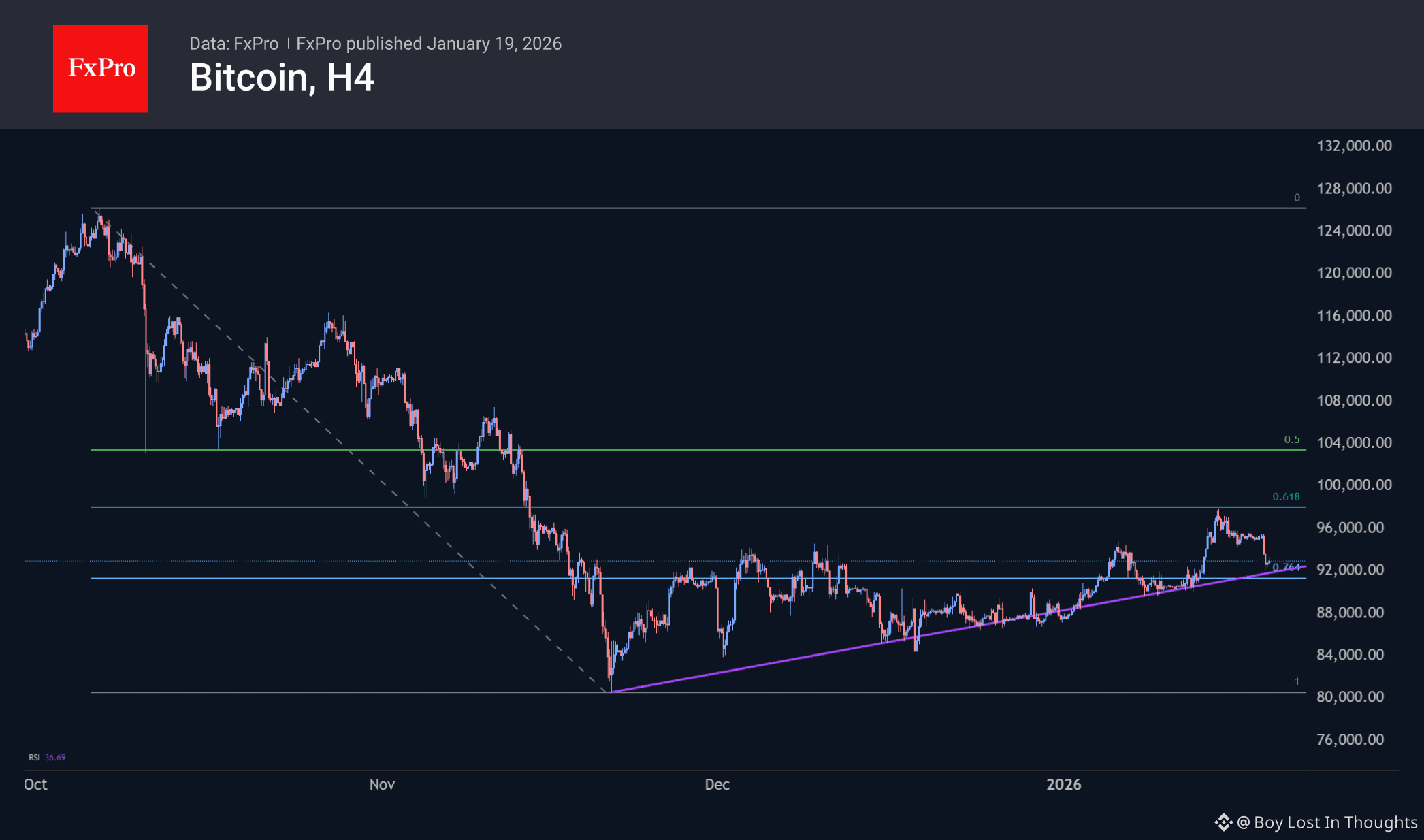

Despite a sharp Monday morning sell-off triggered by global risk aversion, Bitcoin and the broader crypto market remain firmly within a consolidation phase, holding a key uptrend line. The dip—linked to U.S.-EU trade tensions—was amplified by thin weekend liquidity but did not break the technical structure established since late last year.

Major Points :

Market Reaction & Price Action:

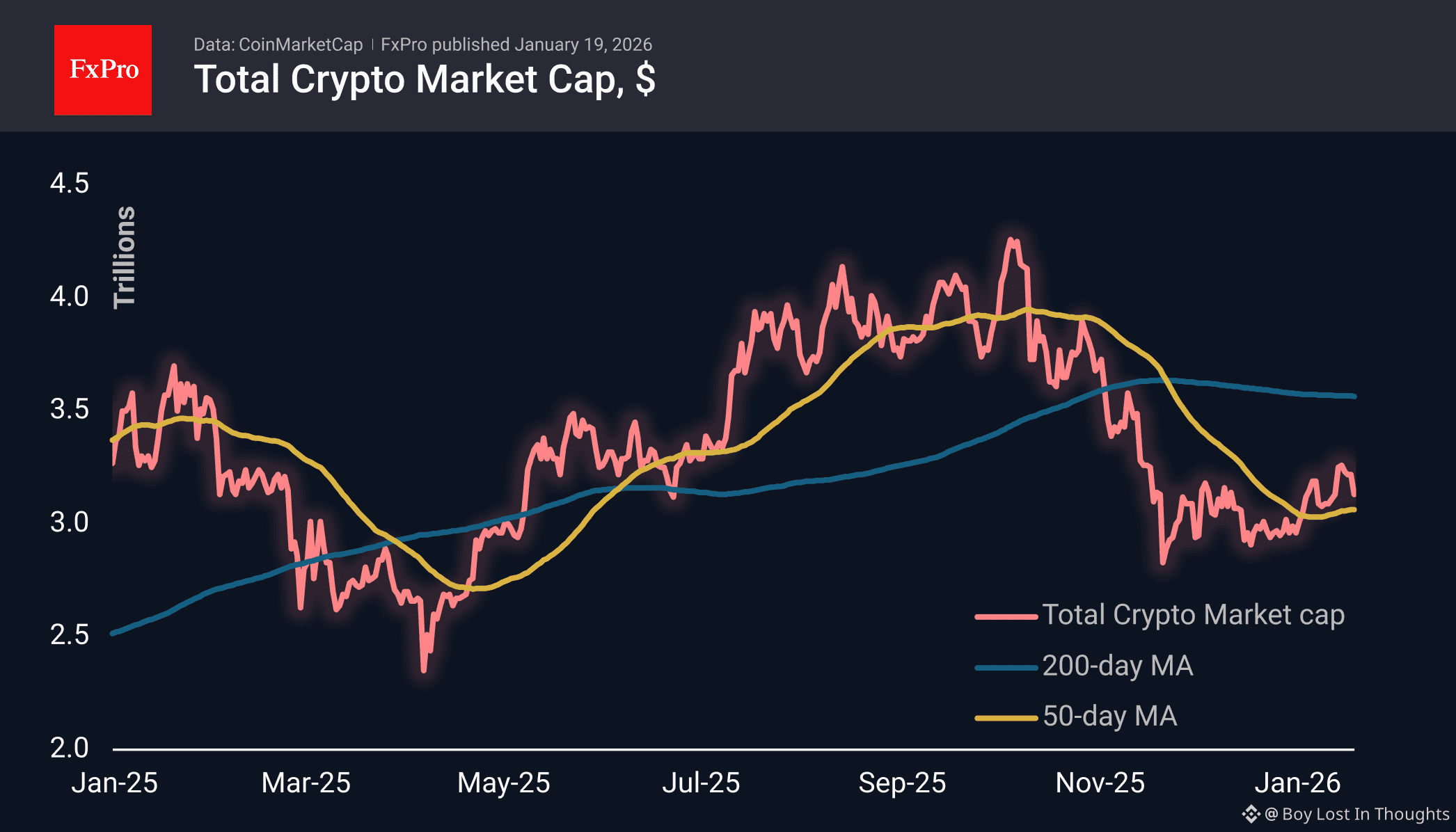

Crypto market cap fell over 3% at the start of Asian trading.

Bitcoin dropped 3.8% initially, paring losses to 2.5% later in the European session.

The move is seen as a bear-driven liquidity grab, but Bitcoin stayed inside its October–November recovery range and above the November–December trendline.

Strong Institutional Inflows:

Spot Bitcoin ETFs saw $1.42 billion in weekly inflows—the highest since October 2024.

Cumulative BTC ETF inflows since January 2024 reached $57.82 billion.

Ethereum ETFs posted $479 million in weekly inflows; Solana ETFs have seen 12 straight weeks of inflows.

Growing On-Chain Activity & Adoption:

Ethereum addresses hit a record 1+ million on January 15, with daily transactions peaking at 2.8 million.

Crypto card payment volume has grown 15x in three years, reaching $1.5 billion monthly.

Iranian Bitcoin purchases surged amid currency collapse and civil unrest.

Warnings & Washouts:

Over 11.6 million tokens failed in 2025 alone—making it the worst year for crypto project collapses since 2021.

Justin Bons of Cyber Capital warned Bitcoin could collapse within 7–11 years unless it doubles in price every four years or significantly raises transaction fees.