The U.S. Dollar’s strong three-week rebound from its December lows has now hit a critical technical barrier. The rally, which gained nearly 1.8%, is testing key Fibonacci resistance levels on the weekly chart. How the dollar reacts here will determine if this recovery has legs or is about to stall.

Major Points:

Critical Junction: The USD Index (DXY) has reached a major inflection point at Fibonacci resistance near 98.38. The price action in the coming days is pivotal.

Bullish Case Requires Breakout: While the near-term trend is still positive, a sustained break above 99.38 is needed to confirm the rally and target the next key resistance zone at 100.16/42.

Key Support to Hold: For the uptrend to remain viable, the dollar must hold above support at 98.24, which aligns with a rising trendline from the 2025 lows. A breakdown below 97.65 would signal a resumption of the broader downtrend.

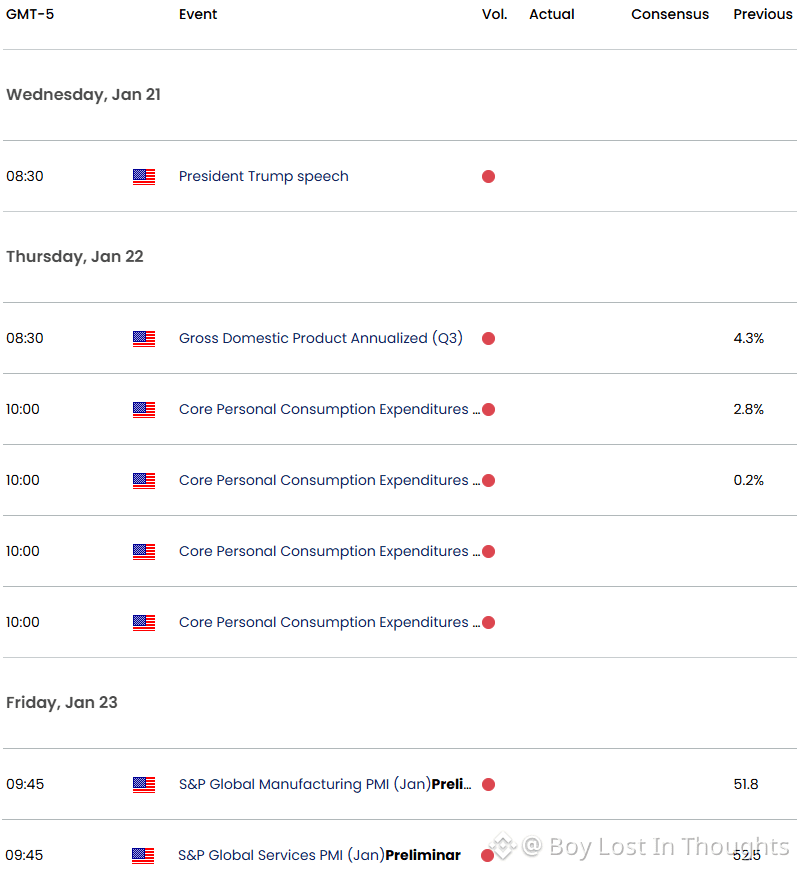

High-Stakes Week Ahead: Key events, including U.S. PCE inflation data and a speech from President Trump at the World Economic Forum, could fuel significant volatility and impact Fed rate-cut expectations—a major driver for the dollar.

Bottom Line for Traders: The dollar's recovery is at a decisive test. Watch for a close above 99.38 for a continuation higher, or a break below 98.24 for a loss of momentum. Key economic data and event risk this week will likely determine the next major move.