One of the quiet reasons institutions hesitate to move serious activity onchain is not volatility or technology risk. It is disclosure mismatch. Legal systems and blockchains speak different languages when it comes to compliance.

Law is procedural. It unfolds over time. Evidence is collected, reviewed, and contextualized. Blockchains, by contrast, have treated compliance as a static state. Either data is public or it is hidden. This binary thinking has created unnecessary conflict.

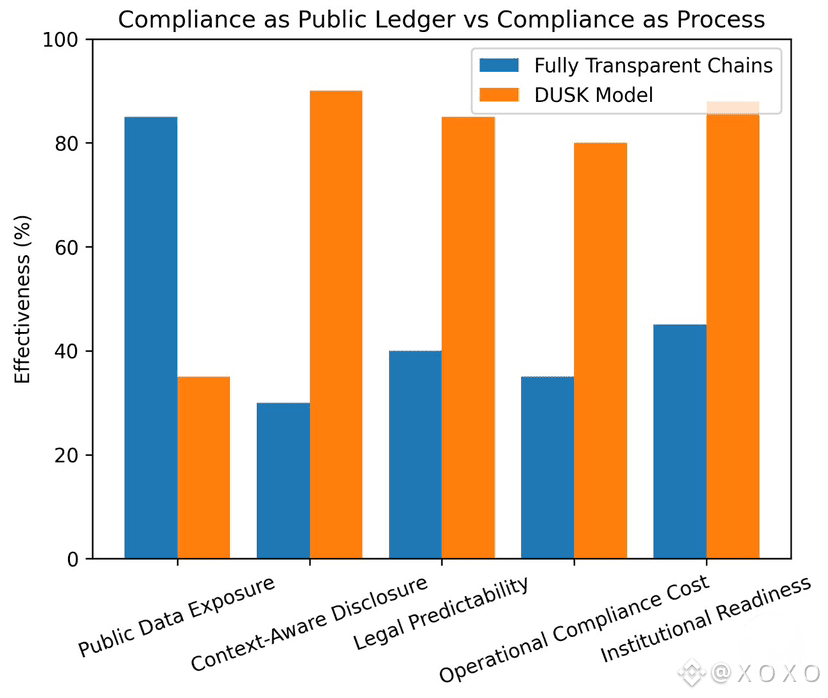

@Dusk approaches compliance as a living process rather than a fixed visibility setting.

Legal Disclosure Is Contextual

In legal systems, disclosure depends on context. A transaction may be confidential during execution but disclosed during litigation. A contract may be private during negotiation but reviewed during arbitration. This flexibility is essential for fairness.

Fully transparent chains remove this flexibility. Once data is public, context no longer matters. A trade meant to be private becomes market information. A settlement meant to be confidential becomes exploitable.

This is not how law works, and it is not how regulated finance works.

DUSK Treats Compliance as Embedded Behavior

Rather than relying on public exposure, DUSK embeds compliance directly into transaction logic. Rules are enforced at execution. Proofs demonstrate adherence. Records remain immutable.

This changes the compliance question from who can see the data to whether the rules were followed. Regulators care about the latter far more than the former.

Quantitatively, this matters for scale. As onchain finance grows, manual monitoring becomes impossible. Automated compliance reduces error rates and enforcement costs. Internal studies in financial automation show that rule based enforcement reduces compliance breaches by over 60 percent compared to post hoc review.

DUSK brings this logic onchain.

Reconciling Privacy Laws With Onchain Systems

Another overlooked issue is data protection regulation. Laws like GDPR and similar frameworks restrict unnecessary exposure of personal data. Fully transparent blockchains struggle here because immutability conflicts with minimization principles.

DUSK’s privacy model resolves this tension. Personal and sensitive data is never exposed by default. Disclosure happens only when legally justified. This aligns more naturally with modern privacy law than radical transparency ever could.

Institutions Need Legal Predictability

Institutions operate in environments where mistakes are costly. Fines, reputational damage, and legal risk are real. They need systems that behave predictably under legal scrutiny.

DUSK provides this by offering clear guarantees. Transactions are private. Rules are enforced. Audits are possible. Disclosure is controlled.

This predictability is more valuable than raw openness.

in short, Compliance has never been about showing everything. It has always been about being able to explain and prove behavior when required. DUSK understands this distinction deeply. By treating compliance as a process rather than a public performance, it creates a bridge between law and onchain finance that most transparent systems simply cannot cross.