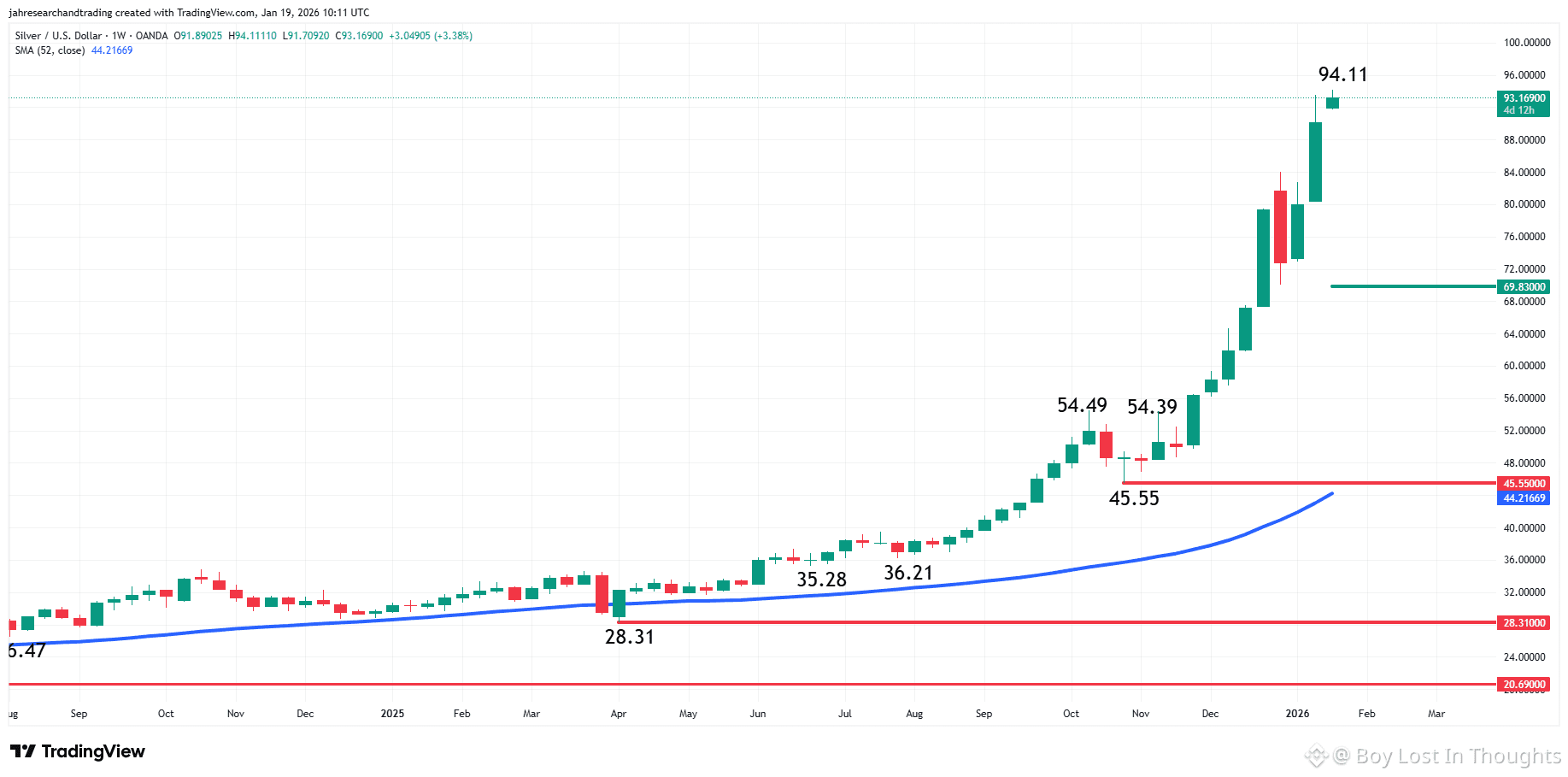

Silver prices skyrocketed to a historic high, breaching $93, as markets reacted to a convergence of explosive headlines. The rally was primarily driven by renewed geopolitical tensions—specifically tariff threats against Europe—and a severe supply shock following China's move to lock down the majority of global silver supply. This has amplified an already tight market, fueled by years of structural deficit and a recent surge in retail investment. While the path toward $100 appears clear, analysts warn the steepness of the rally itself poses a significant risk for a sudden and sharp downturn.

Major Points :

Record Prices: Silver (XAG/USD) hit a new all-time high, trading near $93, fueled by a combination of geopolitical and supply shocks.

Geopolitical Catalyst: Former President Trump's threat of escalating tariffs on eight European nations over Greenland negotiations triggered a surge in safe-haven demand.

Supply Shock: China's new export rules are restricting 60-70% of global silver supply for domestic use, creating an immediate market squeeze.

Retail Frenzy: Investor demand is soaring, with a record $922 million flowing into silver ETFs in one month.

Structural Bull Market: A five-year global supply deficit, driven by industrial demand (solar, EVs), underpins the long-term price rally.

Risks Ahead: The rapid vertical price rise increases the risk of a sharp correction or potential regulatory intervention (e.g., margin hikes).

Key Target: The psychological $100 level is now the next major benchmark for bullish traders.