The first time I understood why “regulated DeFi” is a real category (not just a marketing phrase), it wasn’t from reading a whitepaper. It was from watching how messy basic compliance becomes the moment money moves across borders. A trader friend of mine once tried to settle a small private deal with a stablecoin payment. Simple idea: instant transfer, no banks, no delays. In reality, the other side couldn’t accept it without asking uncomfortable questions: Where did the funds come from? Is this compliant? What if the receiver later needs to prove legitimacy to a bank? They ended up routing the transaction through the old system anyway. And that’s the hidden truth: crypto can move value fast, but regulated finance needs more than speed. It needs privacy, rules, proofs, and accountability, all at the same time.

That tension is exactly where Dusk Network sits, and it’s why the project has slowly earned a different kind of attention from traders and long-term investors. Dusk is positioning itself as a Layer 1 built specifically for regulated financial markets, where privacy is not about hiding from the law, but about protecting sensitive financial activity while still meeting compliance requirements. That’s a very different mission than the “privacy coin” narrative most people associate with confidential transactions.

To understand Dusk, you have to start with a basic contradiction in blockchain. Public ledgers are great for transparency, but financial markets are not built on full transparency. In traditional finance, your bank balance isn’t public. Your portfolio isn’t public. Your trade sizes aren’t public. Even in regulated environments, only the right parties can see the right details: auditors, regulators, counterparties, and institutions with proper access. Public blockchains flipped that model by making everything visible to everyone. That was fine for early crypto culture, but it becomes unrealistic the moment you talk about tokenized securities, bonds, or institution-grade settlement.

Dusk’s core bet is that the next era of on-chain finance won’t be “fully public DeFi,” it will be regulated markets moving on-chain, with privacy built in at protocol level. The key phrase here is selective disclosure. Instead of treating privacy as absolute secrecy, Dusk aims for confidential transactions where validity is provable. In simple terms: you can prove you followed the rules without exposing the sensitive data itself. Dusk’s documentation describes it as privacy plus compliance primitives for regulated finance, while still enabling developers to build with familiar tooling.

This distinction matters because regulation isn’t going away. If anything, the direction of travel is toward clearer frameworks. In Europe, the MiCA era has forced projects to think harder about how privacy and compliance can coexist. Dusk has even publicly argued that regulated DeFi requires KYC while keeping the KYC private, using cryptography to enforce that sanctioned entities can’t transact. That isn’t an ideological stance. It’s a practical one: if you want institutional markets, you can’t design like you’re building for anonymous internet cash.

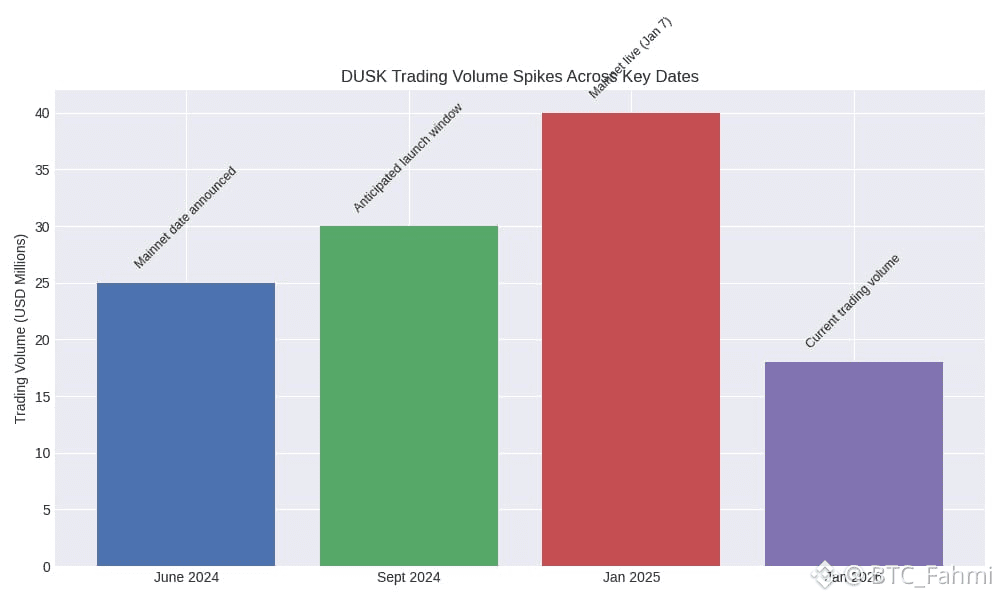

The “journey” part in Dusk’s story is also real. This hasn’t been a quick flip from concept to production. In June 2024, Dusk publicly confirmed a mainnet date of September 20 (announced in late June 2024), framing it as a major milestone for a protocol designed around privacy and compliance for institution-grade market infrastructure. Then the rollout narrative became more gradual, with reporting in early 2025 describing mainnet going live around January 7, 2025, and noting how evolving regulatory expectations influenced timing decisions.

From a trader’s lens, that delay-and-ship pattern is actually informative. Many crypto projects rush to mainnet to catch hype cycles. Dusk’s positioning forces patience because regulated finance adoption is slow, heavily gated, and relationship-driven. It’s not like memecoin liquidity where attention becomes value overnight. If Dusk succeeds, the reward is structural: being the settlement and issuance layer where compliant assets can move privately.

And that’s why the project has become increasingly linked to the broader RWA and tokenized securities conversation. Tokenization is trending, but institutions don’t want their trade flows exposed on a public ledger. They want confidentiality, but they also want the ability to audit. Dusk tries to combine those two, offering confidential transactions that remain verifiable, so validators can confirm rules are followed without exposing private data like amounts or identities.

Partnership signals matter here too, but you should read them carefully. One notable example is the collaboration involving Dusk, NPEX, and Cordial Systems aimed at bringing a stock exchange on-chain, focusing on tokenization and native issuance of regulated assets. Whether this becomes a large-scale adoption story or remains a pilot-stage experiment is the type of question investors should keep asking. In regulated markets, pilots can take years to convert into full production flows. But the presence of these collaborations fits Dusk’s thesis: it’s going after financial infrastructure, not retail trends.

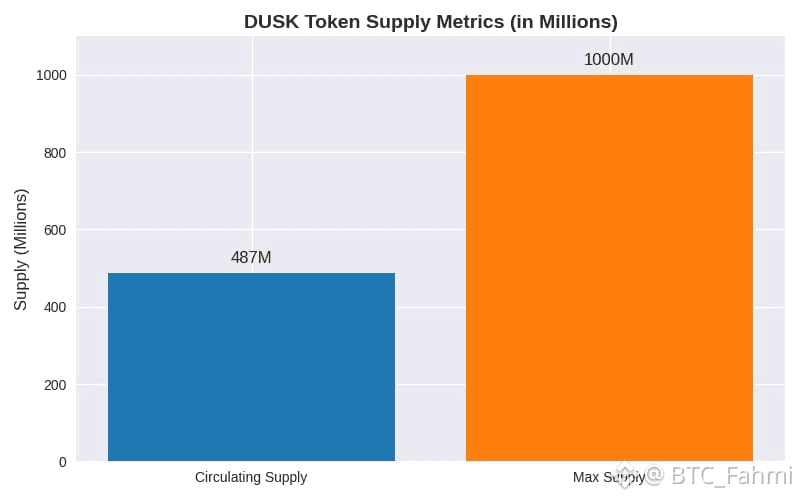

From a market perspective, DUSK remains a relatively small-cap asset compared with major Layer 1s, which creates the classic high-volatility profile traders expect. As of mid-January 2026, DUSK has been trading around $0.17 with market cap estimates around ~$80M–$86M depending on the source and timing, and circulating supply reported near ~487M with max supply of 1B. Volume spikes have also been notable, meaning DUSK can get “tradable” quickly when attention returns.

But the deeper investor question isn’t “will it pump,” it’s whether Dusk’s niche will expand. Regulated private finance sounds narrow until you realize how big the regulated world actually is. The public narrative in crypto often treats regulation as a blocker. The more realistic view is that regulation decides where serious capital can flow. If you believe that tokenized assets and compliant markets are inevitable, then the chains designed around privacy + compliance begin to look less like side projects and more like eventual middleware for finance.

My personal view is simple: Dusk is one of the few projects where the thesis doesn’t depend on retail excitement. It depends on whether institutions genuinely want blockchain settlement without sacrificing confidentiality. That’s a slower path, and it may frustrate traders who want quick catalysts. But if you’re evaluating it properly, you should treat it like infrastructure: adoption is measured in integrations, pilots, and market structure shifts not just hype cycles.