts that usually get exploited. Amounts aren’t visible. Counterparties aren’t obvious. Validators can’t reorder what they can’t see.

Hedger sits right in the middle of this. Every DuskEVM transaction that needs privacy gets turned into a proof. Validators have to verify that proof before SBA can finalize the block. So when demand goes up, fees go up because more cryptographic work is being done. Not because someone waved a bigger number to jump the line.

A CONCRETE ISSUANCE UNDER LOAD

Picture a regulated corporate bond being issued during a busy period. The issuer deploys a contract on DuskEVM. From the outside it looks like normal Solidity. Underneath, Hedger translates it so Phoenix can handle ownership privately. Moonlight checks eligibility. The transaction hits the mempool. Validators, with DUSK staked, get selected into committees. SBA runs. The block finalizes.

The bond exists. There’s no waiting period. No “probably settled.” It’s done.

If several issuances hit at once, they compete for block space. Fees rise. DUSK demand rises with them. Emissions don’t change. That’s intentional. The protocol doesn’t try to smooth this out or pretend timing doesn’t matter. It charges for the work being done.

WHERE THE FRICTION ACTUALLY LIVES

This is where institutions start to feel friction. Fixed settlement costs are comforting. Dusk doesn’t promise that. You can’t just subsidize fees without consequences.

I had a long conversation recently with a developer who wanted to abstract gas away for issuers. The problem wasn’t tooling. It was math. Verifying proofs costs something. Running SBA costs something. Push fees below that and either validators lose incentive or security weakens. Dusk refuses both options.

From the validator side, this changes incentives over time. Early on, emissions matter most. As RWA volume grows, fees become the real income. Validators that invest in uptime and infrastructure get selected more reliably. If someone misbehaves, soft slashing kicks in. Participation is suspended, not burned. Capital isn’t destroyed, but reliability is enforced. That matters a lot to institutional operators.

THE SUPPLY CURVE AS A MECHANICAL CONSTRAINT

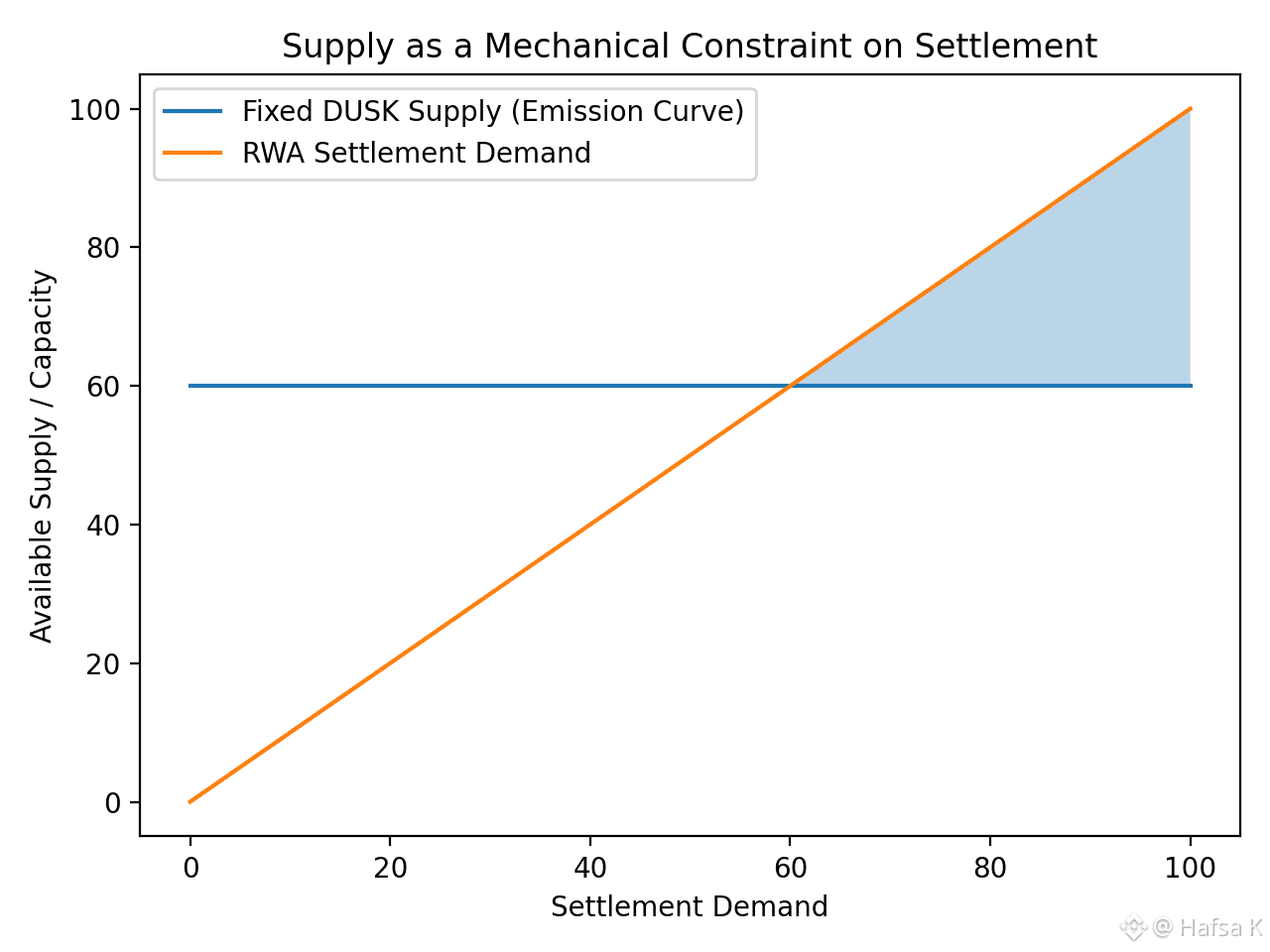

The supply curve is basically a fixed gear. RWA demand is the load attached to it. If demand ramps up quickly, liquidity tightens. Fees rise. Smaller validators feel pressure. Stake concentration becomes visible.

Dusk doesn’t hide that. You can see it in committee selection and stake distribution. The protocol lets the pressure show instead of inflating it away.

Earlier today I overheard two traders talking about a tokenized asset platform on another chain that had to pause issuance. Emissions were flooding the system faster than fees could catch up, and validator incentives broke. On Dusk, that escape hatch doesn’t exist. The supply doesn’t speed up to rescue bad assumptions.

REGULATED SCARCITY, NOT ARTIFICIAL CONSTRAINT

This is what regulated scarcity actually looks like. No emergency votes. No parameter toggles. Just a slow emission curve paired with fees that only show up when real assets move.

DUSK becomes scarce not because people sit on it, but because every compliant, confidential settlement consumes it as proof that real work happened.

The network looks quiet most of the time. Blocks finalize. Committees rotate. Nothing dramatic. But the mechanics are already there. If RWA volume grows from hundreds of millions to billions, Dusk doesn’t need to change how it works. Demand presses against a supply curve that was never meant to bend quickly.

Real finance doesn’t come in cycles. It piles up over time. Dusk was built to carry that weight without pretending it’s lighter than it is.