Settlement ambiguity is easy to ignore when markets are calm. It sits there quietly, filed under “technical detail,” until things get messy. Then it shows up all at once. Not as a bug, but as confusion. Who owns what. Which transfer actually happened. Whether a transaction that looked fine a minute ago still exists.

That gap, between a transaction being included and actually being settled, is where real damage happens. And it’s exactly the gap Dusk was built to close once on-chain activity stopped being experimental and started carrying legal weight.

I still keep some old incident notes from the 2022 deleveraging mess. Not price charts, just raw logs. Block times stretching. Short forks appearing under load. Transactions that were “confirmed” quietly disappearing after a deeper reorg. On transparent chains, this isn’t shocking. You’re taught to wait. More blocks means more confidence. During a crash, that logic falls apart. “Probably settled” stops being reassuring when money is moving fast and counterparties are nervous.

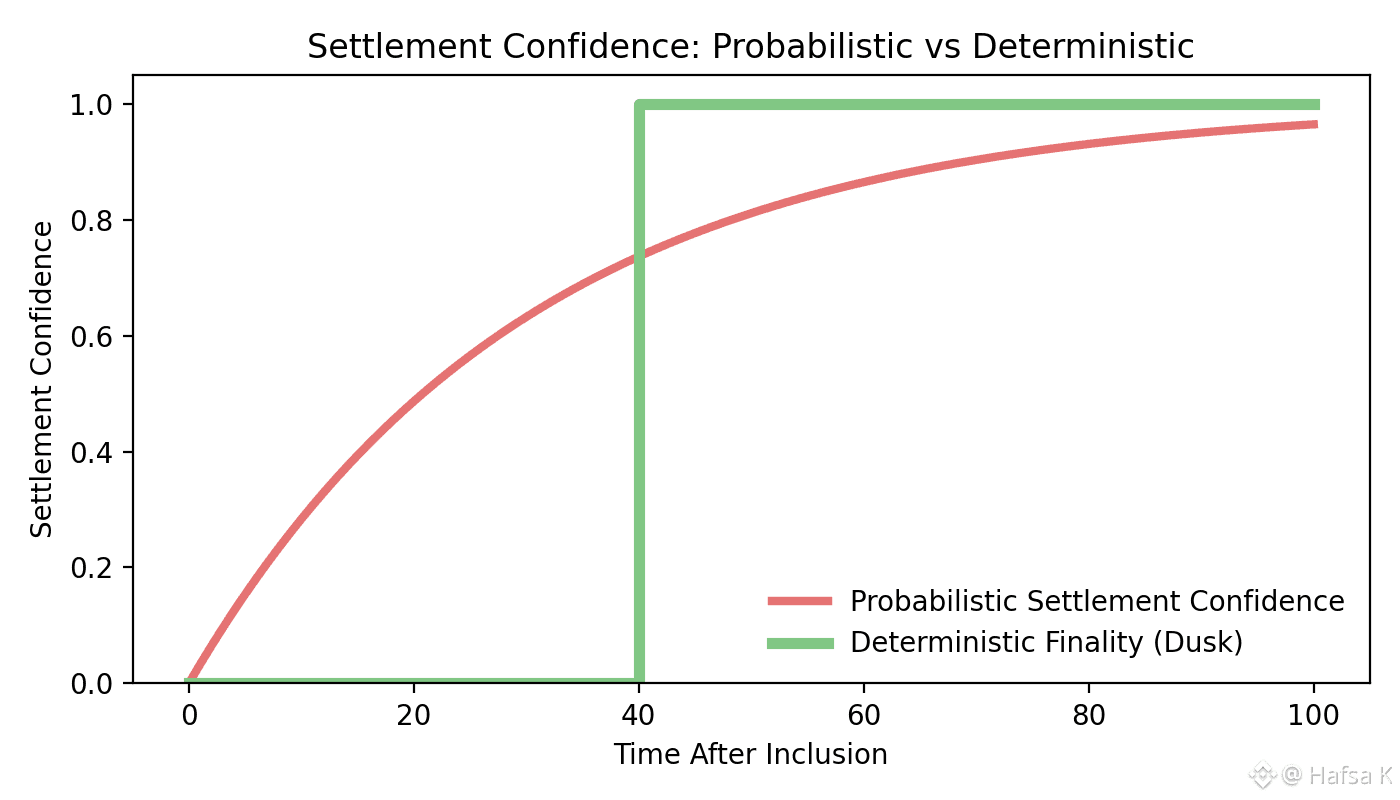

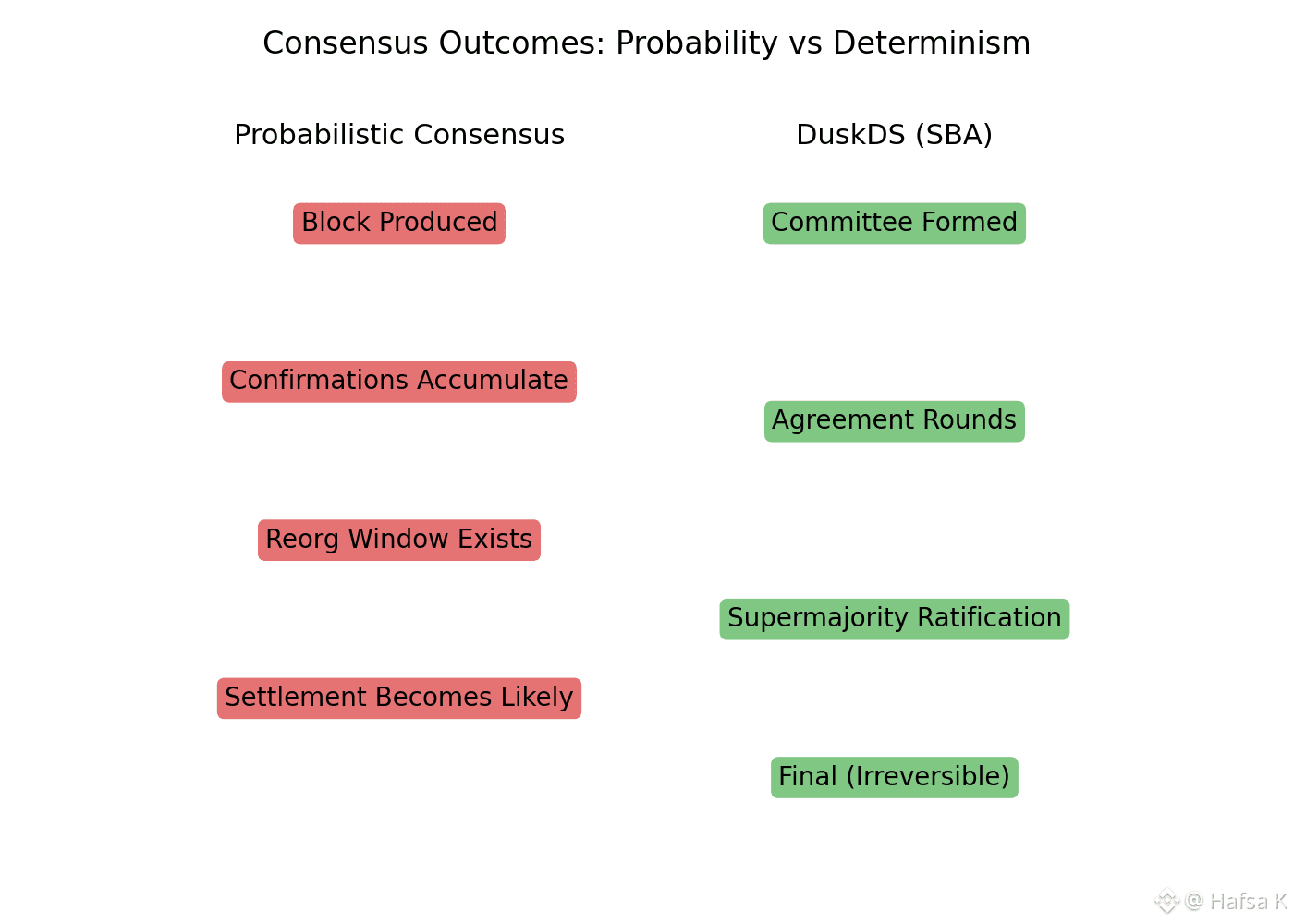

Dusk treats that uncertainty as a design failure, not something to optimize around later. The DuskDS layer exists for one reason: to make settlement final when it happens. It uses Segregated Byzantine Agreement, which forces a supermajority of validators to agree before a block is ratified. Once that step is done, the state is locked. There’s no alternative history waiting to replace it. No surprise rewrite.

This isn’t a special mode. It’s how every transaction on Dusk works. Moonlight transfers. Phoenix transactions. Shielded or public, they all settle the same way. Privacy and finality aren’t layered on separately. Phoenix notes use zero-knowledge proofs, but they still land with the same irreversibility as anything else on the chain. Disclosure only happens later, and only if the protocol allows it.

Around midday last year, during one of those cascading liquidations that spilled from centralized venues into DeFi, I was on a call with a developer who sounded exhausted. They had just watched a tokenized issuance fall apart. The contract worked. The transaction landed. Then a short reorg wiped it out. By the time the chain stabilized, counterparties were gone. No one wanted to sit in settlement limbo. The loss wasn’t theoretical. It was time, trust, and legal clarity.

On Dusk, that same flow looks very different. The issuer deploys through DuskEVM. From a developer’s point of view, it feels familiar. Solidity. Standard tooling. Under the hood, everything routes through DuskDS. Tokens mint under Phoenix, so ownership and amounts stay private. Validators, bonded with staked DUSK, enter the SBA rounds. Agreement is reached. The block is ratified. Data is available on-chain. At that point, the issuance exists as a fact, not a probability. Auditors can verify it later using selective proofs. The ledger never needs to rewind.

That difference matters most when things go wrong. On Nakamoto-style chains, volatility increases incentives to reorder transactions and extract MEV. Blocks are treated as suggestions until enough time passes. On Dusk, validators don’t get to play that game. The consensus process doesn’t reward clever timing during chaos. It rewards doing the job correctly and staying online. Once finality is reached, there’s nothing left to exploit.

This comes with real constraints. Validators on Dusk do more than pass blocks around. They participate in structured consensus rounds that require reliable networking and disciplined operations. Developers notice this too. On DuskEVM, you can’t just throw more gas at a problem and hope it sticks. Hedger turns execution into zero-knowledge proofs with fixed verification costs. Those costs have to be accounted for because the committee needs to verify everything before finality can be guaranteed.

I remember another conversation, this time over coffee, with a developer who was clearly frustrated by that rigidity. They were used to pushing transactions through congestion by paying more. On Dusk, that instinct doesn’t work. The protocol doesn’t allow bursts that could undermine settlement guarantees. At first it feels restrictive. Then it clicks. You never have to explain to a regulator why a confirmed transaction vanished five minutes later.

From an audit and custody point of view, this changes the tone completely. When a Phoenix transaction shows up on Dusk, it isn’t provisional. Auditors aren’t looking at a temporary state that might disappear. Hedger keeps private execution verifiable. DuskDS ensures the record stays put. There’s no need for emergency pauses or full-ledger exposure just to resolve a dispute.

Elsewhere, we spend huge amounts of effort building wrappers and insurance layers to protect against probabilistic settlement. Dusk avoids that by refusing ambiguity at the protocol level. Privacy without finality just hides problems. Finality without privacy exposes too much. Dusk ties the two together so neither can fail on its own.

Markets don’t care about elegant explanations when liquidity dries up. They care whether the system holds its shape under pressure. When things start to slip, the value of a ledger isn’t throughput or ecosystem size. It’s whether “final” actually means final.

On Dusk, a settled transaction isn’t a suggestion or a statistical outcome. It’s a fact.

That difference feels subtle. Until the day everything else starts to give way.