If you’ve been watching Layer-1 launches over the last year, XPL, the native token of the Plasma chain, is a useful case study in how market narratives collide with hard engineering limits. Plasma’s mainnet and token debut in late September 2025 brought a lot of attention because the project positioned itself as a stablecoin first, payment-oriented L1 with practical developer ergonomics. The token launch itself made headlines at the time due to its large initial valuation and the speed at which liquidity formed across exchanges. As of mid-January 2026, XPL trades around the mid-teens in cents, with a market capitalization in the low hundreds of millions and daily volume that still reflects active participation. Those numbers matter, because incentives and execution constraints are inseparable.

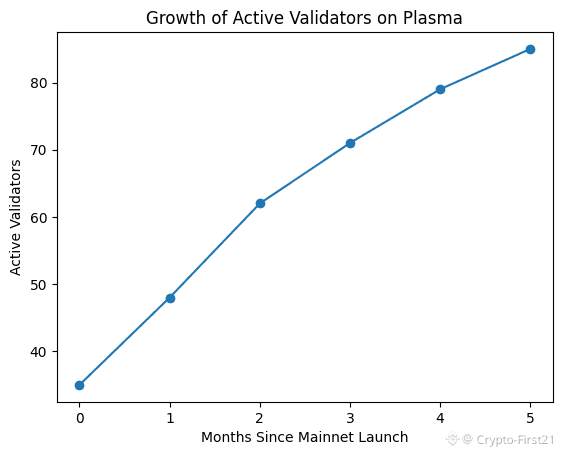

Here’s how I think about XPL and the execution-layer limits that actually determine whether a chain is useful for payments, DeFi, or higher-frequency flows. First, the token itself is not abstract. XPL is used for gas, staking, and validator incentives. That sounds basic, but it’s the foundation of everything else. Token economics decide who runs nodes, how many nodes stay online during quiet periods, and whether the network can afford fast finality without compromising security. When people talk about performance, they often forget that performance is paid for. Without sustainable rewards, no amount of clever design survives contact with reality.

Execution layers are constrained by four forces that never go away: consensus design, state and storage costs, transaction execution rules, and the incentive model that supports node operators. You can advertise extreme throughput numbers, but unless consensus supports low-latency finality and validators are compensated for bandwidth and hardware, those numbers only exist in testing environments. Plasma’s execution stack leans on EVM compatibility, which lowers friction for developers by letting existing tooling carry over. That choice makes sense, but it also imports familiar tradeoffs: gas accounting, state growth, and the need for discipline around contract design. Compatibility helps adoption, but it doesn’t eliminate constraints. It just changes where they show up.

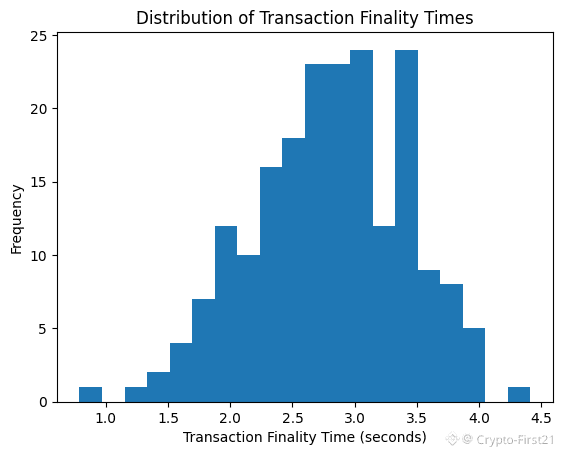

Finality is another area where theory often diverges from practice. For payments, speed alone isn’t enough. What matters is certainty. Merchants, custodians, and settlement systems need to know when a transaction is irreversible. That’s why modern payment-focused chains emphasize fast finality rather than raw transaction counts. Plasma’s architecture reflects that priority, aiming for confirmation times that fit real-world financial workflows. The tradeoff, as always, is that aggressive finality often implies tighter validator coordination or a smaller active set. Decentralization and performance exist on a spectrum, not as absolutes.

Incentives tie all of this together. If rewards are too high, inflation pressures the token price, which undermines the same incentives they were meant to create. Watching circulating supply changes and validator participation since launch gives better insight into network health than price charts alone.

Latency-sensitive activity introduces another layer of constraint. High-frequency execution isn’t just about throughput; it’s about propagation delays, transaction ordering, and how value is extracted from timing advantages. Execution layers that want to support serious trading or settlement flows need predictable ordering rules and protection against abusive extraction. But mechanisms that reduce MEV often introduce overhead or coordination costs. Plasma’s emphasis on payments narrows the attack surface compared to open-ended DeFi, but it doesn’t eliminate the tension between fairness and speed. Traders will always probe the edges of whatever rules are in place. Developer behavior matters more than roadmaps.

From a trader’s perspective, the most important signals aren’t marketing claims. They’re measurable. How many validators are active, and where are they located? What does block finality look like during congestion? How do fees behave when activity spikes? When Plasma launched, attention centered on token distribution and early liquidity. The longer-term story is whether that liquidity translates into durable settlement usage and stable validator economics. That’s the point where an execution layer graduates from speculation to infrastructure.

I’ve learned over the years that building settlement networks is as much economic and social engineering as it is technical. Code sets the rules, but incentives decide whether people follow them. With XPL and Plasma, there’s a genuine attempt to align token utility with real payment and execution needs. Whether that alignment holds through market cycles is still an open question. The early data tells us the system is live, liquid, and being tested by real users. The rest will be determined by how well the protocol absorbs stress, adapts incentives, and resists the slow erosion that kills many otherwise solid designs.

If you’re watching XPL closely, ignore the noise and focus on execution in the literal sense. Validator stability, finality under load, and incentive sustainability are what determine long-term value. Everything else is commentary.