Bitcoin's price tumbled more than 1.8% to under $91,920, breaking a key bullish pattern that had pointed toward a surge past $100,000. The drop came as U.S. stock futures fell and safe-haven assets like gold rose—a sign of growing risk-off sentiment after former President Donald Trump threatened tariffs against several countries over Greenland. Analysts warn that a break below $90,000 could trigger deeper sell-offs, especially among ETF investors.

Major Points :

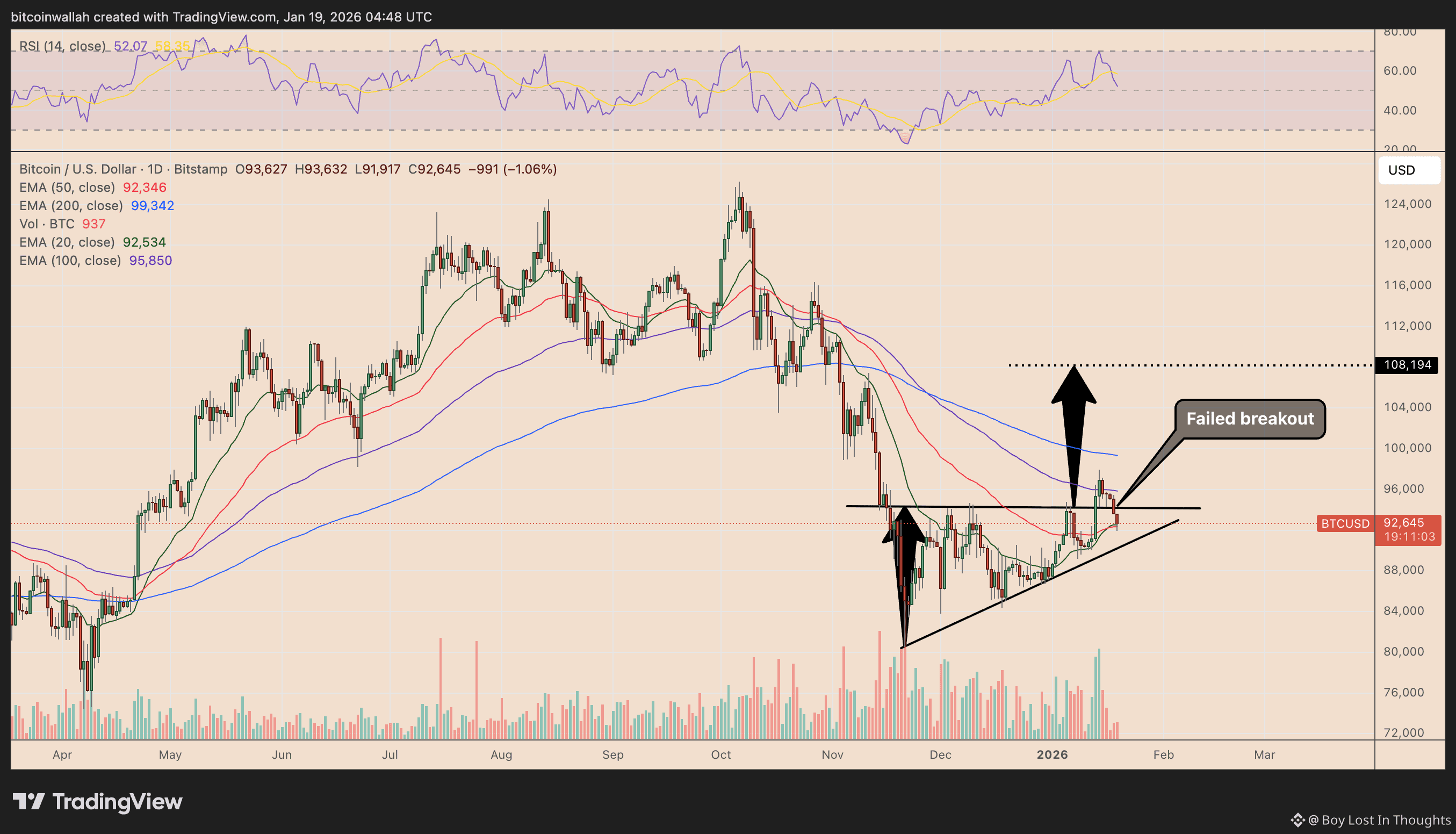

BTC broke below $91,920, invalidating an ascending triangle setup that had projected a move above $100,000.

Trump’s Greenland-related tariff threats sparked a broad risk-off shift, pulling down Nasdaq futures and lifting gold.

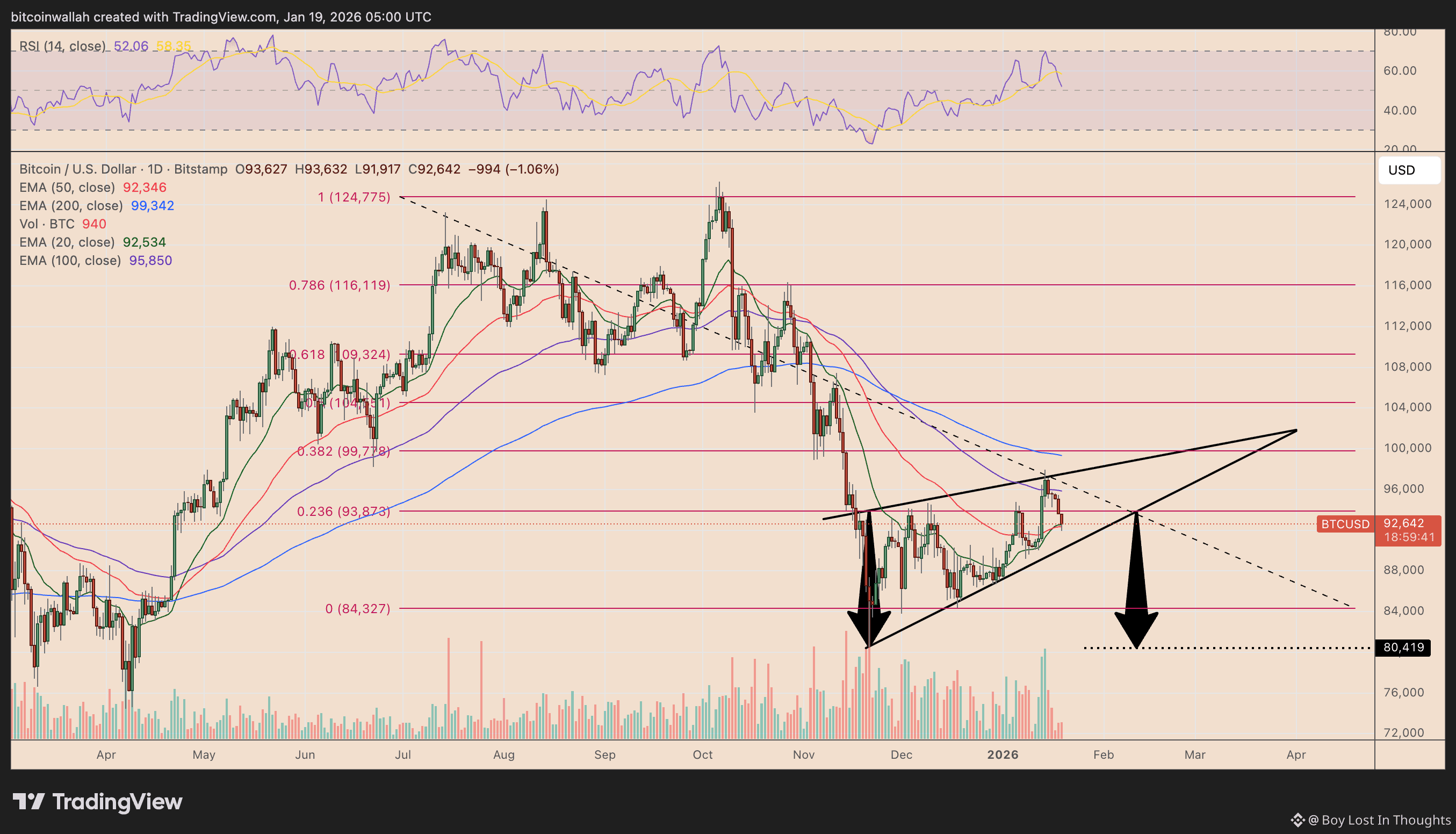

A rising wedge pattern on the daily chart suggests weakening momentum and raises the risk of a drop toward $84,000–$80,000 if support fails.

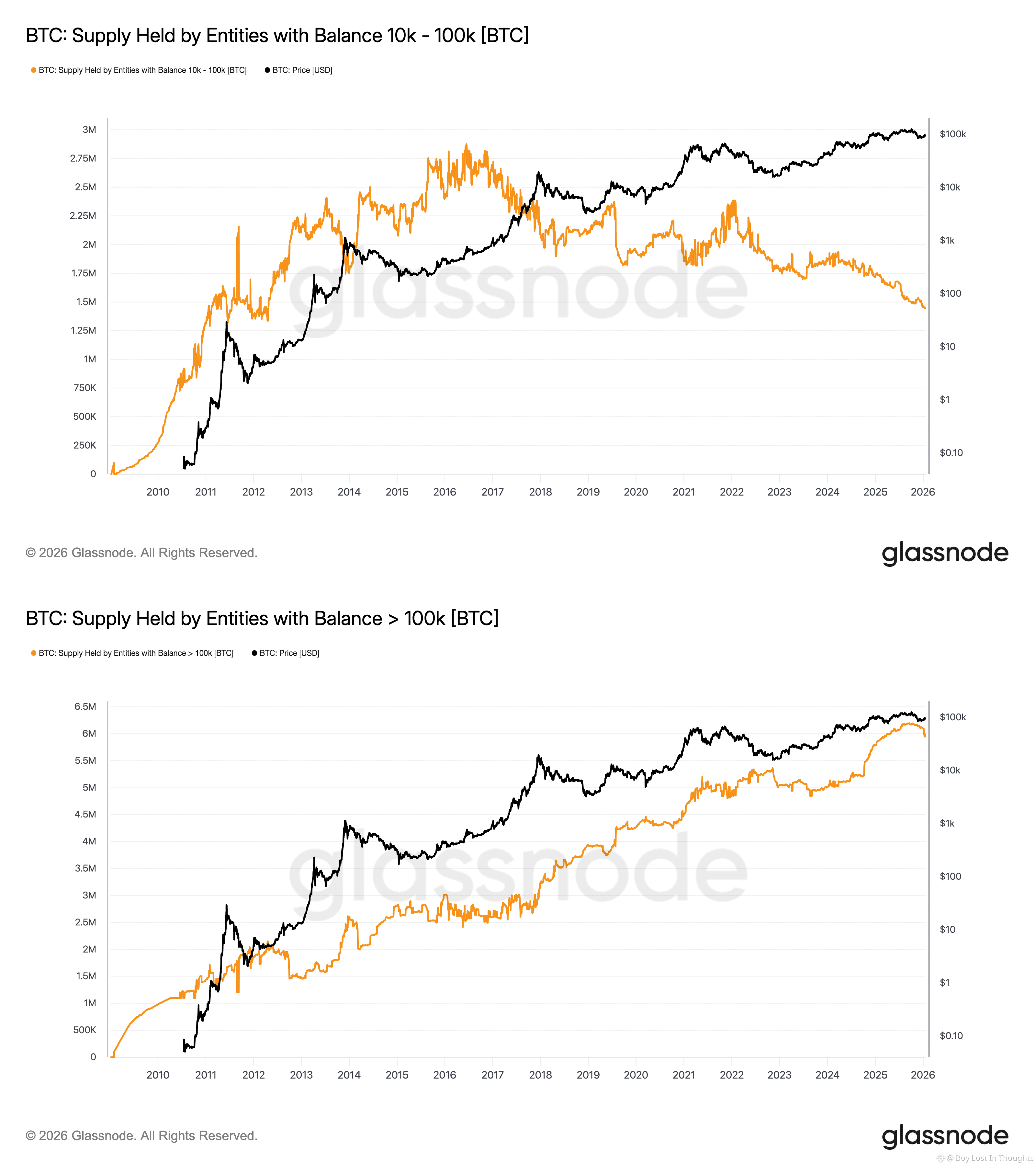

Large holders (10,000+ BTC) are reducing their balances, signaling distribution, while mid-tier holders (1,000–10,000 BTC) are buying the dip.

Key watch level: A break below $90,000 may accelerate selling pressure when U.S. markets reopen.