The stablecoin market crossed $225 billion in supply with trillions in monthly transfers. Yet most blockchains still treat stablecoins as an afterthought. Plasma built differently.

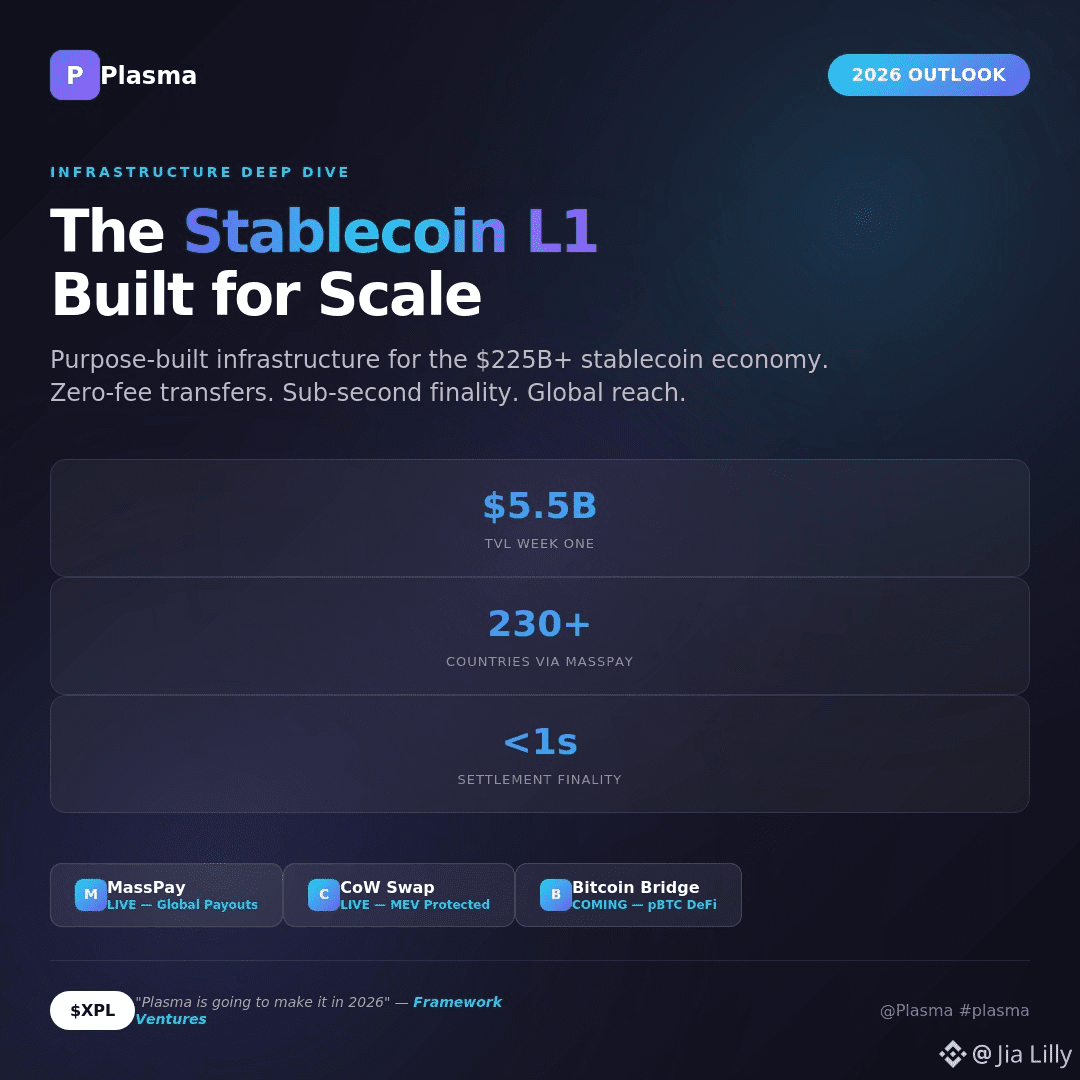

Launched in September 2025 with $2 billion in day-one liquidity, Plasma scaled to $5.5 billion TVL within its first week. The network now processes zero-fee USDT transfers through a protocol-managed paymaster system. Users move dollars without holding XPL for gas.

Recent developments signal aggressive expansion. In December 2025, Plasma integrated MassPay, enabling USD₮ payouts across 230+ countries. Marketplaces, gig platforms, and creator networks can now settle payments in under one second with minimal fees. MassPay's CEO called it "unlocking the future of payouts."

CoW Swap went live on Plasma in January 2026, bringing MEV-protected swaps and zero gas fees to traders. This addresses a critical pain point front-running bots extract billions annually from retail traders on other chains.

The architecture itself explains the traction. PlasmaBFT delivers sub-second finality using a pipelined Fast HotStuff algorithm. The Reth-based execution layer maintains full EVM compatibility, so developers deploy existing Ethereum contracts without modifications. A trust-minimized Bitcoin bridge enables pBTC for DeFi applications.

Framework Ventures co-founder Vance Spencer stated Plasma "is going to make it in 2026," pointing to upcoming product launches. The firm led Plasma's $20M raise at a $500M valuation.

Token economics present both opportunity and risk. XPL powers staking, validator rewards, and complex transactions beyond simple transfers. The January 25 unlock releases 88.89M tokens ($12.38M) for ecosystem growth. The larger July 2026 unlock of 1 billion tokens from US public sale participants represents the real test.

Current metrics show 78K daily active users, down from 137K peak. The question is whether MassPay integration, CoW Swap volume, and Bitcoin bridge adoption can drive demand to absorb supply pressure.

Plasma One, the consumer-facing neobank, positions XPL for mainstream adoption by making USD₮ useful for everyday saving and spending. The vertical integration strategy blockchain, payment rails, and consumer app mirrors successful fintech playbooks.

For stablecoin infrastructure, Plasma represents a focused bet: purpose-built architecture versus general-purpose chains retrofitted for payments.