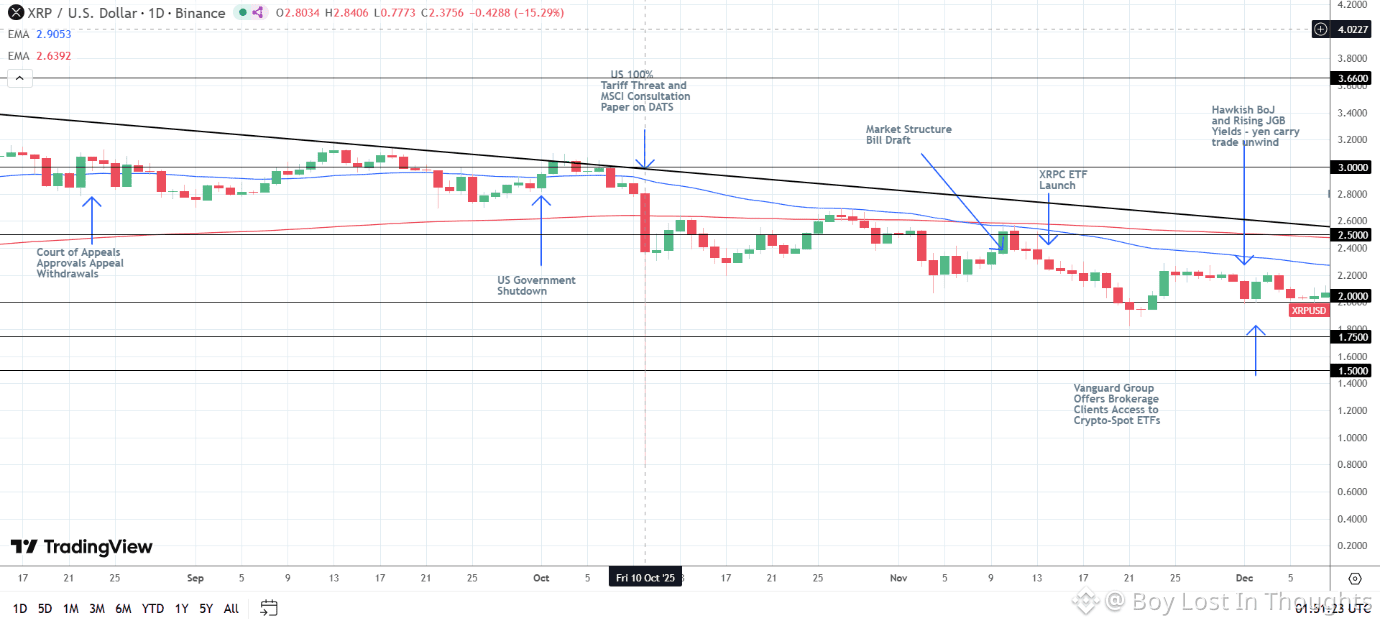

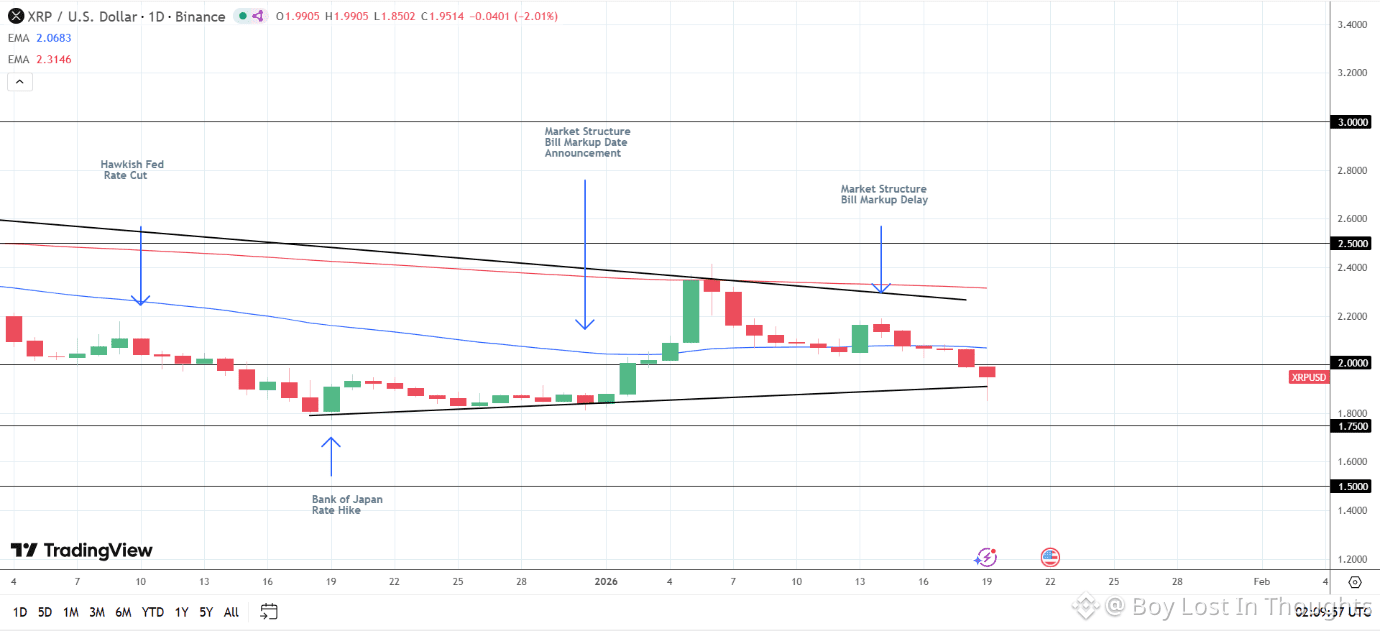

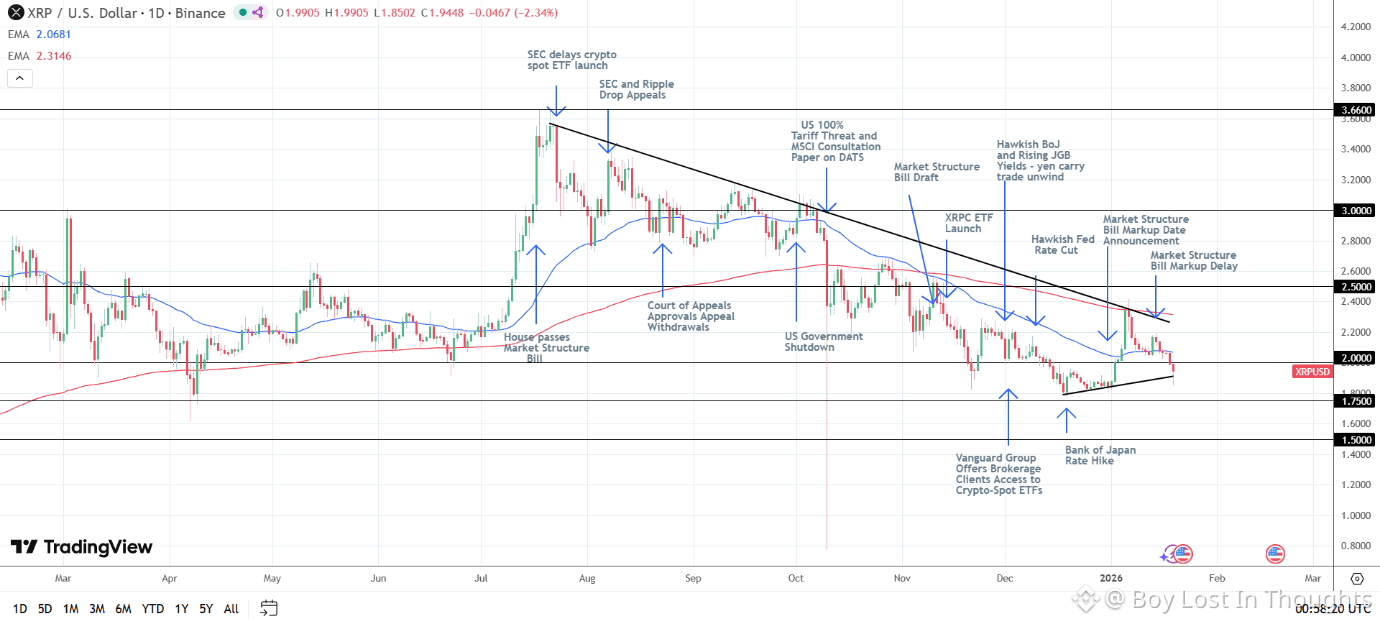

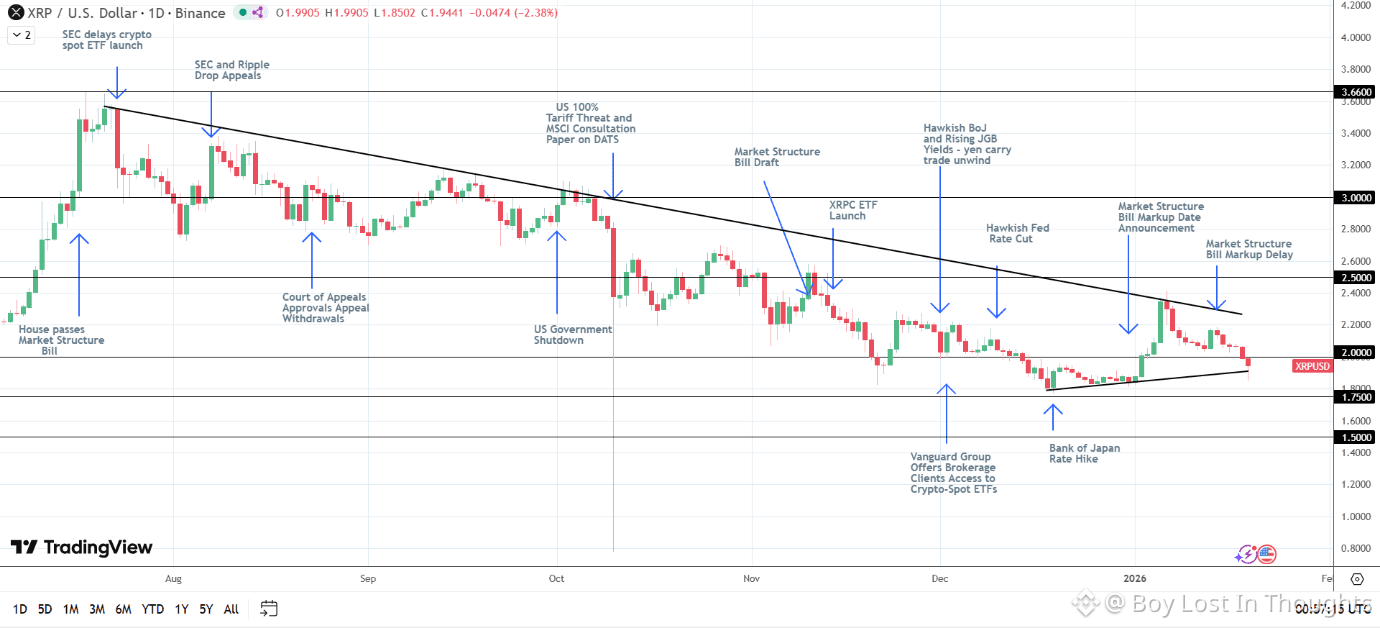

XRP has dropped below the key $2.00 mark, extending a five-day losing streak amid renewed U.S.-EU trade tensions and delays in U.S. crypto legislation. Despite the sell-off, analysts maintain a bullish medium-term outlook, citing strong ETF demand and expected regulatory progress.

Key Points:

Price Drop: XRP fell below the psychologically important $2.00 level, touching around $1.85, as U.S. tariffs on European nations and a postponed Senate crypto bill weighed on sentiment.

Causes: The sell-off was triggered by U.S. trade policy uncertainty and a delay in the “Market Structure Bill,” which has heightened regulatory fears.

Bullish Catalysts: Strong institutional demand via XRP-spot ETFs and ongoing legislative efforts support a positive medium-term outlook, with price targets of $3.00 (4–8 weeks) and $3.66 (8–12 weeks).

Critical Support: Holding above $1.85 is essential to maintain the bullish structure. A break below could signal a deeper correction.

Risks: Further trade escalation, stalled crypto legislation, or hawkish central bank moves could pressure XRP lower.

What to Watch: Trade war developments, U.S. crypto bill progress, Fed policy signals, and XRP-spot ETF flows will guide price action in the near term.