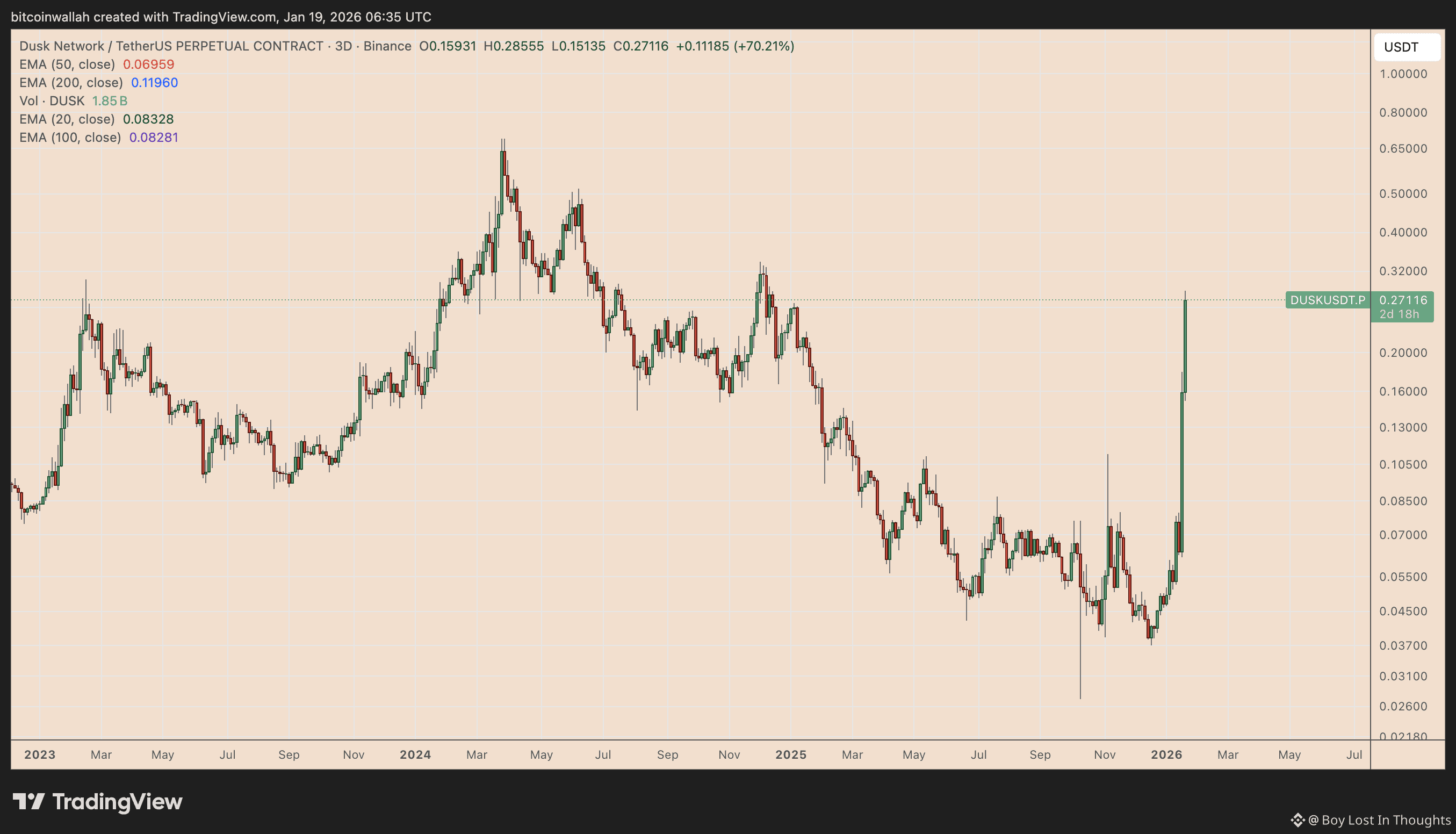

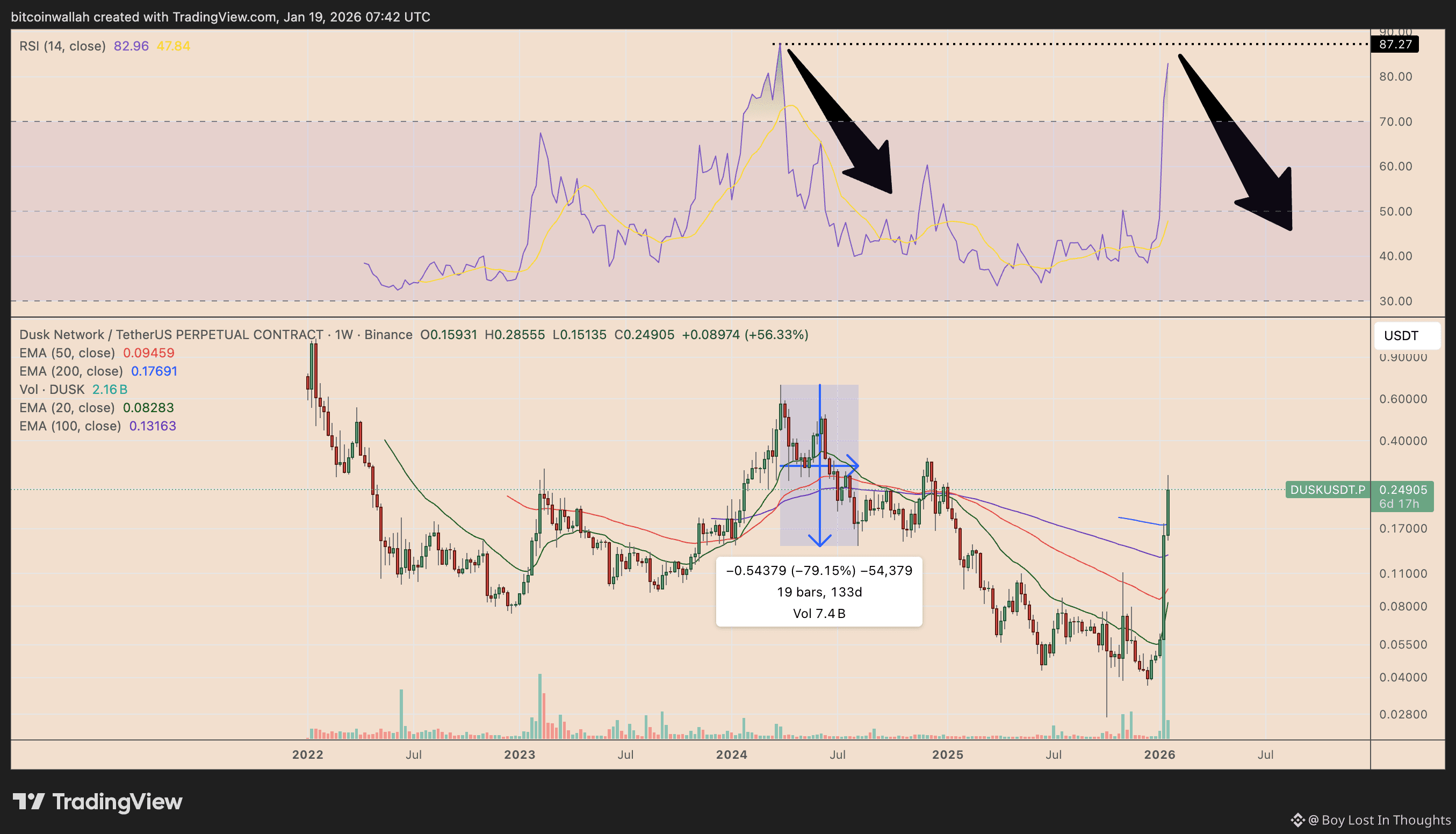

Dusk Network (DUSK) has exploded by 545% in 2026, capitalizing on renewed interest in privacy coins. However, analysts warn the rally is dangerously overextended. With extreme overbought signals and a precarious position at a major technical resistance level, the token faces a high risk of a severe crash, echoing a similar 80% plunge from 2024. The next price move hinges on its ability to hold critical support.

Major Points :

Meteoric Rise: DUSK has surged approximately 545% year-to-date, reaching $0.2855, partly fueled by a sector-wide shift toward privacy coins following Zcash's governance problems.

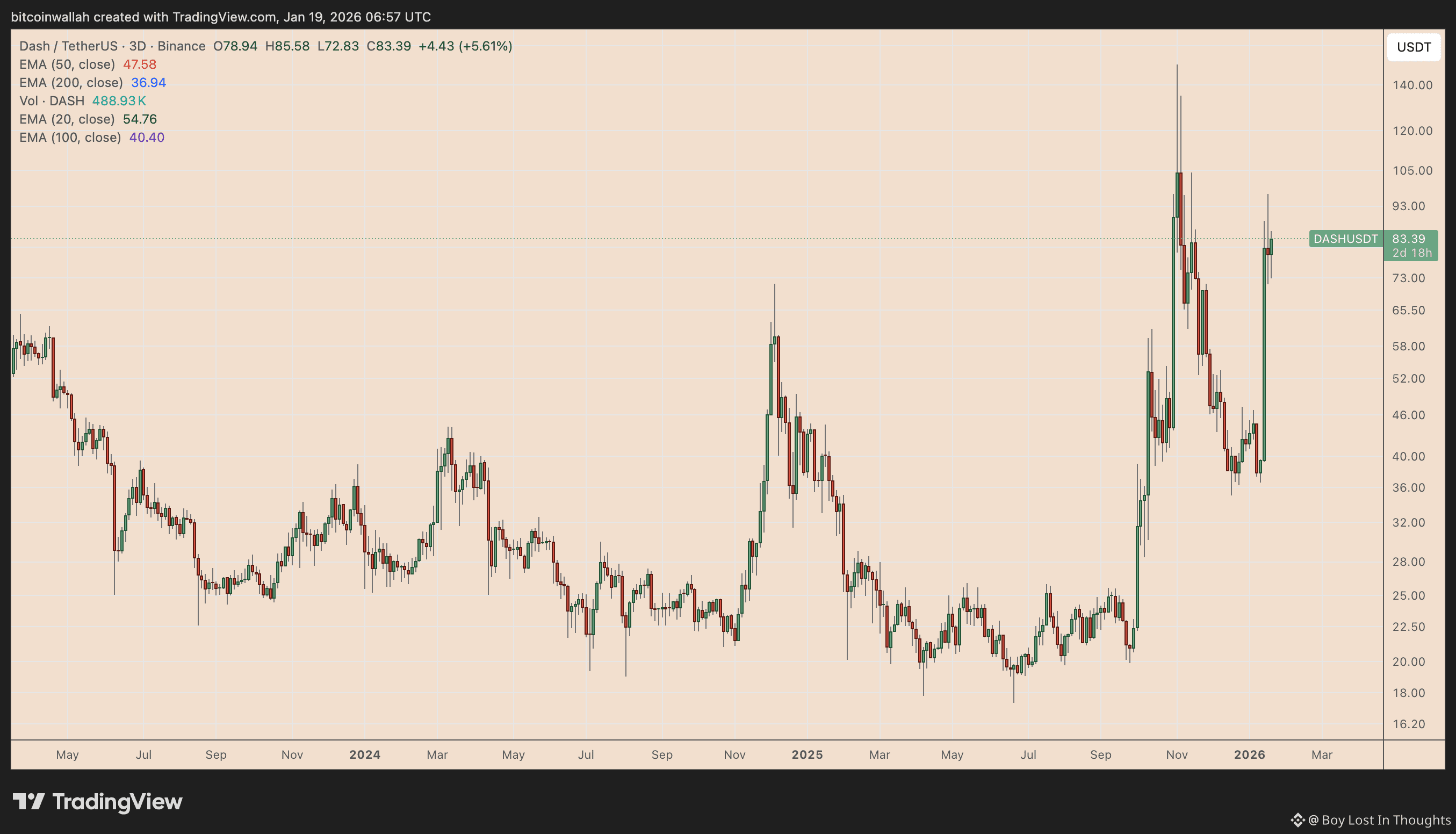

Rally Drivers: The boom started with investors seeking privacy-focused assets. DUSK, with its smaller market cap and thin liquidity, saw an outsized price move as it attracted speculative flows looking for the next laggard.

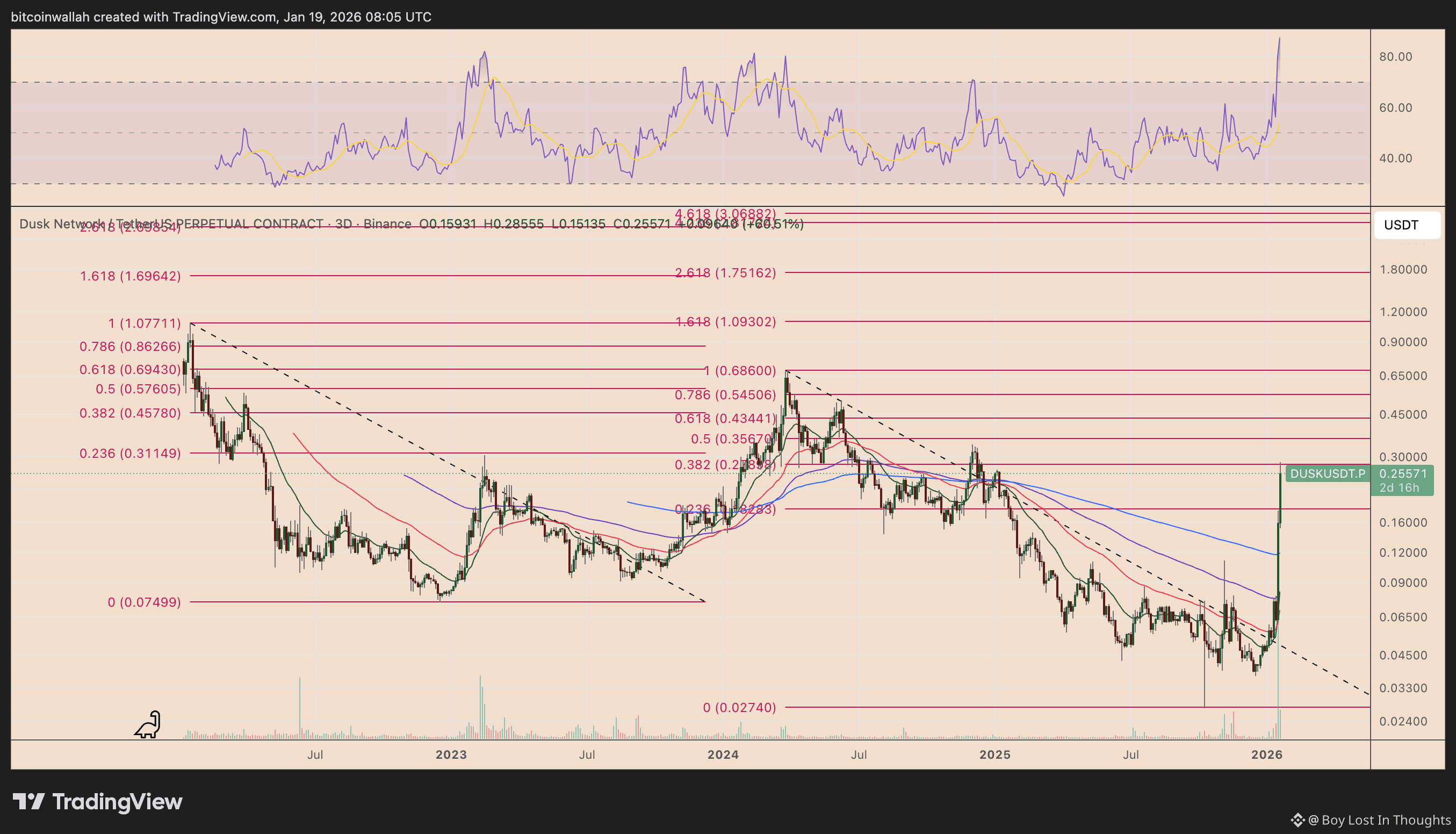

Extreme Overvaluation Warning: Technical indicators scream "overbought." DUSK's Relative Strength Index (RSI) is near 83 (well above the 70 danger threshold), a condition that preceded an ~80% crash in 2024.

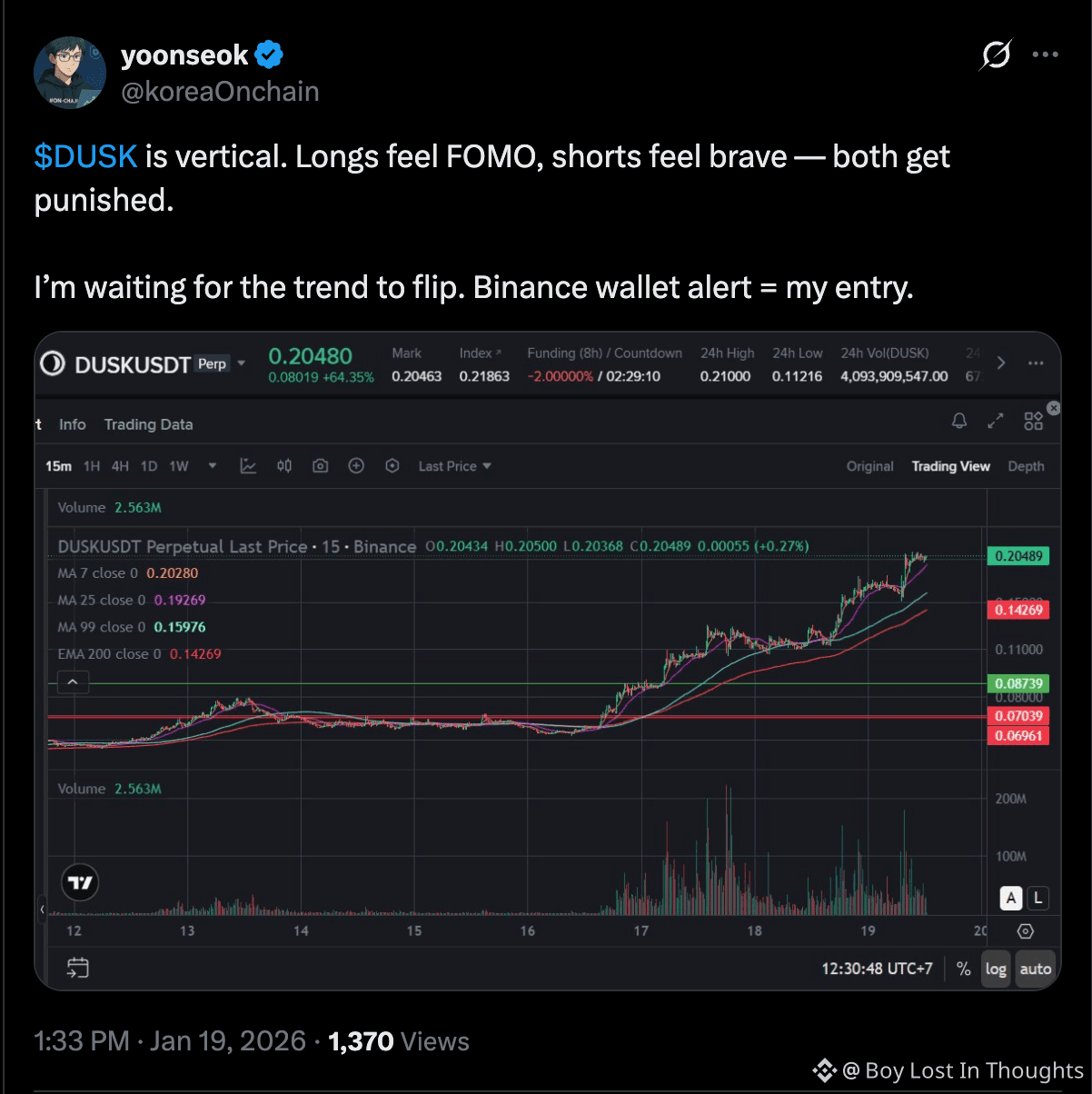

Critical Inflection Point: The price has hit a key Fibonacci resistance level (~$0.219). A rejection here could trigger a sharp correction, with potential support levels much lower at ~$0.183, $0.15–$0.16, and as deep as $0.12.

Upside Potential (If It Holds): To maintain bullish momentum, DUSK must hold above $0.219 and reclaim its recent peak. If it does, next targets could be $0.357 and $0.434.