The Stablecoin Problem and a Specialized Solution

The digital asset landscape is undergoing a pivotal transformation, moving from speculative trading towards practical utility and real-world finance. At the center of this shift are stablecoins, with a market valuation consistently exceeding $150 billion. They promise the benefits of blockchain—borderless, 24/7 transactions—with the price stability of traditional currency. However, a critical flaw persists: stablecoins primarily reside on general-purpose blockchains that were not designed for them. This creates a fundamental user experience failure. To send $100 of USDT, a user must first purchase a separate, volatile asset like ETH to pay the network fee. This friction is a major barrier to mass adoption for payments and remittances.

Plasma (XPL) emerges as the direct answer to this problem. It is not another "Ethereum killer" aiming for universal smart contract supremacy. Instead, Plasma is a specialized Layer 1 blockchain engineered from its core to be the optimal settlement layer for stablecoin transactions. Its thesis is simple yet powerful: by building a network exclusively optimized for stable-value assets, it can deliver a user experience and efficiency that generalist platforms cannot match.

Core Innovation: Abstracting Complexity for Seamless Use

Plasma's most user-centric innovation is its native gas sponsorship mechanism. On its network, transactions involving simple stablecoin transfers can have their fees ("gas") paid by the protocol itself. This means an end-user can send USDT or USDC without ever needing to acquire, hold, or manage the native XPL token. This abstraction of complexity is a quantum leap in usability, making cryptocurrency transactions as straightforward as sending a text message.

Beneath this seamless surface lies a high-performance technical stack:

· Consensus: The network utilizes PlasmaBFT, a derivative of the efficient HotStuff BFT consensus, enabling sub-second finality and high throughput, essential for payment-scale applications.

· Compatibility: It maintains full Ethereum Virtual Machine (EVM) compatibility. This strategic choice allows the vast ecosystem of Ethereum developers and decentralized applications (dApps) to deploy on Plasma with minimal effort, instantly bringing mature DeFi and other financial tools into its stablecoin-native environment.

The XPL Token: Economic Engine and Upcoming Inflection Point

While users may not interact with XPL directly for basic transfers, the token is the indispensable economic backbone securing and governing the Plasma network. Its utilities are critical:

1. Security: Validators must stake XPL to participate in block production, securing the network in a Proof-of-Stake model.

2. Network Fuel: XPL is required to pay for all complex smart contract executions, such as swaps on a decentralized exchange or loans in a lending protocol.

3. Governance: XPL will grant holders voting rights over the protocol's future development and parameters.

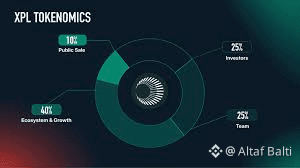

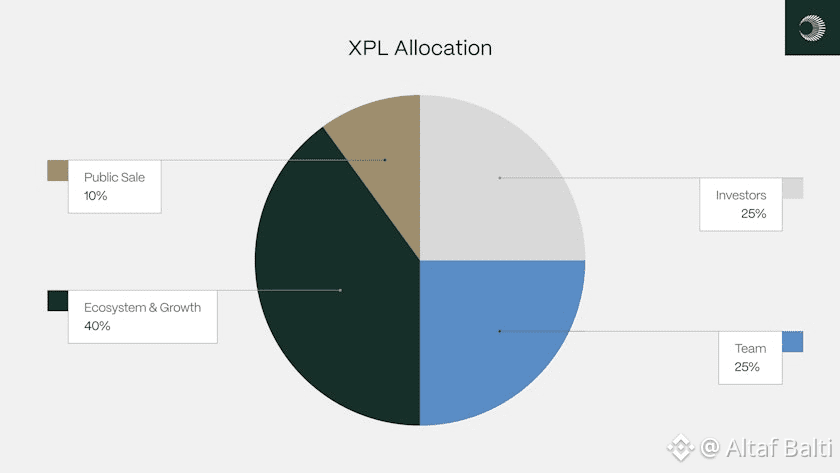

A pivotal event for the XPL token economy is on the horizon. On July 28, 2026, a scheduled unlock will release 2.5 billion XPL (representing 25% of the total 10 billion supply) to early team members and investors. This event represents a significant test for the project. The market's ability to absorb this new supply will depend entirely on the organic growth and utility Plasma has achieved by that date. Successful navigation of this unlock is a key milestone for demonstrating mature, demand-driven tokenomics.

Strategic Roadmap and Market Position

Plasma has demonstrated early traction, attracting over $2 billion in stablecoin liquidity shortly after its mainnet launch. It is backed by notable investors like Founders Fund and has received explicit support from Tether's leadership.

Its strategic roadmap for 2026 focuses on expansion and deeper integration:

· Bitcoin Bridge: Developing a secure method to bring native Bitcoin onto the network, unlocking BTC's vast liquidity for use within Plasma's high-speed DeFi ecosystem.

· Global Expansion: Scaling its consumer-facing "Plasma One" application in key regions like Southeast Asia and Latin America to drive real-world adoption for savings and payments.

· Decentralization: Progressively transitioning network validation to a broader, independent set of operators to enhance resilience.

Conclusion: A Focused Bet on the Future of Digital Money

Plasma (XPL) represents a compelling bet on a specific future: one where stablecoins become the dominant medium for digital value exchange. By forsaking a generic approach in favor of deep specialization, Plasma optimizes for speed, cost, and user experience in a critical niche. Its upcoming token unlock in 2026 presents a clear catalyst that will measure real adoption against speculative interest.

The project's long-term success hinges on its execution—growing its ecosystem of applications, attracting mainstream users to its neobank products, and securely bridging major assets like Bitcoin. If it succeeds, Plasma is poised to become essential financial infrastructure, the dedicated rail upon which the daily movement of digital dollars operates. In a crowded blockchain arena, its focused vision may well be its greatest strength.